Bitcoin and top cryptos plummet further as analyst terms market crash 'structural'

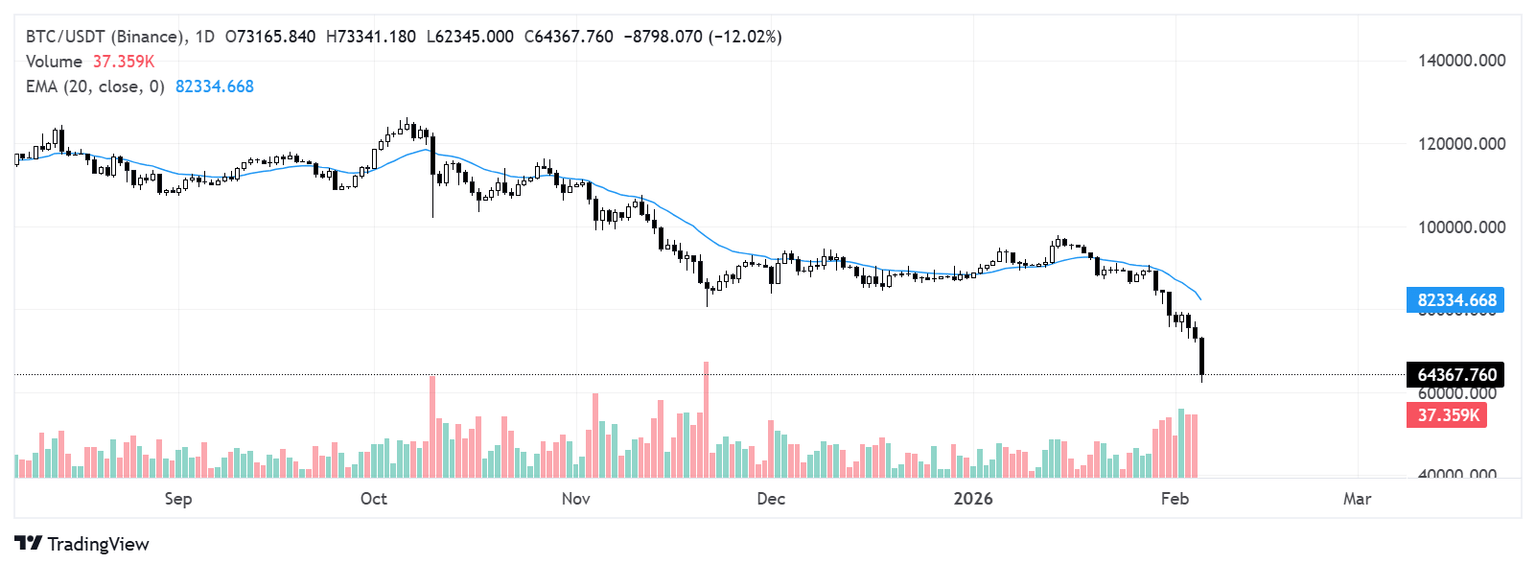

- Bitcoin has dropped more than 11% over the past 24 hours, its largest decline since the October 10 leverage flush.

- The global crypto market has dropped more than $1 trillion since January 14, or $45 billion per day.

- The Kobeissi Letters noted that the market is in a "virtuous cycle" where liquidations and sentiment deterioration have repeated back and forth.

Bitcoin (BTC) has declined below $65,000 on Thursday, down 11% over the past 24 hours. The move marks its largest decline since the October 10 leverage flush. Since then, the top crypto has erased more than 50% of its value since the October 10 leverage flush.

Several top cryptos are also plunging, with Ethereum (ETH), BNB, XRP, and Solana (SOL) down 11%, 10%, 16%, and 11%, respectively.

The move has sparked a more than 10% decline in the crypto market, pushing its losses to nearly 40% since October 10. Notably, the global crypto market has dropped more than $1 trillion since January 14 or $45 billion per day.

The decline has sparked over $2.09 billion in liquidations over the past 24 hours, with the largest liquidation order occurring on Binance — a BTC-USDT worth $12.02 million. Crypto liquidations have reached $10 billion since January 24, about 55% of the record amount seen on October 10, according to Kobeissi Letters.

The stock market is also experiencing a similar decline, with the S&P 500 and Nasdaq Composite down by 1.23% and 1.59%, respectively. Amazon shares tumbled nearly 11% in after-hours following the release of its Q4 earnings, where it estimated capital expenditures of roughly $200 billion for 2026.

Why cryptocurrencies have remained down since October

According to The Kobeissi Letters, the market decline is structural as cryptocurrencies have "never truly recovered" since the October 10 leverage flush. The analysts noted in a Thursday post that the market is in a "virtuous cycle" in which liquidations and sentiment deterioration have repeated back and forth despite fundamentals not changing much.

Other factors highlighted include Bitcoin's market depth remaining 30% below its October peak — similar to the FTX crash in 2022 — and the rapid decline in stocks despite strong earnings and minor changes in fundamentals. "Liquidation gaps in crypto are carrying over into equities," the post states.

The analysts added that today's decline of about $9,000 may have stemmed from an institutional investor liquidating its holdings. They added that the market will establish a bottom when structural liquidity returns, but after "capitulation in price and leverage," combined with intense bearish sentiment.

"We seem to be somewhere near that point," the analysts wrote.

Bitcoin is trading around $64,400 at the time of publication on Thursday.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi