Ethereum Price Analysis: ETH primed to retest $2,100

- Ethereum price could be rejected by a critical resistance barrier.

- A spike in selling pressure could see Ether as low as $2,100.

- Investors may take advantage of the downswing to buy Ether at a discount allowing prices to rebound.

Ethereum seems to be trying to break through a crucial area of resistance. Failing to do so could lead to a steep correction.

Ethereum price surrenders to the bears

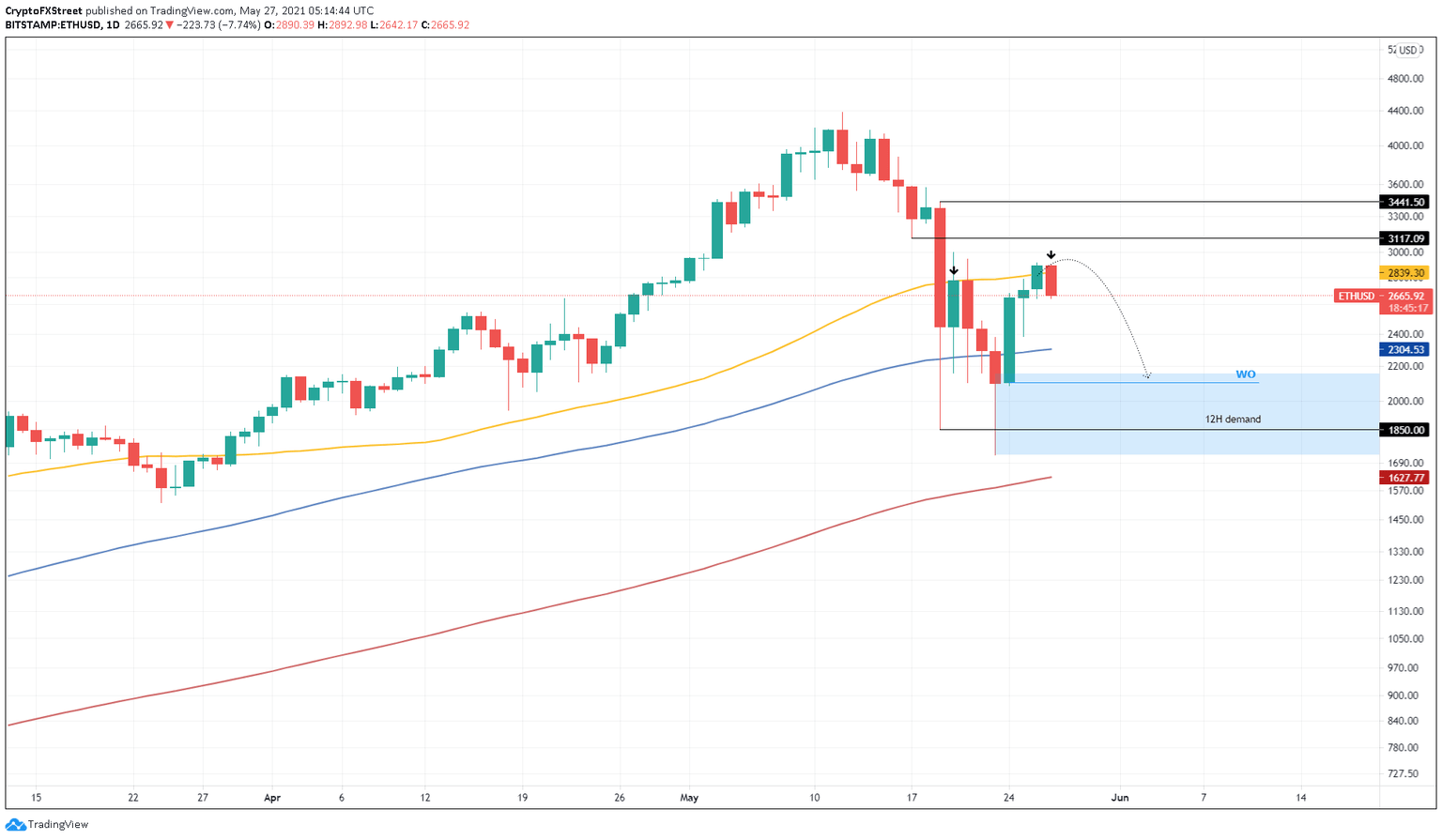

Ethereum price is facing its second rejection at the hands of the 50-day moving average at $2,839. If a similar turn of events were to unfold, ETH could be headed toward the demand zone that extends from $2,153 to $1,730.

While this would be an extremely bearish case, the 100-day moving average at $2,304 will be the first pitstop for sellers or an entry point for buyers.

Failing to hold above this barrier would drag the Ethereum price down to the weekly open at $2,101.

ETH price is optimistically looking at a 15% drop to $2,304, but under dire circumstances, this crash could extend to $2,101. Ethereum will likely begin a bullish reversal after retesting this support level or briefly dipping below it.

ETH/USD 1-day chart

On the flip side, if Ethereum price continues to surge above the 50-day moving average at $2,839 and produces a decisive daily close above $3,117, it would invalidate the bearish thesis. In this newly developed narrative, ETH could rally by 10% to test the swing high at $3,441 set up on May 19.

Author

FXStreet Team

FXStreet