Ethereum Price Prediction: ETH consolidation projects 40% gains

- Ethereum price is forming an ascending triangle pattern, forecasting a 40% upswing to $4,100.

- A decisive close above $2,916 will signal the start of the bull rally.

- If ETH breaks past the support level at $2,275, it will invalidate the bullish thesis.

Ethereum price is forming a bullish consolidation pattern that hints at a rally toward the all-time highs. However, ETH must clear critical resistance levels present in between the current position and the target.

Ethereum price heads toward a bullish breakout

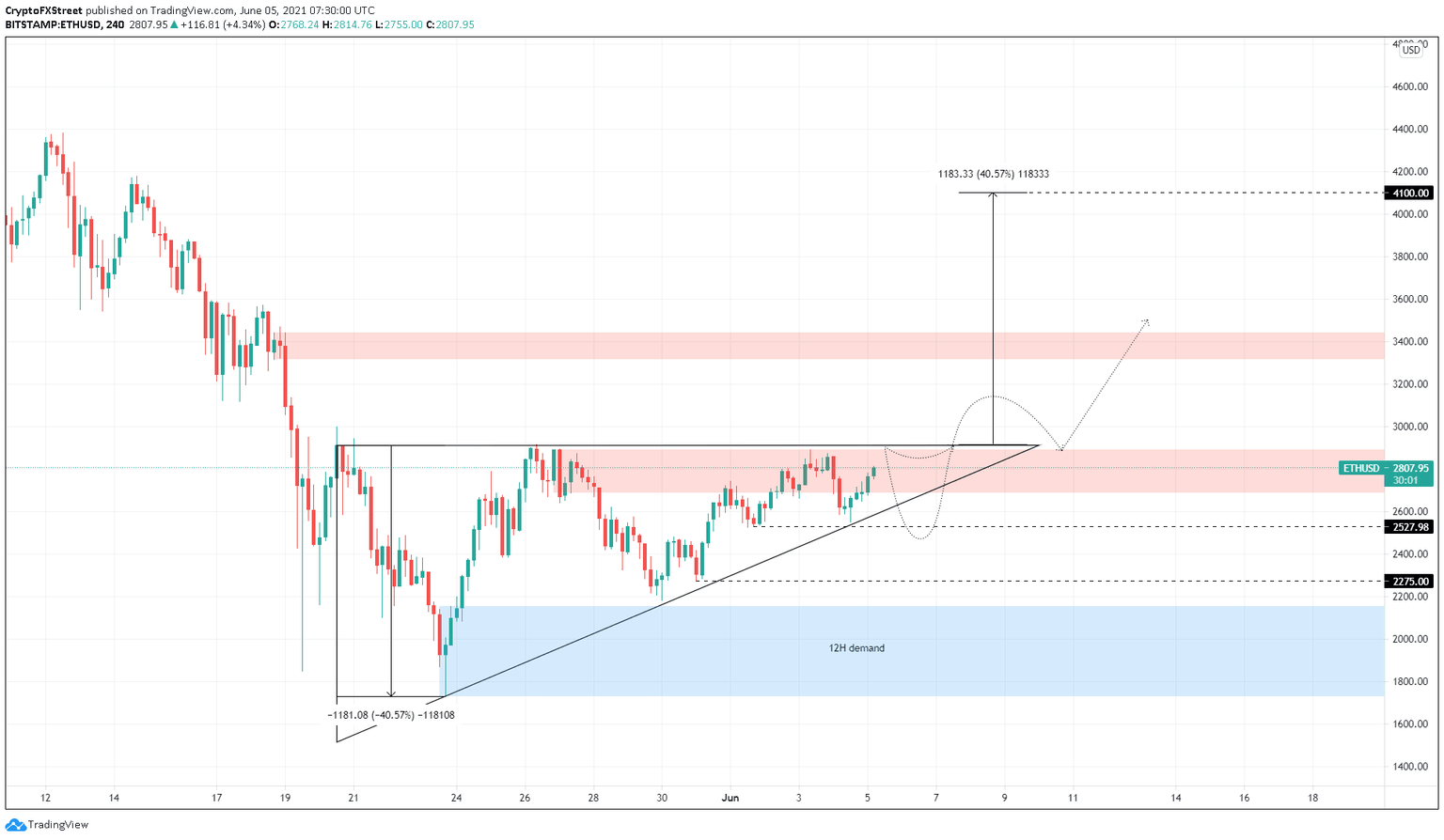

Ethereum price has set up three equal highs since May 20 while creating three lower lows. An ascending triangle pattern forms when these swing points are connected using trend lines.

This setup forecasts a 40% upswing to $4,100, determined by measuring the distance between the first swing high and low and adding it to the breakout point at $2,916.

Therefore, Ethereum price needs a decisive 4-hour candlestick close above $2,916 to signal a bullish breakout.

It is likely the lows at $2,527 will be swept before Ether moves higher. This downswing will either come after the horizontal resistance level is broken or before it. Either way, investors should expect the recent swing low to be swept before the bull rally manifests itself.

For the ETH to hit its intended target, it has to slice through the supply zone extending from $3,315 to $3,441.

ETH/USD 4-hour chart

If Ethereum price fails to surge past the initial supply zone, extending from $2,689 to $2,889, the upswing will be unconfirmed. Under these circumstances, if ETH shatters the support level at $2,275, it will invalidate the bullish outlook.

The second point of failure would be a breakout above $2,916, followed by an inability of the buyers to keep the smart contract token higher. If the resulting downward move slices through $22,75, ETH is likely to consolidate here or head to the demand zone present under it.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.