Ethereum price struggles to crack $1,300 but bulls remain in control

- Ethereum price hit a high of $1,289 and got heavily rejected.

- The digital asset plummeted down to $1,065 but quickly recovered as bulls bought the dip.

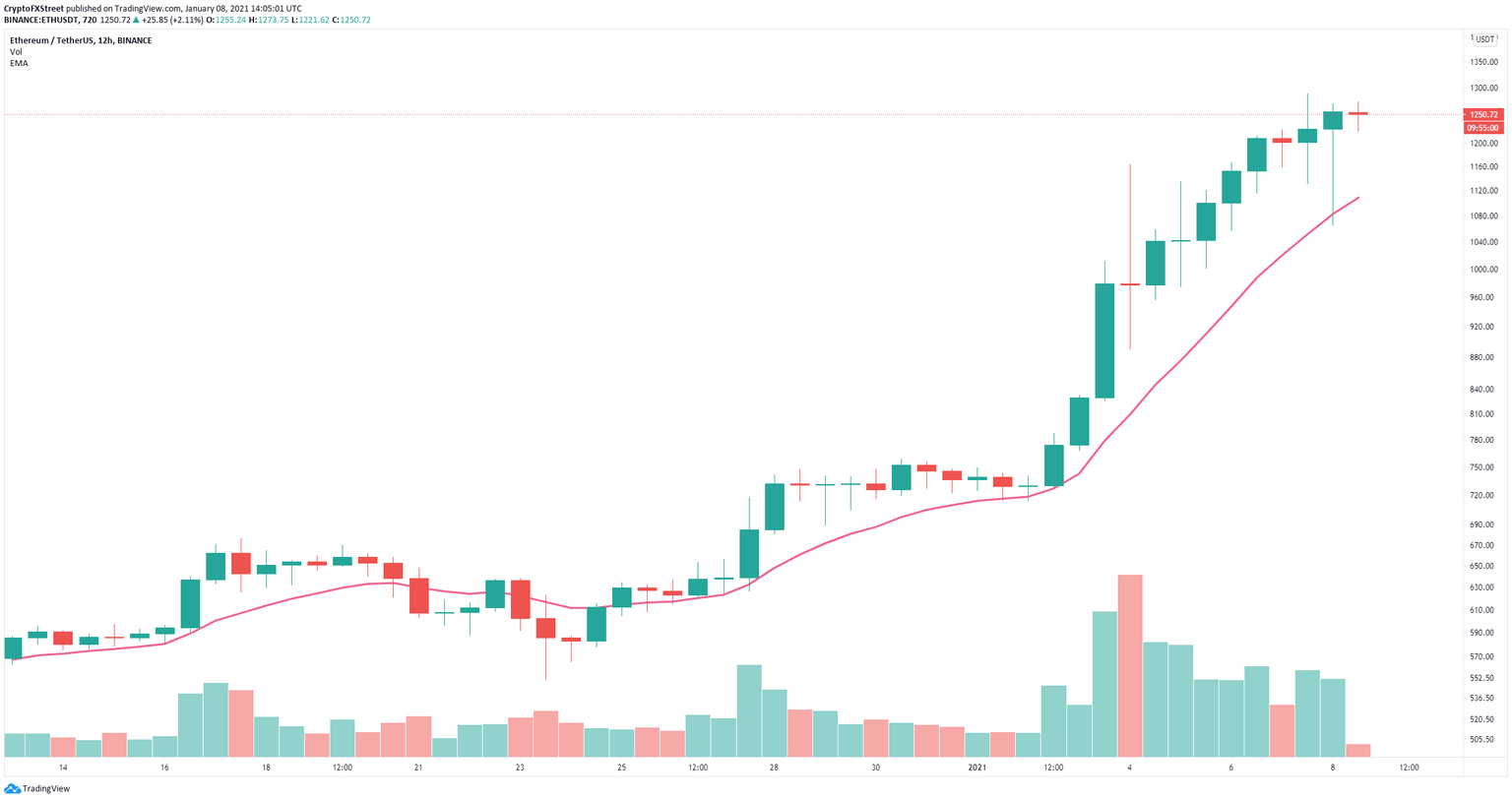

Ethereum had a major breakout on January 2, climbing from $700 towards $1,162 in 48 hours. Since then, the digital asset has slowed down significantly against Bitcoin, which has established new all-time highs.

Despite the significant rally, Ethereum is showing some red flags as the digital asset looks to be topping out around $1,300. Bitcoin regained its dominance against the market as the ETH/BTC pair quickly shifted in favor of BTC.

Ethereum price needs to climb above $1,300 to maintain control

ETH/USD 12-hour chart

On the 12-hour chart, Ethereum bulls have defended a crucial support level at $1,080, which is the 12-EMA. As long as they can keep Ethereum price above this point, the uptrend will remain intact. A breakout above $1,300 can quickly drive ETH towards the all-time high at $1,440.

ETH MVRV (30d) chart

However, it seems that Ethereum price has just passed into the risk zone according to the MVRV (30d). This metric has hit its highest point since December 2017 and it’s usually an accurate indicator of potential tops and upcoming corrections.

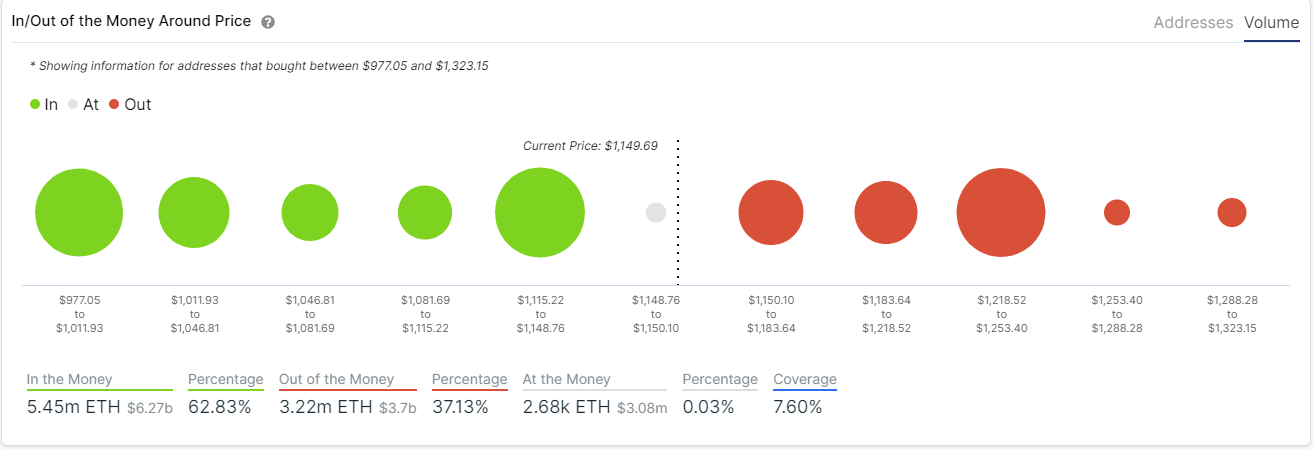

ETH IOMAP chart

If the bears can push Ethereum price below the 12-EMA at $1,100 on the 12-hour chart, the digital asset can quickly dip towards $1,000, which is the next most significant support point according to the In/Out of the Money Around Price (IOMAP) chart.

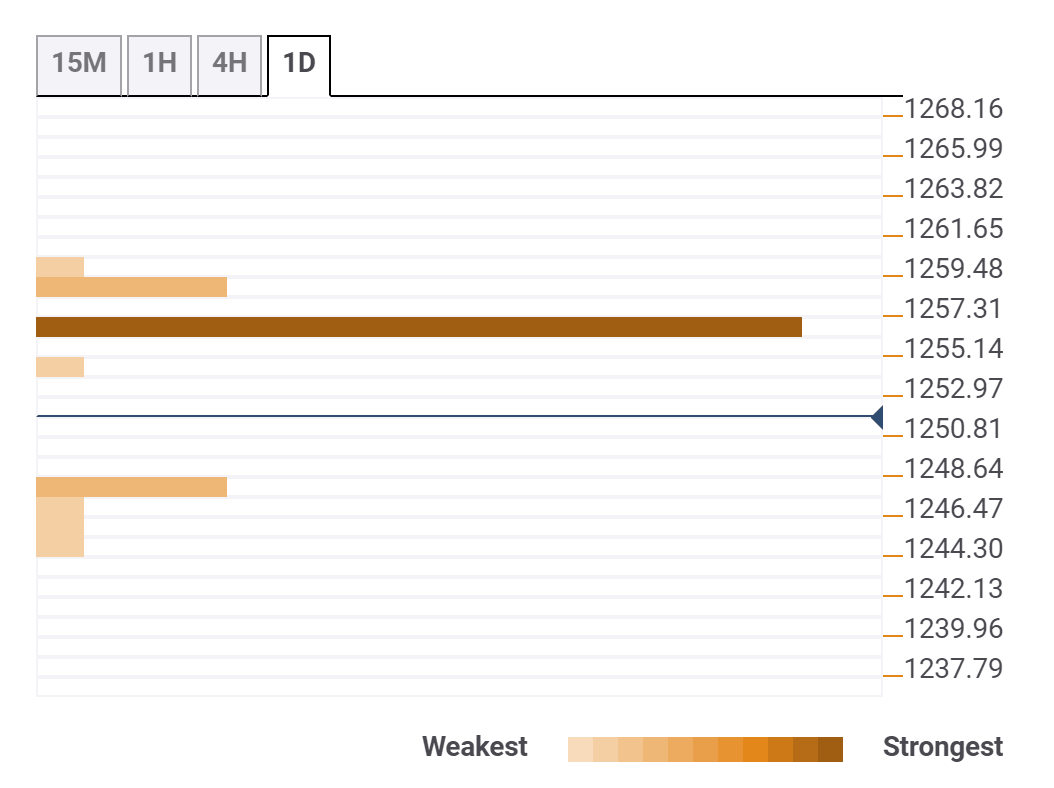

ETH Confluence Levels

Looking at other potential resistance or support levels, the Confluence Detector shows a strong resistance point at $1,257 which is the 23.6% Fibonacci level on the daily chart. Additionally, right before $1,260, two previous highs on the 15-minutes and hourly charts serve as resistance again. Only one significant support level on the way down is located at $1,248 which is the 5-SMA on the hourly chart.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.10.11%2C%252008%2520Jan%2C%25202021%5D-637457118856185422.png&w=1536&q=95)