Ethereum price scrambles to find footing after selling spree

- Ethereum price shows no signs of slowing down after dropping 15% in the last day.

- This downswing is likely to continue until ETH finds a stable footing at $1,284.

- Invalidation of the bearish outlook will occur if ETH produces a swing high above $1,700.

Ethereum price is undergoing a selling spree after a massive, week-long rally that pushed its price up by more than 60%. As a result, ETH is currently scrambling to find stable support levels.

Ethereum price on a downward spiral

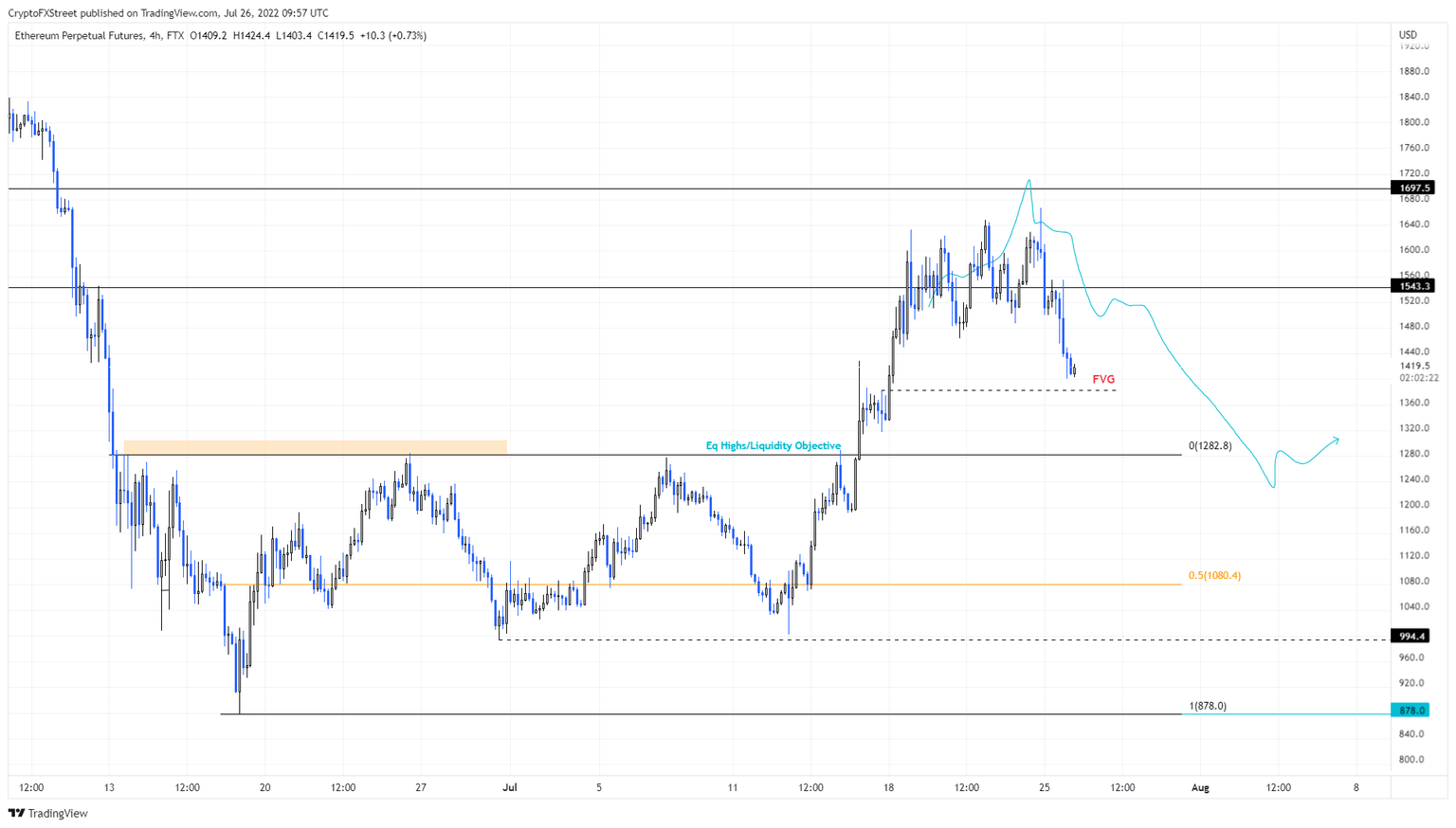

Ethereum price has undone roughly 18% of the gains it witnessed over the last four days. In doing so, ETH has also filled the Fair Value Gap (FVG), aka price inefficiency preset up to $1,383. This downswing is likely to find temporary support up to $1,340, but a breakdown of this area will further collapse the previously created range high at $1,284.

In total, ETH is likely to drop another 10%, at least from a conservative standpoint. However, a breakdown of the range high could result in an even steeper decline to the midpoint of the range at $1,080.

This level is likely to absorb most of the selling pressure and also provide an opportunity for the sidelined buyers. In some cases, this move could also drive the Ethereum price below the swing lows formed at $994.

The correction will allow market makers to collect the liquidity resting below equal lows, which could serve as a catalyzing agent for a trend reversal.

With the Federal Reserve getting ready to hike interest rates on July 27, the markets are likely going to be extremely volatile. So traders should exercise caution as a sweep of the range low at $878 could also occur.

ETH/USDT 4-hour chart

On the other hand, if Ethereum price bounces off the $1,284 support level, there is a chance of a reversal. If buyers band together and produce a higher high above $1,700, it will invalidate the bearish thesis.

Such a development is likely to propel ETH to the $2,000 psychological level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.