Ethereum Price Prediction: ETH rally to catch investors off guard as massive sell signals erupt

- Ethereum price might reverse soon as it grapples with the 200 six-hour SMA at $2,810.

- The MRI indicator has flashed a preemptive top signal suggesting another sell-off might be around the corner.

- On-chain metrics suggest an increase in sell-side supply as whales continue offloading their holdings.

Ethereum price could be at the rally’s precipice and could come tumbling down if investors continue to book profits or start panic-selling. If this were to happen, ETH is likely to revisit the May 19 lows.

Ethereum price primed for a reversal

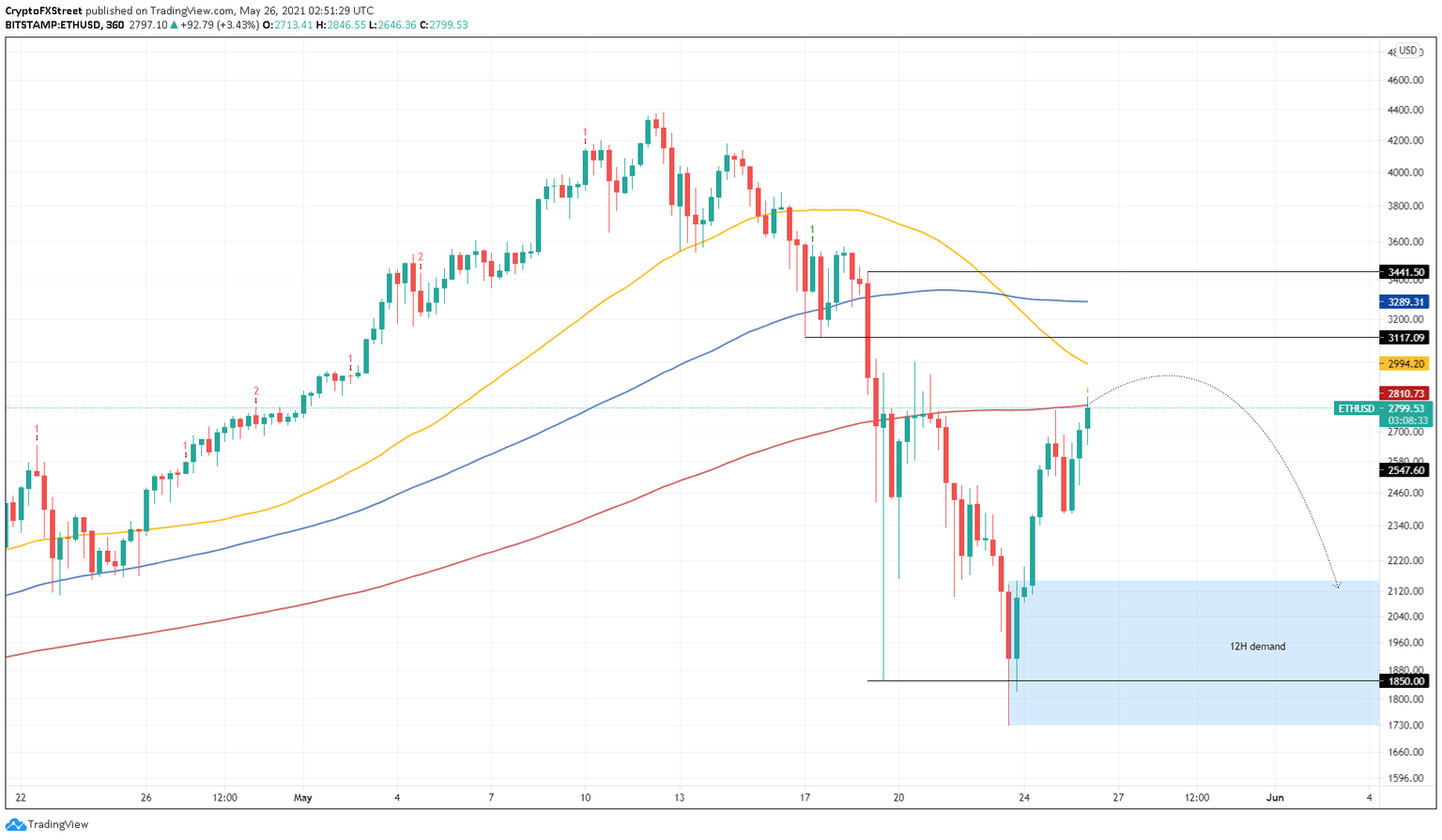

Ethereum price has rallied roughly 53% from the May 19 swing low at $1,850 or 65% from the May 23 bottom at $1,730. This quick recovery might come undone as it is threatened with the Momentum Reversal Indicator’s (MRI) preemptive cycle top signal in the form of a yellow ‘down’ arrow on the 6-hour chart.

This technical formation suggests that a continuation of the uptrend will produce a reversal signal that forecasts a one-to-four candlestick correction.

Further multiplying ETH’s woes is the 50 six-hour SMA ($2,994) driving below the 100 six-hour SMA ($3,289), creating a bearish crossover. This development suggests that the short-term selling momentum is rising faster.

Going forward, investors can expect the smart contract token to retrace 25% to retest the demand barrier’s upper boundary at $2,153. If the ask orders continue to pile up, Ethereum price could likely retest the May 19 swing low at $1,850.

ETH/USD 6-hour chart

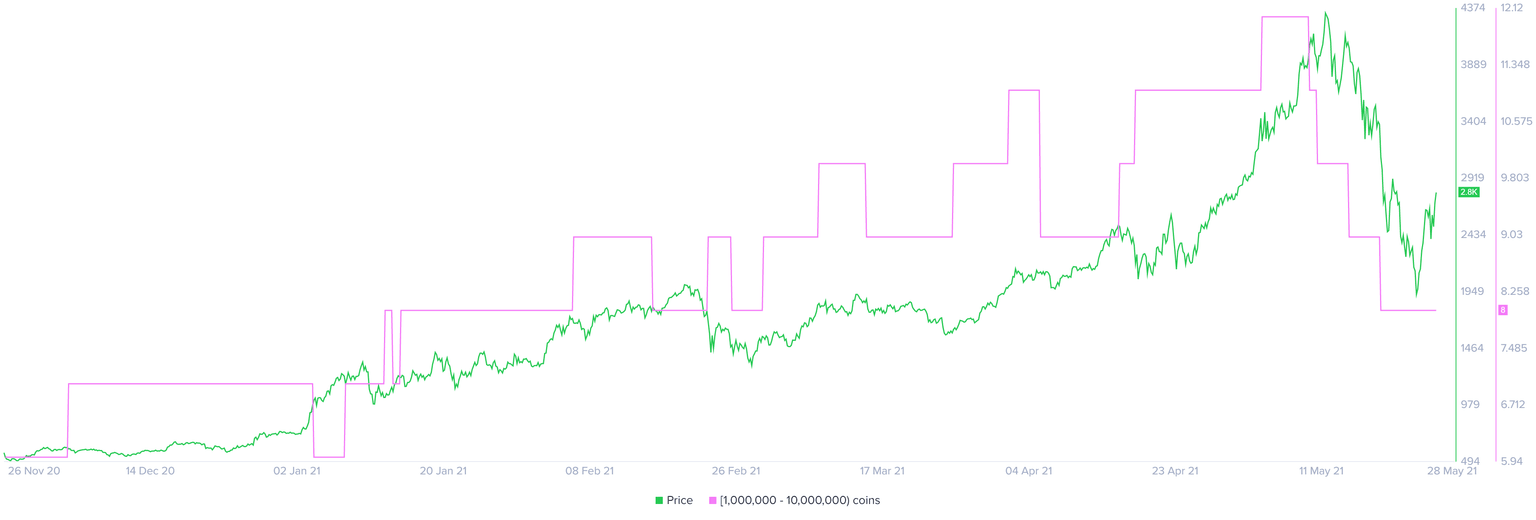

Adding credence to this bearish outlook is an 11% decrease in the number of whales holding between 1,000,000 to 10,000,000 ETH. In fact, this category of investors was heavily offloading their holdings as Ethereum price approached $4,000 in the second week of May. Three such whales have booked profits or reallocated their funds since May 9.

ETH supply distribution chart

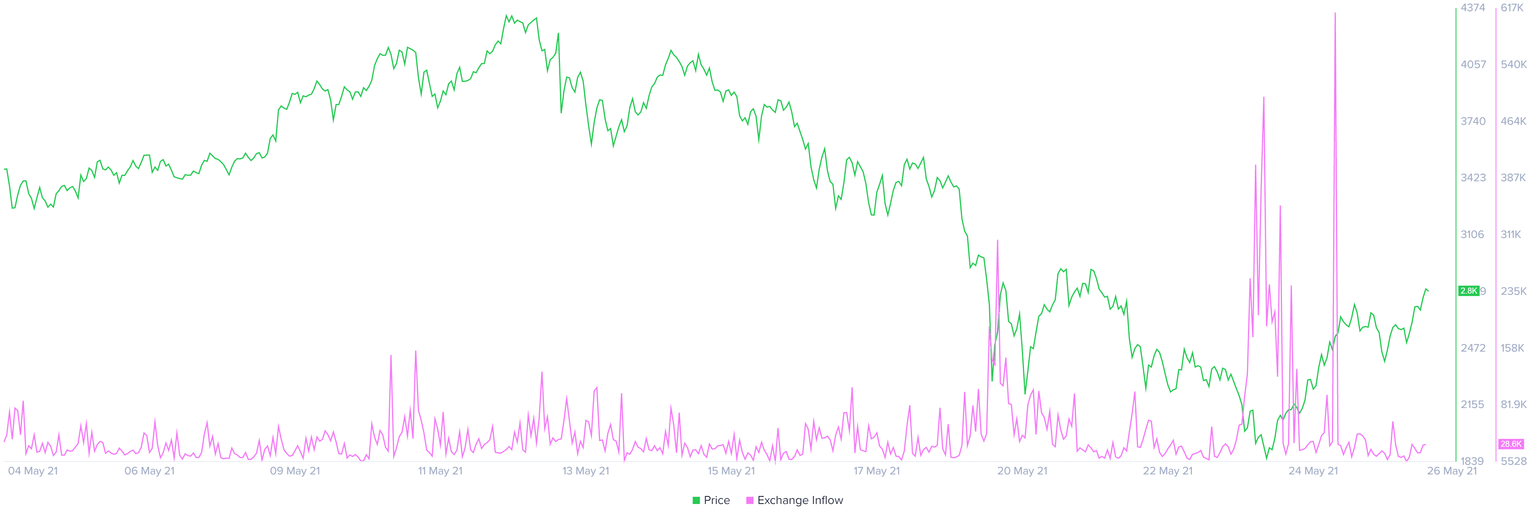

Further echoing the grim outlook is the increase in the supply of ETH available on exchanges from 20.81 million ETH to 21.42 million ETH from May 19 to date. This 3% uptick suggests that the investors on these centralized entities are not optimistic about the performance of the altcoin pioneer and might be inclined to sell.

ETH supply on exchanges chart

All in all, Ethereum price exudes bearishness and might be due for a crash. However, if the bid orders rise, setting up a higher high due to a six-hour candlestick close above $3,117 would alleviate the pessimistic outlook detailed above.

If the bulls maintain Ethereum price above $3,289, the bearish momentum will face invalidation. Under these conditions, ETH could rise 4% to tag the May 19 swing high at $3,442.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.