Ethereum whale scoops up 86.7 billion Shiba Inu while large wallet investors shed SHIB

- Large wallet investors have shed their Shiba Inu holdings recently, however, BlueWhale0073 continued accumulating SHIB.

- The Ethereum whale scooped up 86.7 billion Shiba Inu tokens to their portfolio despite the recent drop in Shiba Inu price.

- Analysts note that Shiba Inu price has moved above the descending trendline and could begin its recovery soon.

Ethereum whales have accumulated Shiba Inu consistently through the meme coin’s bloodbath. While most large wallet investors have shed their Shiba Inu holdings, BlueWhale0073 has scooped up more SHIB tokens for their portfolio.

Ethereum whale increases Shiba Inu holdings

Based on data from WhaleStats, a crypto intelligence platform that tracks activity of the 100 largest Ethereum whales, “BlueWhale0073” has added an impressive amount of Shiba Inu to their portfolio.

Large wallet investors recently reduced their holdings of the meme coin, as it plummeted in the recent bloodbath. Despite the volatility in Shiba Inu price, the Ethereum whale identified as “BlueWhale0073,” has scooped up 86.7 billion SHIB tokens.

The whale has bought nearly 90 billion Shiba Inu tokens, worth over $1 million. The whale sold Shiba Inu tokens soon after the purchase. The volatility in the Shiba-Inu-themed cryptocurrency has created opportunities for large wallet investors to trade SHIB in a large quantity.

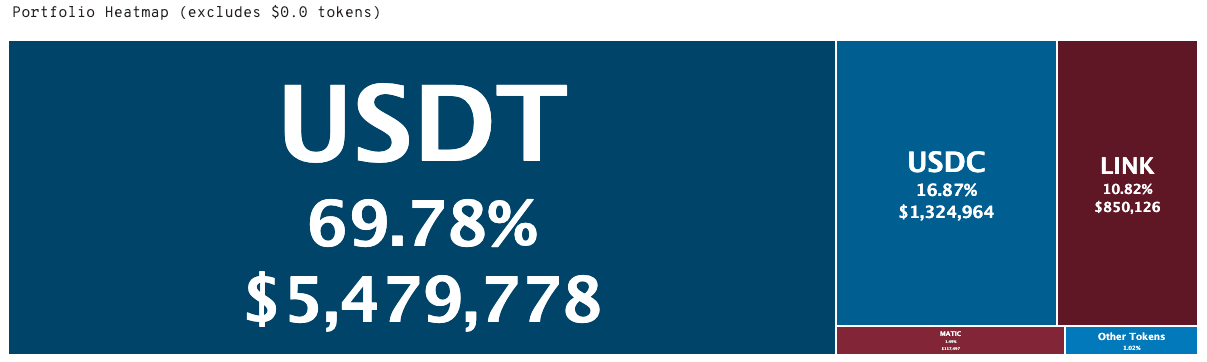

The whales wallet address currently holds stablecoins USDT and USDC and altcoin, Chainlink.

BlueWhale0073 portfolio

The top 100 Ethereum whales have decreased their holdings in Shiba Inu from $833 million to $544 million. The recent decline is a driver of bearish sentiment among investors and Shiba Inu holders.

The amount of Shiba Inu tokens held by Ethereum whales has now diminished.

Analysts predict recovery in Shiba Inu price

Analysts have evaluated the Shiba Inu price trend and predicted a recovery in the meme coin. Crispus Nyaga, a leading analysis bullish on Shiba Inu. The analyst notes that Shiba Inu has managed to move above the descending trendline and SHIB is likely to continue its climb.

Nyaga believes the target for Shiba Inu price is $0.000014.

Shiba Inu price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.