Ethereum restaking sees major boost ahead of Dencun Hard Fork, EigenLayer TVL surpasses $11 billion

- Ethereum restaking protocol EigenLayer total value of locked assets climbs to $11.71 billion.

- Ethereum Dencun Hard Fork, scheduled for March 13, has likely catalyzed the growth of restaking on EigenLayer.

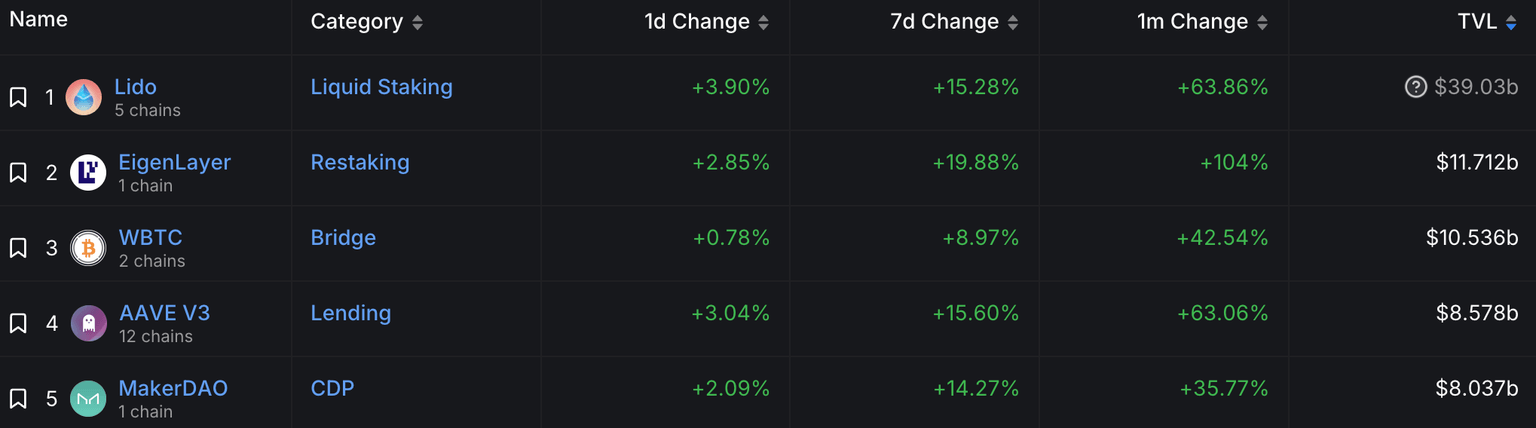

- EigenLayer is now the second-largest DeFi protocol, with 20% TVL increase in the past week.

EigenLayer is a restaking protocol that has observed a considerable increase in the Total Value of assets Locked (TVL) in its platform in the past week. The upcoming Ethereum Dencun Hard Fork and the rise in Ether’s beta plays, like Layer 2 chains and liquid staking tokens, are the two catalysts likely driving gains in EigenLayer’s TVL.

Also read: Nearly $200 million in ETH burned as Ethereum gears up for Dencun upgrade

EigenLayer TVL exceeds $11 billion

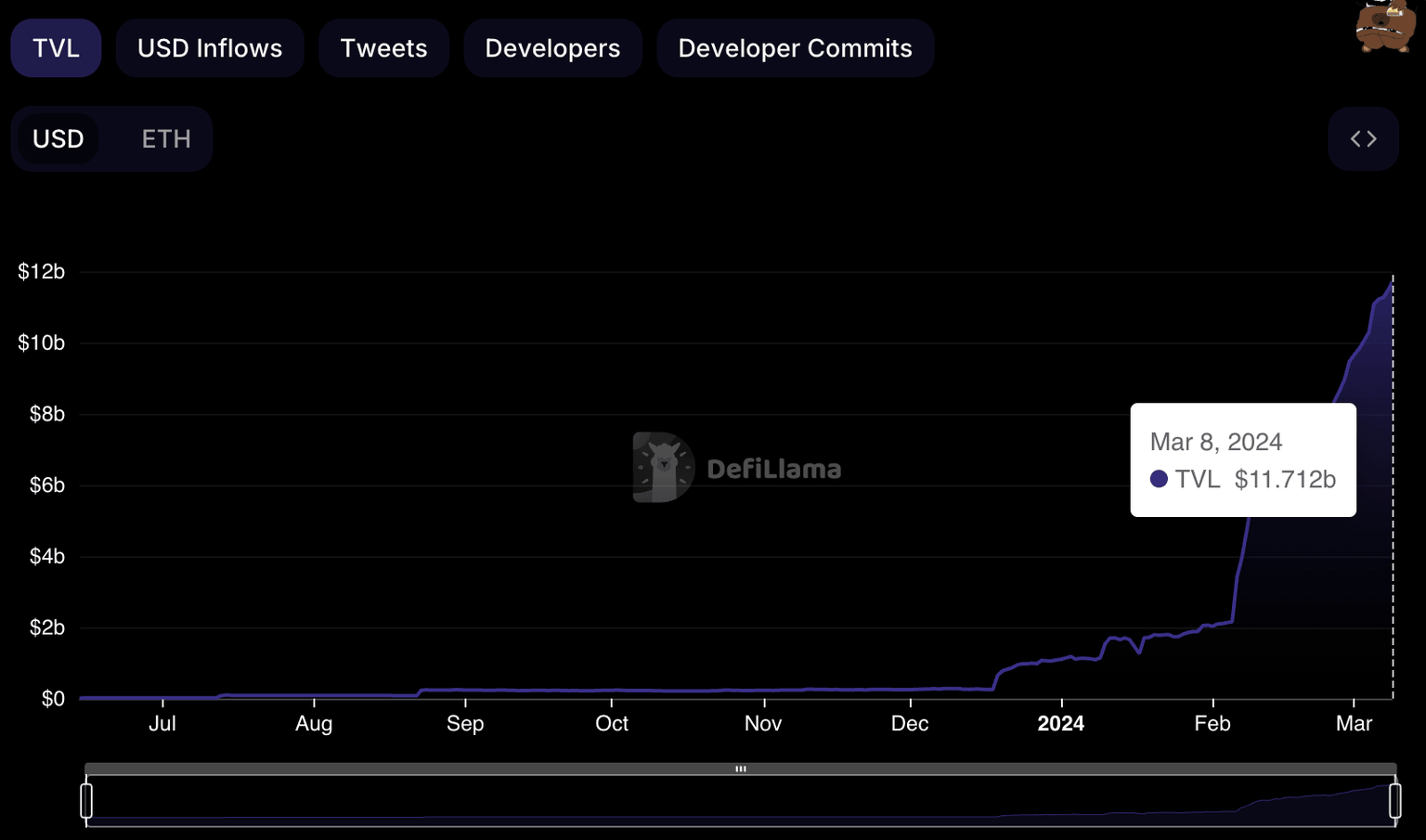

EigenLayer’s TVL has climbed from $9.675 billion in the beginning of March to $11.712 billion on Friday. Ethereum beta plays, like Layer 2 tokens, staking and restaking protocols, have made a resurgence among narratives relevant to crypto, with the upcoming Dencun upgrade.

Ethereum TVL. Source: DeFiLlama

Ethereum’s Dencun upgrade is set to reduce cost for Layer 2 chains, driving the altcoin’s adoption and likely boost demand for Ether and their native tokens in the medium to long term. This has likely fueled the narrative for protocols that support staking and restaking of Ether by traders.

The restaking platform’s rising TVL has pushed it to second place, second to Lido, one of the largest crypto staking platforms. EigenLayer’s users can restake their staked Ether to allow other blockchains to benefit from Ethereum’s engine.

Data from DeFiLlama shows EigenLayer’s TVL climbed 20% in the past week.

DeFi protocols’ TVL. Source: DeFiLlama

To find out more about the Dencun Hard Fork, check this post.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.