Ethereum price nosedives as Binance backs out of FTX acquisition

- Ethereum price has lost 30% of its market value since the start of November.

- A strong influx of volume accompanies the decline, hinting that the ETH will continue to fall.

- Invalidation of the downtrend requires a breach above $1,360 for confirmation.

Ethereum price nosedived during the US midterm elections As price declined. The technicals suggest a sweep-the-lows event is underway. Key levels have been defined to gauge ETH’s potential landing ground.

Ethereum price rolls over

Ethereum price has suffered a devastating liquidation as the bears have produced a 30% decline since November 1. The free-fall mudslide has picked up momentum in recent hours as an influx of volume can be spotted on the daily chart. Now that sidelined bears have joined the trend, the ETH price may have a hard time recuperating.

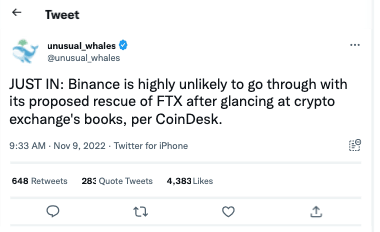

Ethereum price currently auctions at $1,163. The sell-off comes at an interesting time as two powerhouse exchanges, Binance and FTX, feud over risk-on policies. On November 9, Binance announced it would fully acquire FTX and provide aid to the liquidity crunch experienced during the devastating selloff. During the Asian session, a Twitter handle by the name of unusual_whales tweeted that “Binance may want to pull out of the deal after glancing at the exchange books.”

Hopefully, the ending feud will bring resolve to the crypto market decline. If not, Ethereum could continue declining toward the summer lows at $880 for a further 25% decline. The Relative Strength Index confounds the sweep-the-lows idea as the indicator has lost support and now declined into extremely oversold territory.

For traders looking to join the downtrend, invalidation of the bearish case can occur if the bulls breach the $1,360 liquidity levels. If the level is tagged, ETH could re-route north and rally towards $1,800 and potentially $2,000. Such a move would result in an 80% increase from the current Ethereum price.

ETH USDT 4-Hour Char

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.