Ethereum Price Analysis: ETH snaps four-day uptrend but sellers fear entry above $983

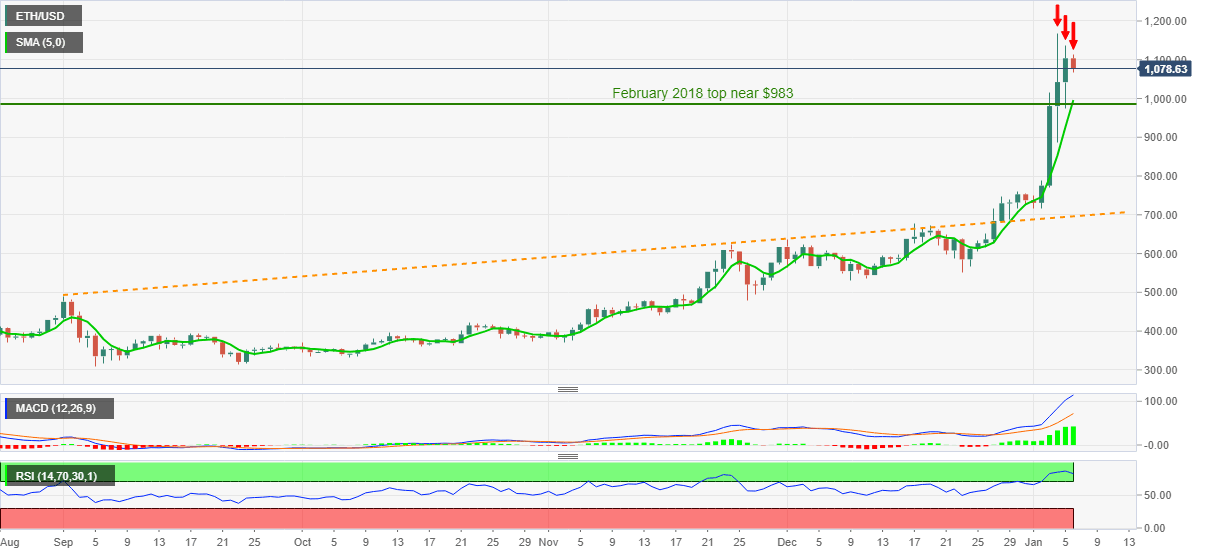

- ETH/USD extends pullback from $1,123 amid overbought RSI.

- Lower high formation also directs bears toward 5-day SMA, February 2018 top.

ETH/USD marks its first intraday losses in four while declining to $1,080 during early Wednesday. The ethereum buyers seem to have lacked upside momentum following their run-up to the highest since late January 2018 during Monday. Since then, the quote has been marking a lower high formation amid overbought RSI, which in turn favor sellers.

However, 5-day SMA and February 2018 top, respectively near $995 and $983, will follow the $1,000 threshold to challenge the bears’ entry.

In a case where the ETH/USD drops below $983, March 2018 peak surrounding $890 could return to the charts ahead direction the quote towards the previous resistance line stretched from September 2020, near $695.

Meanwhile, the recent top close to $1,170 guards the pair’s immediate upside before recalling the ETH/USD bulls.

Following that, January 28, 2018 high near $1,225 and the year 2018 top close to $1,420 will be in the spotlight.

ETH/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.