How realistic is the Ethereum price target of $2,000?

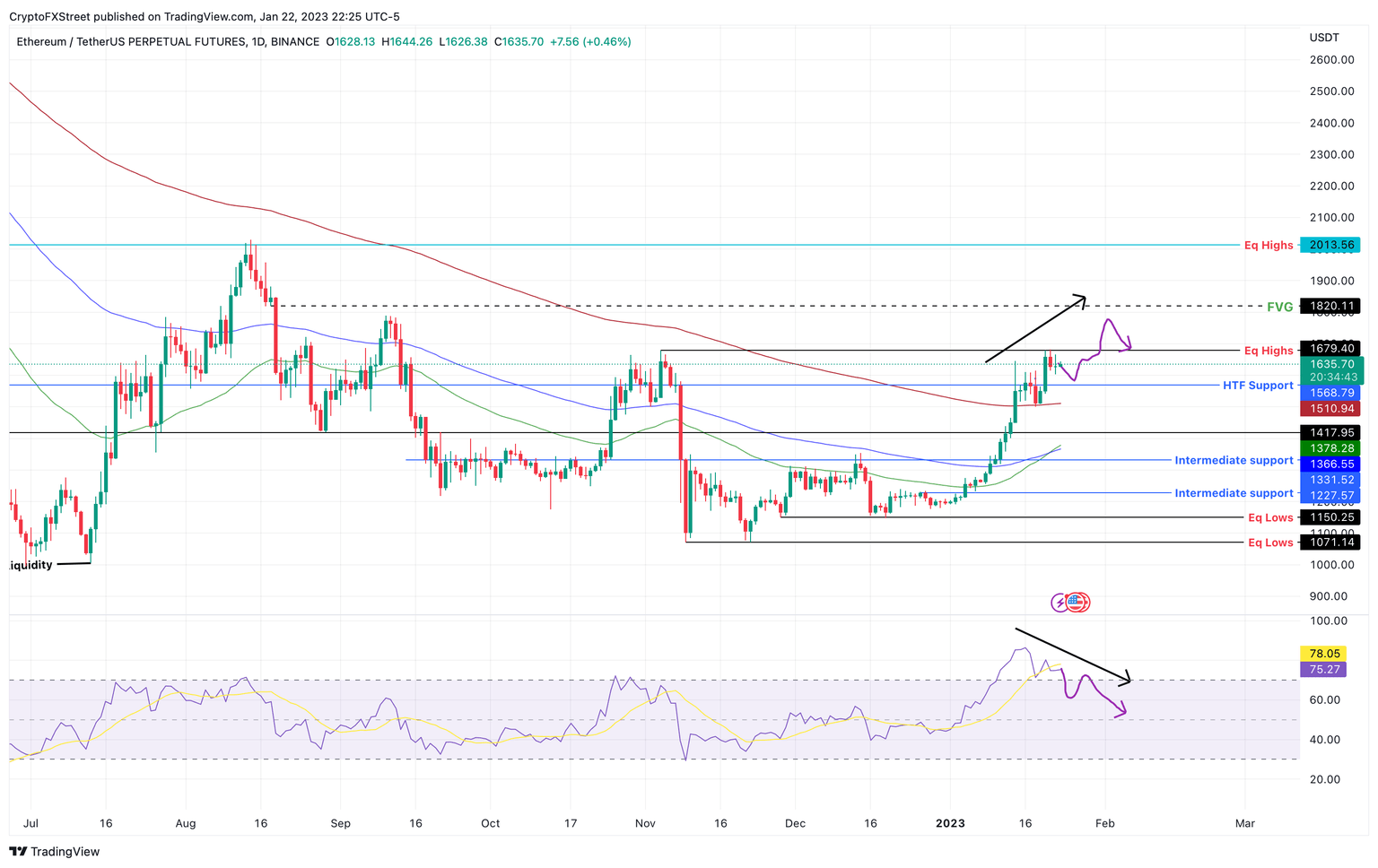

- Ethereum price shows clear signs of exhaustion as the bearish divergence develops on the daily chart.

- Investors can expect another leg-up to push the smart contract token above $1,679 and tag the $2,000 psychological level.

- A confirmation of the downtrend will occur if ETH slips below the 200-day EMA at $1,509.

Ethereum price has been producing higher highs as bulls catch their breath after an explosive rally. This slow movement seems to be setting up for a minor pullback, but depending on Bitcoin price and its liking, things could change drastically.

Ethereum price in a difficult spot

Ethereum price has produced two higher highs on January 17 and 21 after its 38% ascent over the last three weeks. These swing points, standalone, mean nothing, but when viewed with the Relative Strength Index’s (RSI) lower highs, it is indicative of the waning momentum.

This non-conformity is termed bearish divergence and hints that the bullish trend is exhausting and that a reversal could be in the works.

However, technicals are not the end-all, be-all in the realm of cryptocurrencies as Bitcoin holds a larger sway over altcoins, even the second largest by market capitalization. Therefore, Ethereum price could trigger another run-up, despite the obvious exhaustion and produce a third higher high while the RSI produces a third lower high. Such a move will retain the bearish divergence but will allow market makers to collect the buy-stop liquidity resting above $1,679 and trap the early bears.

Investors should note that during this liquidity hunt, Ethereum price could extend as high as $2,000.

ETH/USDT 1-day chart

If Ethereum price does decide to go higher, it is a short-term bullish outlook, running on fumes. This outlook will change if Bitcoin bulls make a strong comeback. In such a case, ETH could continue heading higher.

On the other hand, if Ethereum price slices below the 200-day Exponential Moving Average (EMA), it will confirm the start of a bearish trend. Such a development will open the path for sellers to take control and knock ETH down to the 50-day and 100-day EMA confluence at $1,361.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.