Forecasting Ethereum price accumulation levels should bears takeover before FOMC

- Ethereum price continues to consolidate around $1,570 with no signs of directional bias.

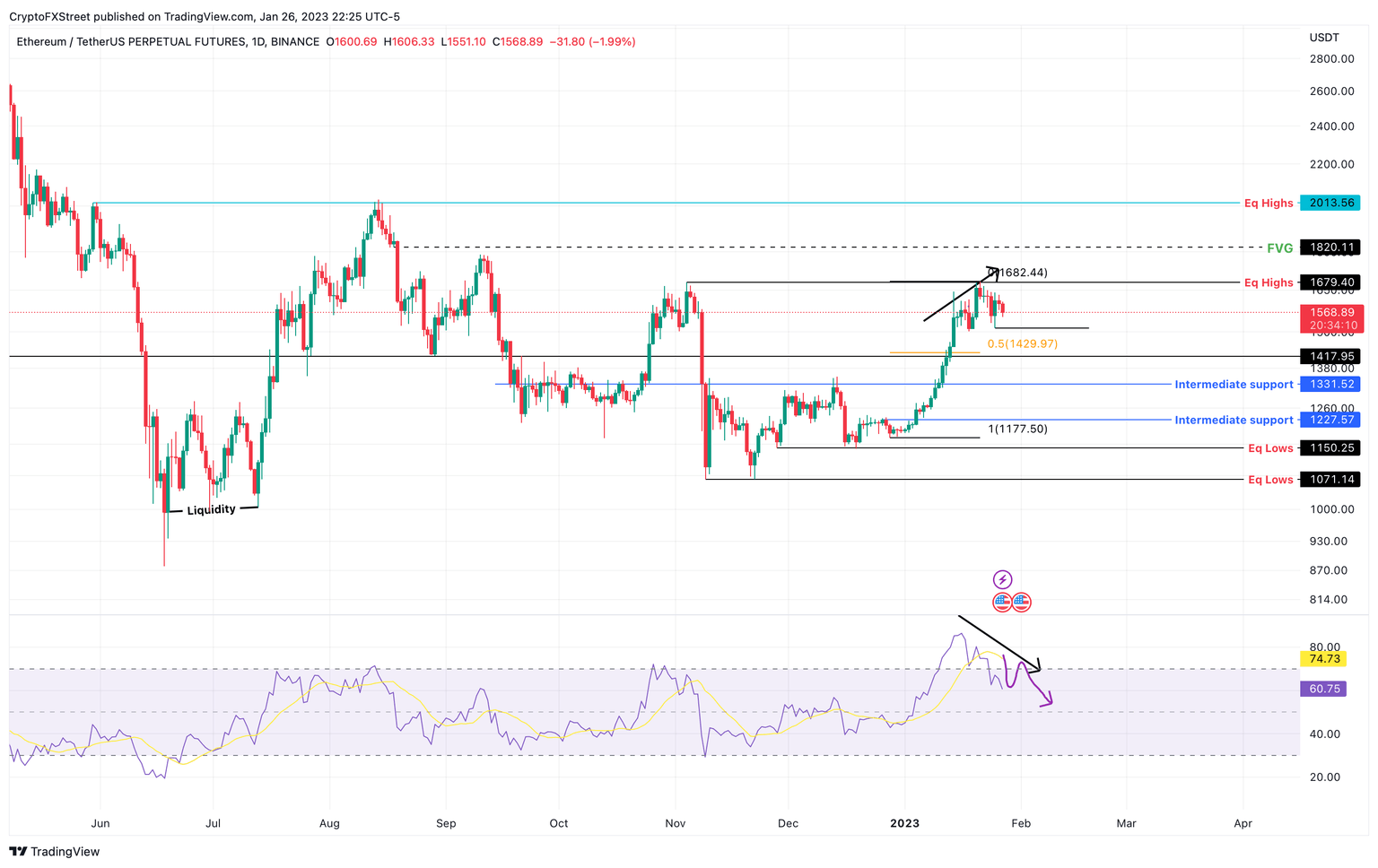

- A breakdown of the market structure at $1,515 could result in a quick descent to key accumulation levels.

- A daily candlestick close above $1,679 would invalidate the bearish thesis for ETH.

Ethereum price shows a clear sideways structure as it encounters a crucial hurdle. As a result, ETH has set up a liquidity zone around this level, but the winds might shift in favor of bears and induce volatility on February 1 when the Federal Open Market Committee (FOMC) convenes.

Ethereum price at critical juncture

Ethereum price has set up equal highs at $1,679 after failing to push through it. As a result of the buy-stop liquidity resting above this hurdle, there is a likelihood that ETH market makers will push the altcoin higher before triggering a massive selling spree.

The bearish outlook will compound if Ethereum price breaks the bullish market structure by producing a lower low below $1,515. This move will shift the odds in the bears’ favor and kick-start a sell-off that will likely knock ETH down to two key levels - $1,429 and $1,331.

Ethereum price rallied 41% in the first three weeks of 2023 and the midpoint of this ascent is $1,429, hinting that a mean reversion play could be opening up for short-sellers. If the selling pressure continues to build up ETH could slice through $1,429 and reach the next support level at $1,331.

Further adding credence to the bearish outlook for Ethereum price is the Relative Strength Index, which has developed a bearish divergence. This technical formation hints that ETH is likely to collapse due to the declining momentum but rising prices.

ETH/USDT 1-day chart

Regardless of this pessimistic outlook, bears should be wary of a liquidity run that could trigger a sweep of the equal highs formed at $1,679. If this move is followed by a spike in selling pressure that triggers Ethereum price to flip the aforementioned level into a support floor, it would not only produce a higher high but also favor sidelined buyers to step in.

Such a move from Ethereum price would invalidate the bearish outlook and potentially trigger a swift move to $1,820 and 2,013 hurdles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.