Ethereum network activity explodes, suggesting imminent breakout

- Ethereum network observes a 31% uptick in the number of unique addresses interacting on its blockchain.

- Amidst a surge in on-chain activity, ETH posted over 5% daily gains on Thursday.

- Nearly $27.3 billion worth of ETH is pulled out of circulation and staked in the ETH2 deposit contract.

- With over $1.1 billion worth of Ether burned, analysts expect a "deflationary effect" on the altcoin's price.

The Ethereum reserve on exchanges has plummeted to a three-year low, and the altcoin is gearing up for a breakout.

Ethereum on-chain activity witnesses massive spike, is ready to skyrocket

The second-largest cryptocurrency has witnessed one of the biggest spikes in address activity since July 2021. Active addresses are an indicator of the number of unique addresses sending or receiving Ether. Historically, a spike in this indicator is indicative of a bullish breakout in Ethereum price.

Over the past five days, there has been a 31% increase in the number of unique addresses interacting on the Ethereum network based on data from Santiment, a behavioral analytics platform. This implies that Ethereum is primed for another leg up in the ongoing rally.

Ethereum active addresses for the past 30 days.

Rising on-chain activity is driving the altcoin's price higher. Ethereum has posted 5% daily gains and is trading at $3,604.25 at the time of writing.

The brewing Ethereum supply shock is fueling the narrative of an upcoming bull run. Since the implementation of EIP-1559, nearly 303,000 Ether worth over $1.1 billion has been burned and subsequently pulled out of the circulating supply.

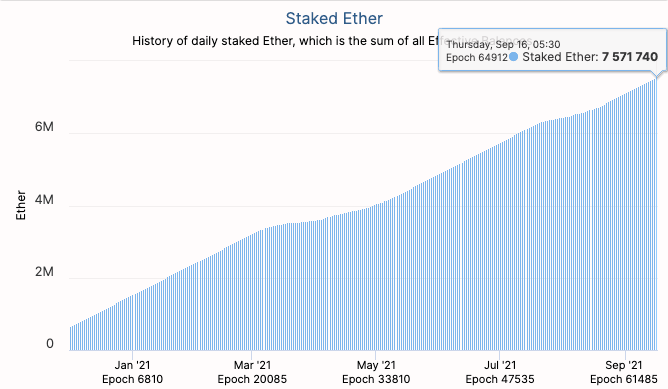

The volume of Ethereum staked in the ETH2 deposit contract is the only other critical factor influencing the altcoin's circulating supply.

Over 7.57 million Ether has been staked in the deposit contract. The combined volume of Ethereum burned and staked is on the rise, effectively reducing the quantity of the altcoin in circulation and bringing about a supply shock.

Quantity of Ethereum staked in ETH2 deposit contract.

Pseudonymous cryptocurrency analyst and trader @Pentosh1 believes that it is time for Ethereum to break out. Another 80% reduction in issuance of Ether is expected after its transition to proof-of-stake, widely referred to as "The Merge."

Over $1,000,000,000 in $eth burned since EIP went live. A 54% reduction in issuance. Have you seen what happens 2 months after $BTC halvings?

— Pent◎shi Wont DM You (@Pentosh1) September 15, 2021

And don’t let me remind you. Eth has another 80% reduction in issuance coming from the merge. It’s simply undervalued https://t.co/H15x15nEUG

FXStreet analysts have evaluated the current Ethereum price action and state that it presents a clean and profitable trade.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.