Ethereum price is going nowhere as the first big market trigger is set for today

- Ethereum price sees traders holding their breath for the US CPI numbers.

- ETH is set for a very binary outcome, either up or down, depending on the CPI outcome.

- Expect a volatile session with whipsaw moves and a pop toward $1,450 intraday.

Ethereum (ETH) price is set to enter the final and most volatile week of the year, with today on the menu as the first big catalyst that could determine price action for the coming weeks and possibly even January. US CPI numbers are set to be published today, and markets want a) a drop from last month and b) preferably a number lower than 7.3%. Traders trading this event will want to read further on the possible projections and what it means for Ethereum price valuation.

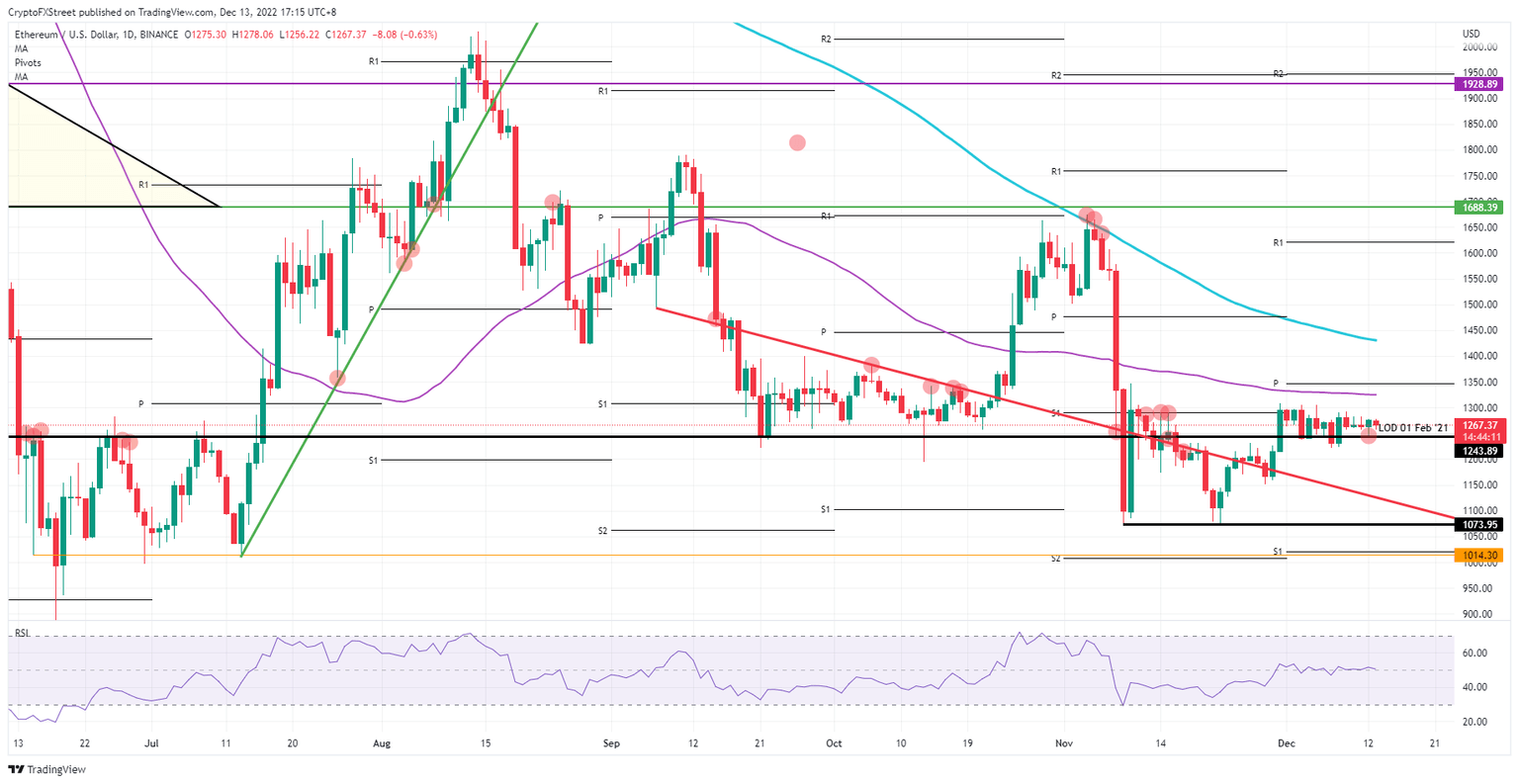

ETH is trading at a 13% upside against a 15% downside

Ethereum price is set to be rocked by one of the major forces in global markets on the back of the US inflation numbers that will be a guide for the coming weeks and possibly trigger a trend going into January of 2023. Trading this number will be very difficult and needs a lot of preparation. Currently, US inflation is at 7.7%, which was the number for October, with expectations that it will decline to 7.3%.

ETH is set to move slightly toward roughly $1,350 should that 7.3% be met, as that is the market consensus. The lower end of the estimations is 7.2%, which means that any lower print will trigger a massive spike up toward $1,450 if inflation continues its quick descent as expected. Hearing the number thus will be key to adjusting the outcome of the trade you are about to take.

ETH/USD daily chart

In the estimations at the high end, 7.5% got penciled in as the most negative scenario. Any print around that level could still bring some upside, but rather mild price action, and would go jointly with some negative dips before finally tying up with small gains. If inflation comes out above 7.5%, and thus even higher than the most bearish expectation, expect ETH to be slashed and quickly nosedive toward $1,073 with possibly a flirt at $1,014 and $1,000 to the downside in the coming weeks.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.