Ethereum price explodes, but upside limited to $3,200

- Ethereum price struggle seems to be coming to an end after a flip of the 50-day SMA at $2,791.

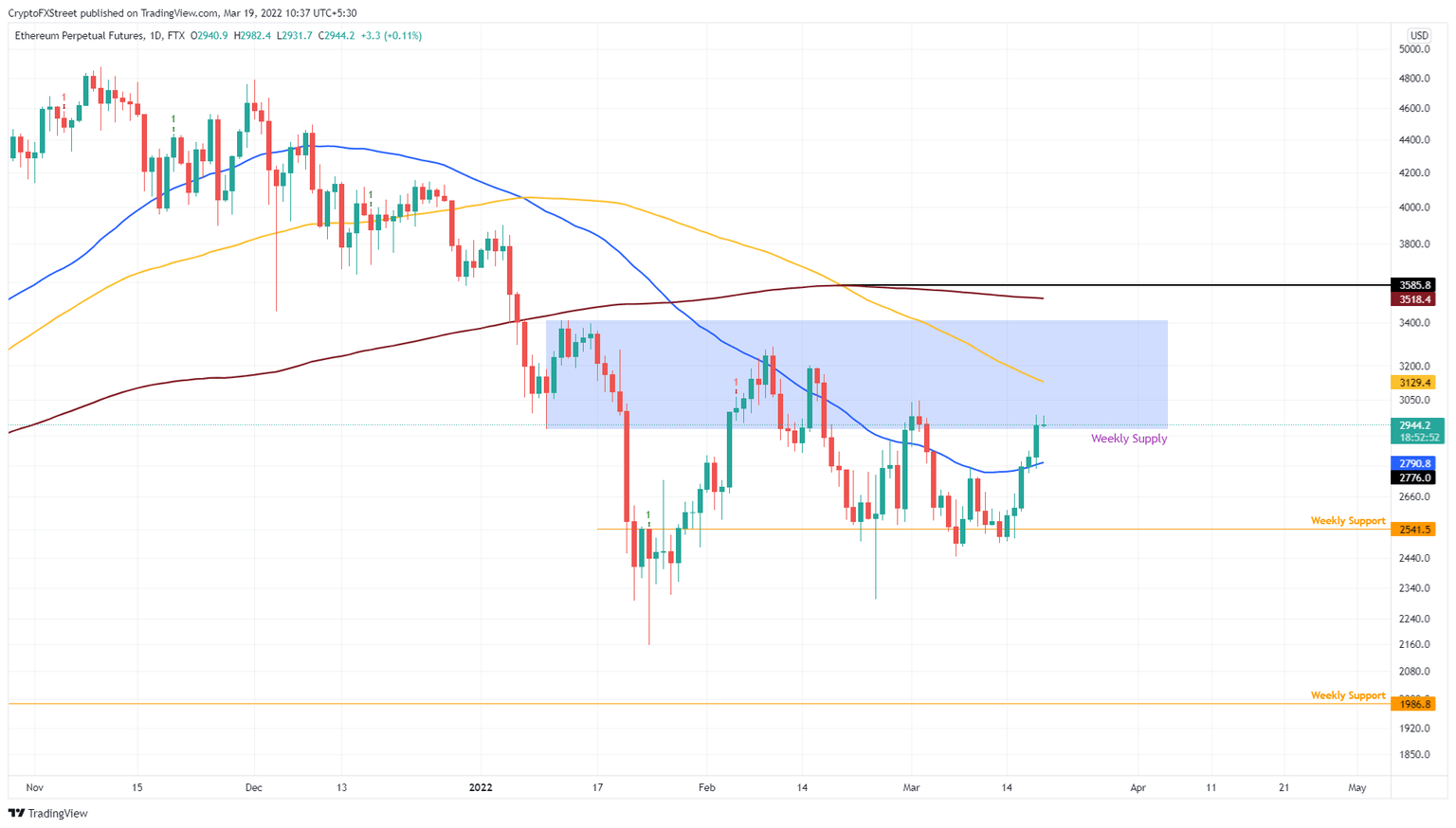

- Investors can expect ETH to plow through the $2,927 to $3,413 supply zone, but slowdown around 100-day SMA at $3,129.

- A lower low below the weekly support level at $2,541 will invalidate the bullish thesis.

Ethereum price follows the big crypto closely, as a result, its price action is tightly wound and stuck between two crucial barriers. Despite the lack of momentum and limited upside, ETH has managed to flip through a vital hurdle and looks ready for more gains.

Ethereum price favors bulls

Ethereum price, like Bitcoin price, is stuck between the weekly supply zone, extending from $2,927 to $3,413, and the weekly support level at $2,413. These barriers have constrained the movement of ETH and therefore its upside potential.

After failing to breach the 50-day Simple Moving Average (SMA) three times over the past month, ETH flipped it on Mach 16. Since then, Ethereum price has also plowed through the said supply zone and is making its way higher.

Going forward, investors can expect the smart contract token to retest the 100-day SMA at $3,129 and, in some cases, hit the $3,200 whole number. However, any move beyond this hurdle seems unlikely.

ETH/USDT 1-day chart

On the other hand, if Ethereum price fails to push through the weekly supply zone, extending from $2,927 to $3,413, it will reveal a weakness among buyers and suggest a potential reversal could occur. A daily candlestick close below the weekly support level at $2,541 will create a lower low and invalidate the bullish thesis for Ethereum price. In this case, ETH bears are likely to drag the coin to the $2,000 psychological barrier or to retest the $1,968 weekly support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.