Gold nearly adds Bitcoin's entire market cap in a single day

Bitcoin traded down on Wednesday as gold rallied 4.4% over 24 hours, adding a massive $1.65 trillion to its market cap in a single day.

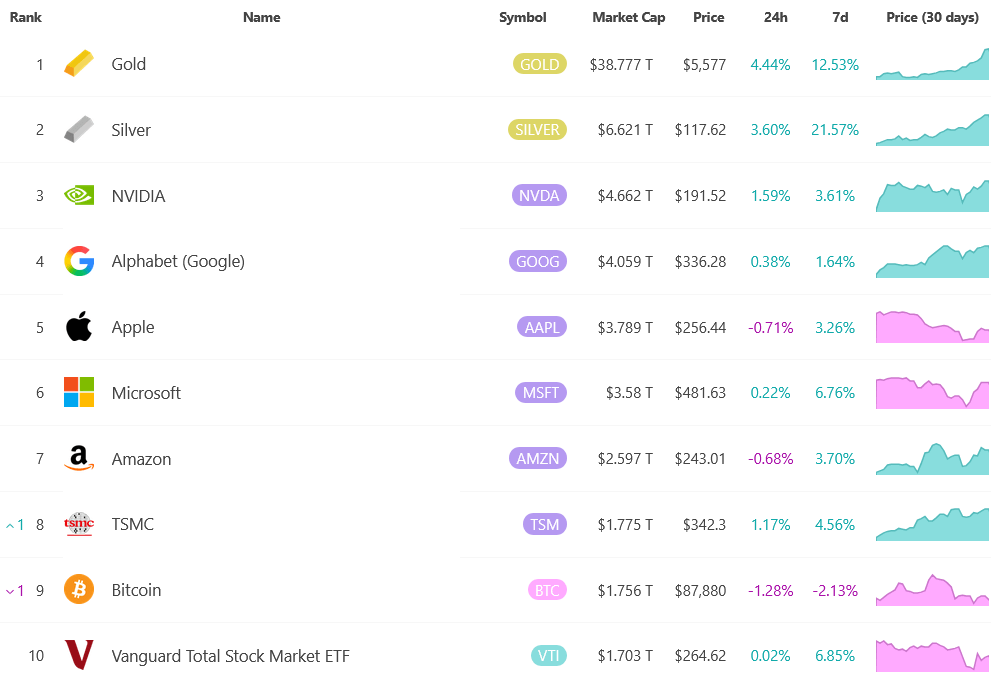

Gold breached $5,500, bringing it to a new all-time high, while its total market cap rose to $38.77 trillion, with the single-day increase nearly matching Bitcoin’s $1.75 trillion market cap, Infinite Market Cap data shows.

Silver is on a tear too, having rallied 21.5% over the last week to a $6.6 trillion market cap, further expanding its lead on Nvidia — the largest publicly traded company — in the process.

Largest assets by market cap. Source: Infinite Market Cap

The multi-month precious metals rally — seen as a result of the “debasement trade” has been contrasted by Bitcoin, which some argue should also behave like a safe haven asset.

The price of Bitcoin has struggled to lift since early October, when it was hit by a crypto market crash that saw more than $19 billion worth of positions liquidated.

Before that Oct. 10 crash, investors were increasingly embracing the idea that Bitcoin and gold would serve as debasement trades during periods of fiscal irresponsibility and monetary expansion.

The current gap between gold and Bitcoin is more apparent when looking at a five-year timeframe, with gold outperforming Bitcoin over the last five years, having risen 173%, while Bitcoin is up only 164%.

Bitcoin could be undervalued, institutional investors say

However, a Coinbase survey released earlier this week found that 71% of 75 institutional investors think Bitcoin is undervalued when priced between $85,000 and $95,000.

About 80% of the institutional investors said they would either hold their crypto positions or buy more in response to another 10% crypto market fall, signaling long-term conviction in the asset class.

Bitcoin, Gold sentiment on opposite ends of spectrum

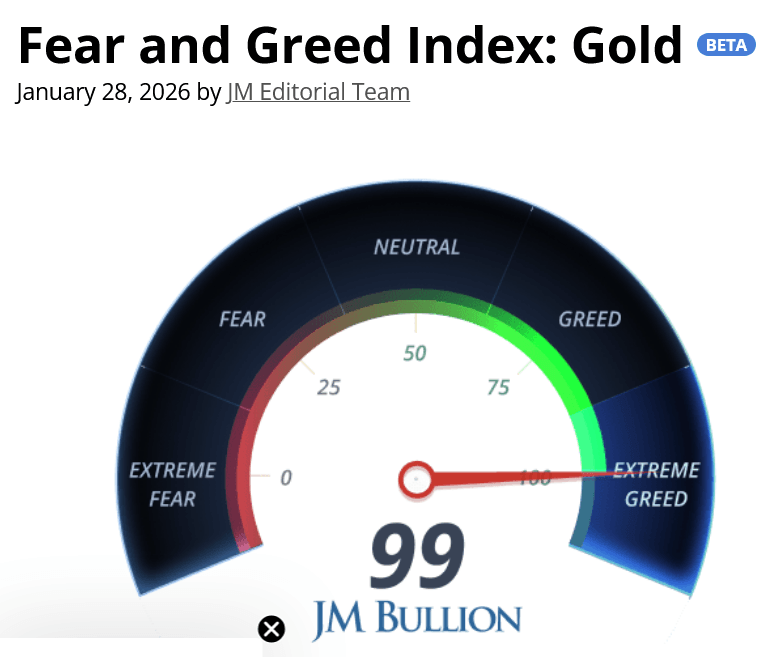

The difference in investor confidence between Bitcoin and gold has also been reflected in sentiment indexes.

The Crypto Fear & Greed Index, which measures Bitcoin and broader crypto market sentiment, is currently 26 out of 100, in the “Fear” zone, while JM Bullion’s Fear & Greed Index score for gold is 99 out of 100, in the “Extreme Greed” zone.

Source: JM Bullion

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.