Ethereum price could be compromised as one of the largest ETH mining pools is shutting down

- China-based SparkPool and Beepool recently suspended operations to comply with Beijing's new regulatory policy on crypto.

- Ethereum proponents await Ethereum's migration to PoS as the sale of mining equipment is now banned by e-commerce platforms like Alibaba.

- Cryptocurrency exchanges, mining firms and equipment sellers are rolling back services for users in Mainland China.

Ethereum mining pools that control over 26% of Ether's hashrate suspend operations in Mainland China and overseas. Ethereum’s migration to PoS is likely to lessen the impact of China’s crypto clampdown on Ether’s price.

Mining pool shut down likely to affect ETH price

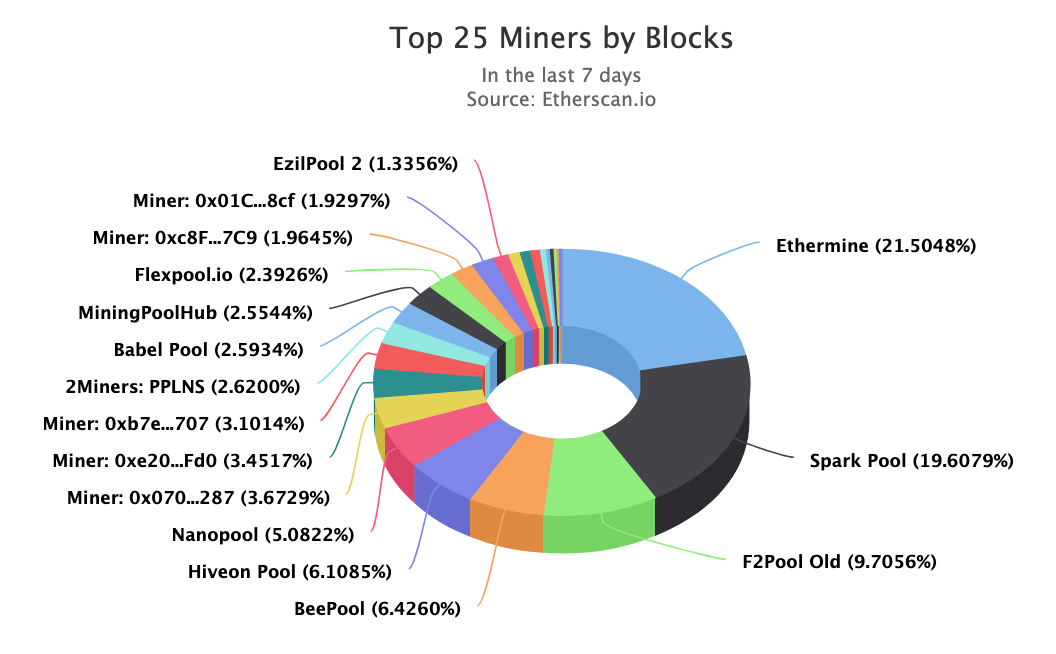

China's announcement of a ban on cryptocurrency and related activities and services has triggered the shutdown of mining pools that control over 25% of Ether's hashrate. The following chart shows the top 25 miners by blocks in the Ethereum network.

Top 25 Ethereum mining pools by blocks

SparkPool and Beepool, the second and fourth-largest mining pools respectively, announced that they are suspending operations a few hours apart.

— SparkPool (@sparkpool_eth) September 27, 2021

By the end of the month, SparkPool, is shutting down its operations both in China and worldwide.

Since "The Great Hashrate Migration" in the Bitcoin network (when China shut down all mining pools) had a negative impact on the top cryptocurrency's price, the community expects the ETH price to be compromised.

Slashing 26% of Ethereum's hashrate will likely drive the altcoin's price lower until "The Merge" kicks in. Ethereum proponents are awaiting the shift from the Proof-of-Work consensus mechanism to Proof-of-Stake.

Once the Ethereum network adopts PoS, miners become irrelevant, and a ban on the sale of mining equipment on e-commerce platforms like Alibaba ceases to impact the altcoin's price.

Pseudonymous cryptocurrency investor and trader @CHalexov2016 commented on the shift to PoS.

Well done! #Ethereum will also ban POW soon! Its why all who seing in future see #Ethereum overtake #BTC ! All world goverments will staet to press hardcore on mining and energy vaisting! POS is our future of #Blockchain ! #Ethereum & #Polkadot win hardcore over #Bitcoin https://t.co/0IkOQ3qX8v

— Chalexov.eth ❤️ (@CHalexov2016) September 28, 2021

FXStreet analysts have evaluated the altcoin, Ethereum price is expected to face an ugly outlook unless ETH hits $3000.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.