Ethereum Price Analysis: ETH primed for new all-time highs as resistance weakens

- Ethereum price prepares for a 30% breakout from a bullish consolidation pattern.

- On-chain metrics support the bullish thesis as ETH moves closer into price discovery mode.

- The 50 and 100 twelve-hour EMA will play a vital role in keeping Ether’s uptrend intact.

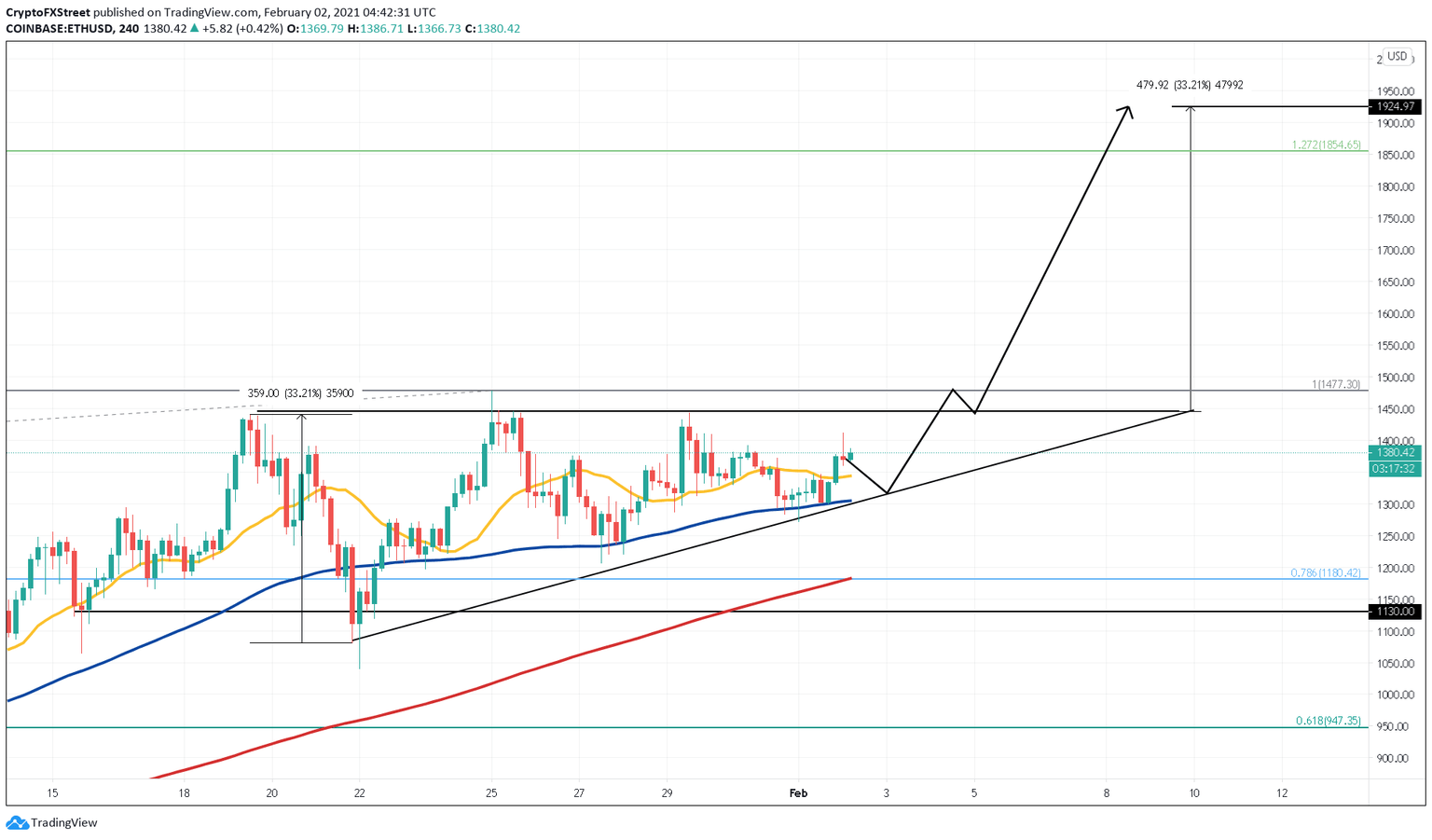

Ethereum price is ready for a significant upswing as the price nears the x-axis of an ascending triangle. A candlestick close above $1,450 would confirm a bullish breakout that may propel ETH towards $1,900, representing a 30% increase.

Ethereum price primed for new all-time highs

Ethereum price is ready for a breakout after a two-week consolidation period where it mostly traded inside an ascending triangle. ETH’s recent move above the 50 twelve-hour EMA shows that bulls want to push prices towards the triangle’s upper trendline.

A subsequent 12-hour candlestick close above the resistance barrier at $1,450 not only confirms a bullish breakout but also could see Ether’s market value rise by more than 30%.

ETH/USDT 4-hour chart

Adding credence to the bullish scenario is IntoTheBlock’s In/Out of the Money Around Price model. This on-chain metric shows clear sailing for ETH with very little resistance ahead.

Only a small cluster of investors have purchased around 100,000 ETH for a market value of $1,385. Although such an insignificant supply wall could momentarily keep rising prices at bay, Ethereum will enter price discovery mode if it manages to slice through it.

Ethereum IOMAP

Moreover, Ethereum’s supply on exchanges has taken a massive nosedive over the past two weeks, indicating a substantial decrease in sell-pressure. It also suggests that investors are confident that ETH will achieve its upside potential, which adds fuel to the optimistic view.

%2520%5B10.47.11%2C%252002%2520Feb%2C%25202021%5D-637478425767769207.png&w=1536&q=95)

Ethereum Coin Supply on Exchanges chart

Although the bullish scenario is plausible, Ethereum price has faced multiple rejections at the $1,450 resistance level. Hence, a failure to breach this hurdle can invalidate the bullish outlook and lead to a steep correction.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.