Ethereum Classic Price Prediction: ETC set for sideways action

- Ethereum Classic jumped up to $62.67 on Wednesday before starting to fade.

- The profit-taking is being seen in all major cryptocurrencies as well.

- On the downside, we have a few supports that will keep ETC around $46.

Ethereum Classic price dipped lower today and looks to fade after the uptrend that lasted five consecutive days, reaching a high of $62.67 on Wednesday.

Ethereum Classic price has a bandwidth of 25%

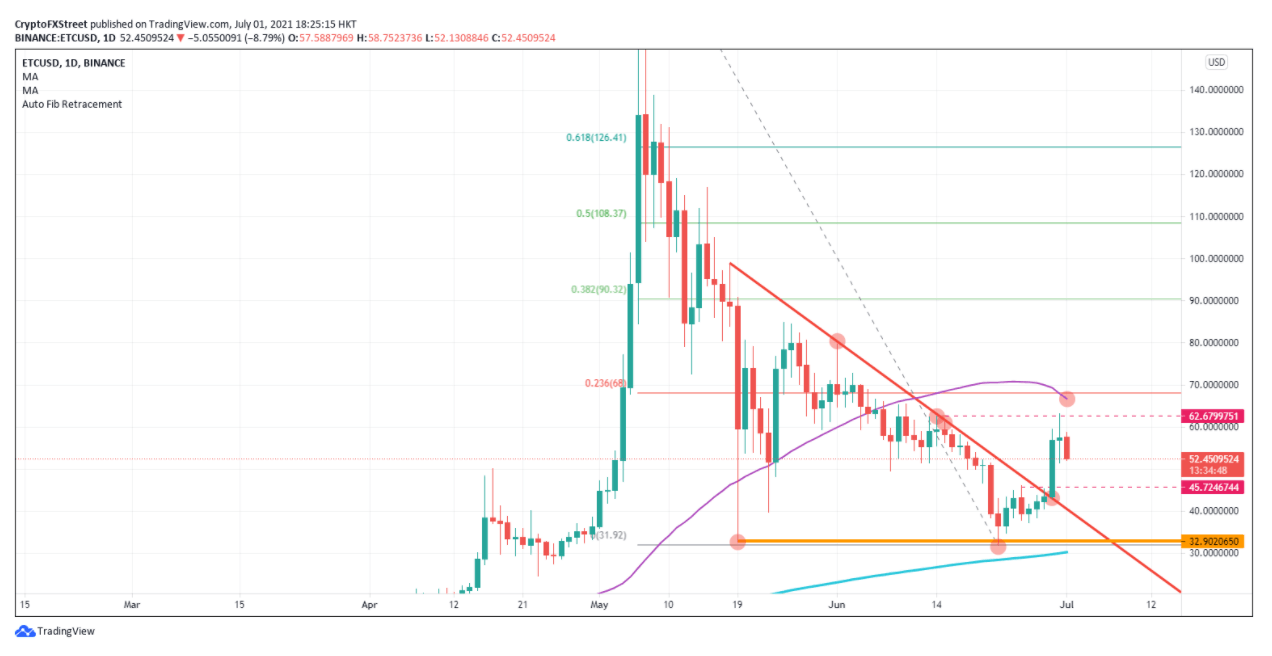

Ethereum Classic's steep climb in May was maybe just a bit too violent and deserved a correction after many indicators pointed to an overbought condition. The fade ETC saw in May and June made it test twice the support at $32.90.

ETC recovered and was able to get out of a bearish pattern with a break to the upside of the descending trendline on June 29.

Ethereum Classic price has proven that it still has the potential to go higher. However, it recently saw a rejection of the $62 level, which might show that further upside is limited. A target of $68 would be excellent, but we see profit-taking today in all major cryptocurrencies. Hence, the upside looks limited for the rest of the week.

The general sentiment should nonetheless help. It is a bit contradictory that we do not see this translated to ETC catching a bid and going for the $68 price target. With the 55-day Simple Moving Average (SMA) and a nearby 23.8% Fibonacci level, this looks like a solid resistance level. It should be tempting for buyers to run the price up toward that level.

On the downside, the break of the descending trend line exposed a short-term floor around $46. Ethereum Classic price shot through this resistance and has not come back since. Sellers will look to target this level for profit-taking on their shorts.

ETC/USD daily chart

To summarize, we see in ETC both buyers and sellers awaiting a break, either way, to jump on the opportunity. This will keep Ethereum Classic price within the bandwidth between $62 to the upside and $46 to the downside. Should we break either boundary, look for $68 with the Fibonacci level and the 55-day SMA as guardians for the resistance.

On the flip side, if the $62 level breaks, we can see a retest of the $32.90 level, with the 200-day SMA and the double bottom as support.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.