Ethereum Price Forecast: ETF inflows return but US selling pressure persists

Ethereum price today: $3,010

- Ethereum ETFs see returned inflows, attracting $117 million after four consecutive days of outflows.

- US investors' selling pressure persists despite inflows into ETH ETFs.

- ETH could tackle the $3,260 resistance if it rises above $3,057.

US spot Ethereum (ETH) exchange-traded funds (ETFs) recorded nearly $117 million in net inflows on Monday, snapping out of a four-day outflow streak, according to SoSoValue data. The positive value came solely from Fidelity's FETH, which pulled in $137.2 million. BlackRock's ETHA shed $20.2 million while other products saw zero flows.

Despite the inflows into US spot ETH ETFs, interest from US investors remains weak. The Coinbase Premium Index, a measure of US investors' sentiment, has remained in negative territory over the past week, signaling a dominant de-risking sentiment.

-1769551944122-1769551944124.png&w=1536&q=95)

A similar sentiment is evident on-chain. An investor who bought 135,284 ETH nine years ago deposited the entire amount to crypto exchange Gemini, according to data cited by Lookonchain. While some community members noted that the move could be for potential selling, considering the bearish undertone across the crypto market, others highlighted that such moves are often used to break direct on-chain links when switching wallets.

Meanwhile, the Ethereum validator entry queue has hit a record high of 3.35 million ETH, indicating more investors are willing to commit their assets to secure the network, according to data from Validatorqueue.com.

Ethereum Price Forecast: ETH faces resistance near $3,000

Ethereum saw $48.1 million in liquidations over the past 24 hours, driven by $31.1 million in short liquidations, per Coinglass data.

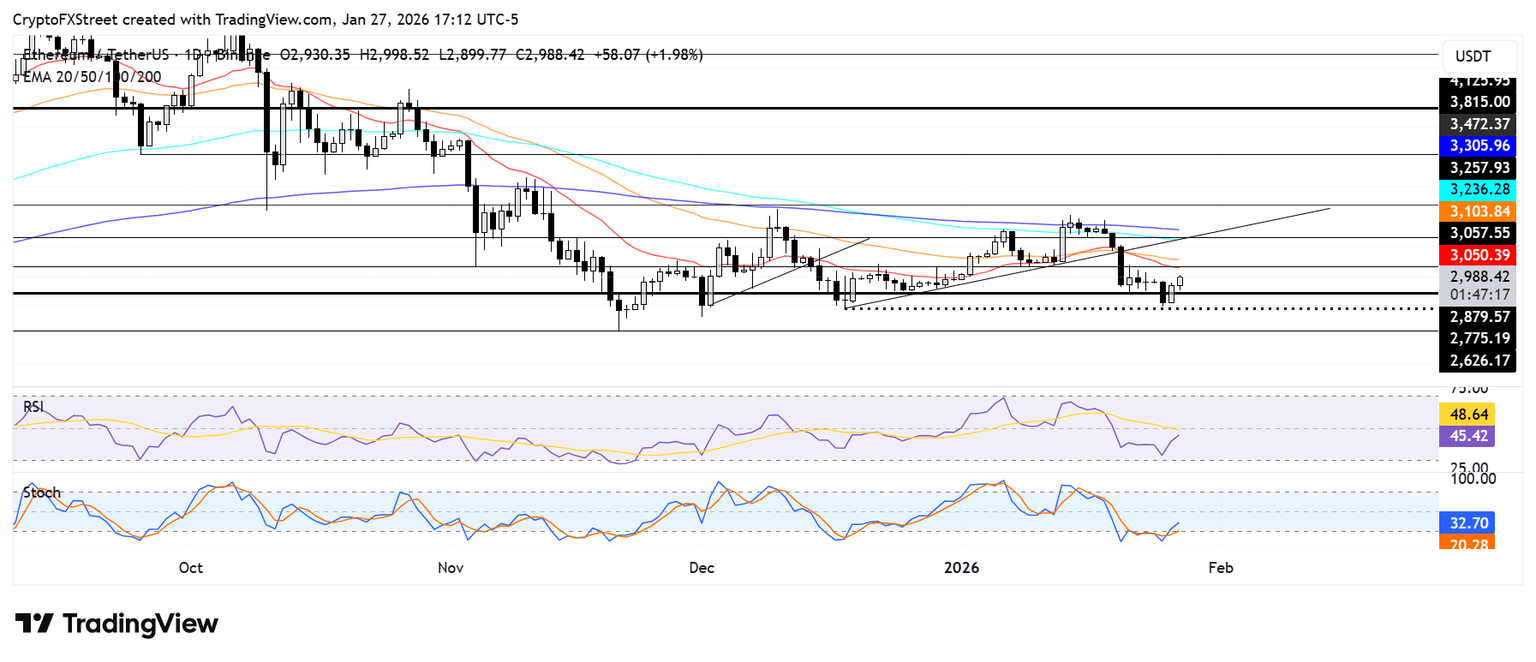

After recovering the $2,880 support, ETH is facing resistance near the $3,000 psychological level, just below the 20-day Exponential Moving Average (EMA) and the $3,057 level.

A firm rise above $3,057 and the 20-day EMA could push ETH toward the $3,260 resistance. On the downside, the top altcoin could fall to $2,775 if it loses the $2,880 support level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending upward but below their neutral levels, indicating a weakening bearish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi