Ethereum Price Forecast: Bitmine expands holdings as ETH bounces off key support

Ethereum price today: $2,910

- Bitmine acquired 40,302 ETH last week, growing its total holdings to 4.24 million ETH.

- The firm also increased its total staked assets to over 2 million ETH.

- ETH could face resistance near $3,058 if it sustains its recent rise above $2,880.

Ethereum (ETH) treasury firm Bitmine Immersion Technologies (BMNR) continued its weekly acquisition of the top altcoin, purchasing 40,302 ETH last week. The move has pushed the company's stash to 4.24 million ETH, worth about $12.29 billion at the time of publication, according to a statement on Monday.

The Nevada-based firm also staked an additional 171,264 ETH last week. Its total staked assets have climbed to over 2 million ETH — nearly 50% of its ETH holdings — deployed across three staking providers. The company projects that it could generate $374 million annually from staking when it stakes its entire ETH balance.

Bitmine Chairman Thomas Lee noted that last week's conversations at the World Economic Forum in Davos showed that policymakers and business leaders are embracing digital assets.

"...We view 2026 as the year policymakers and world leaders now view digital assets as central to the future of the financial system," said Lee. "And as Larry Fink notes, this is positive for smart blockchains. Ethereum remains the most widely used by Wall Street today and most reliable blockchain with zero downtime since inception."

Bitmine also disclosed holdings of 193 Bitcoin (BTC), a recent $200 million stake in Beast Industries, a $19 million stake in Eightco Holdings (ORBS) and a total cash of $682 million.

Last week, the company said shareholders approved its proposal to increase its authorized shares from 500 million to 50 billion.

Bitmine holds the largest ETH treasury globally, followed by SharpLink Gaming with 864,453 ETH and The Ether Machine with 495,405 ETH, per DefiLlama data.

BMNR share price is down over 2% at the time of publication on Monday.

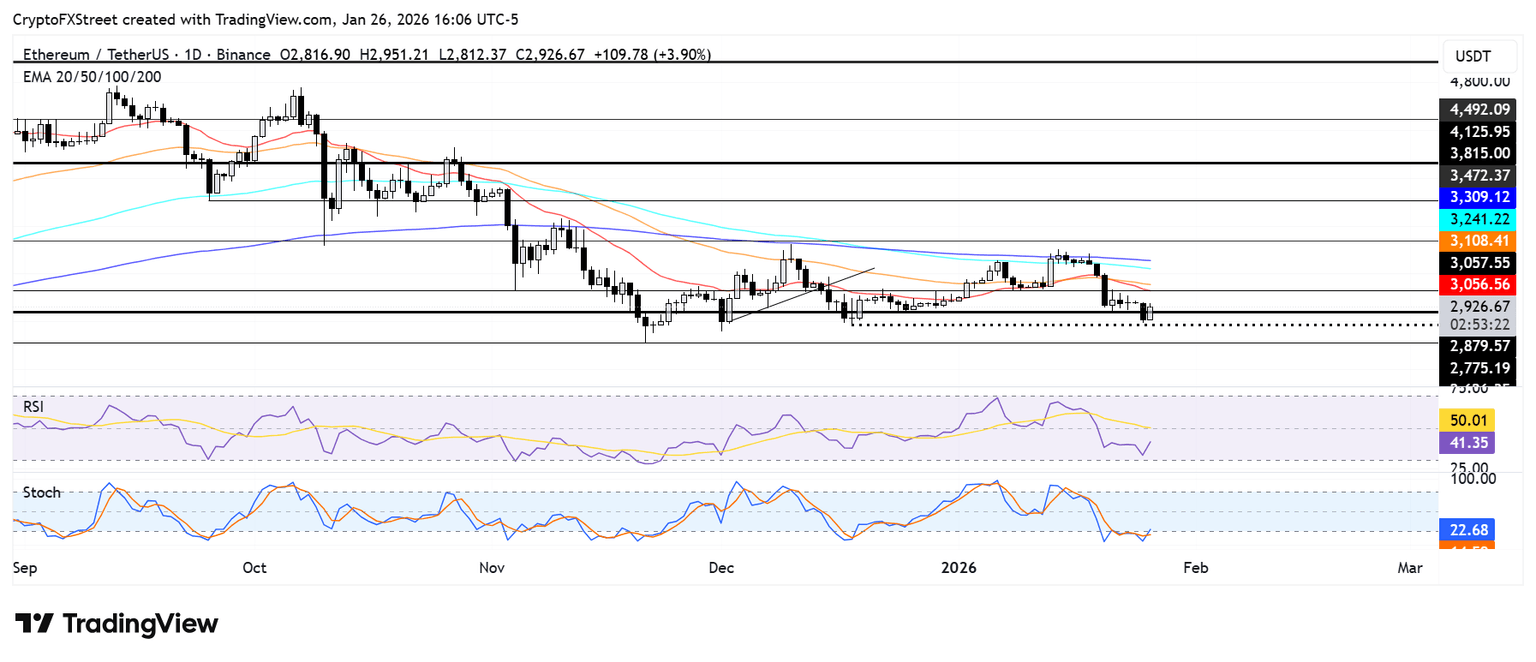

Ethereum Price Forecast: ETH finds support at $2,775, could face resistance at $3,058

Ethereum saw $191.7 million in liquidations over the past 24 hours, led by $111 million in short liquidations, according to Coinglass data. The largest liquidation order was on Hyperliquid, wiping out an ETH-USD position worth $38.8 million.

ETH has recovered above $2,880 after bouncing near the $2,775 support following its weekend decline. If the top altcoin sustains the rise, it could face resistance at the $3,058 level, which is strengthened by the 20-day Exponential Moving Average (EMA).

On the downside, bulls could defend the $2,625 level if ETH breaches the $2,775 support.

The Relative Strength Index (RSI) is below its neutral level while the Stochastic Oscillator (Stoch) has slightly retreated from oversold territory.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi