Ethereum Classic Price Prediction: ETC to rally over 400%

- Ethereum Classic price has been bouncing in a cumulative phase after an explosive rally in the first week of May.

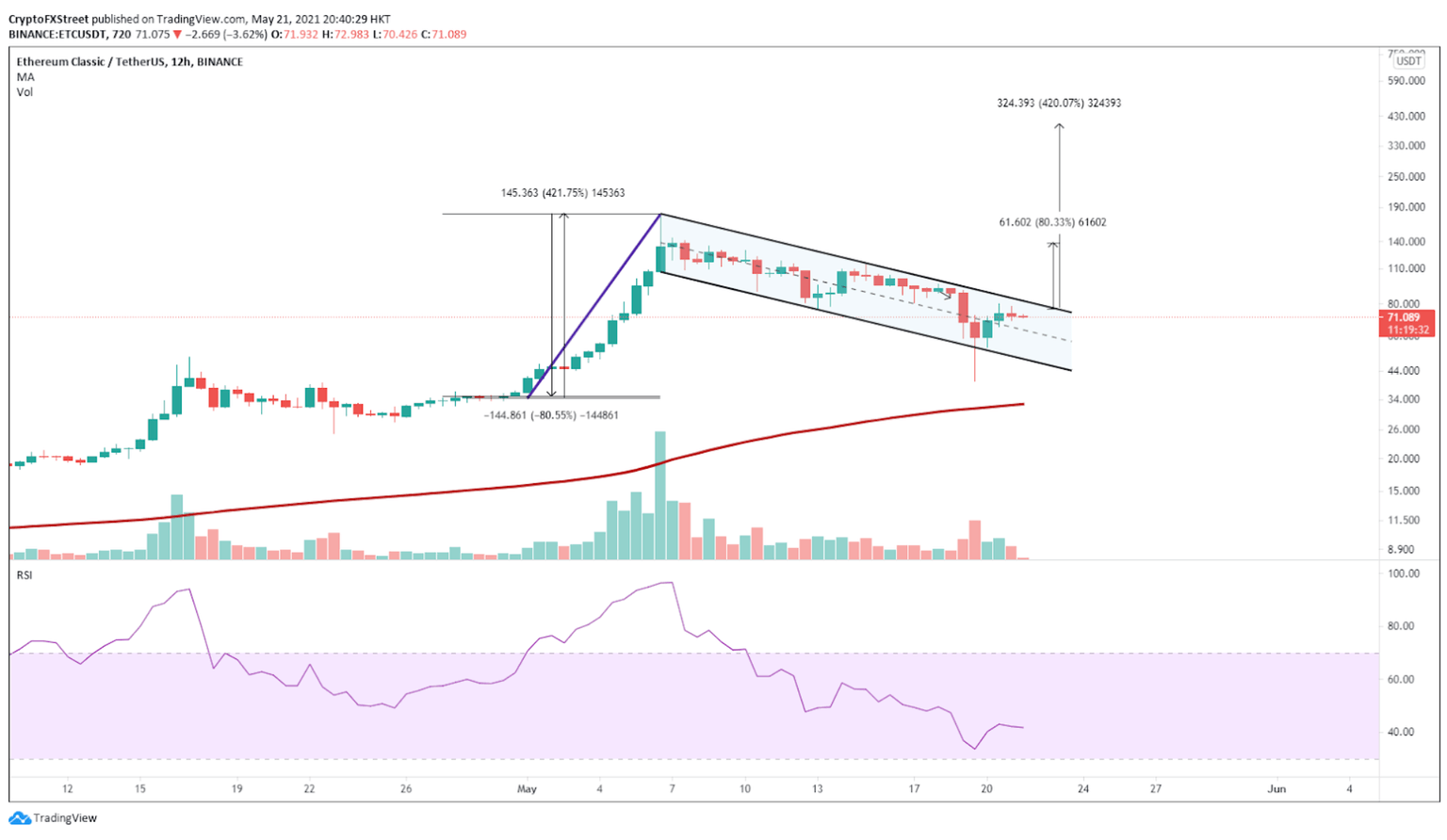

- The consolidation phase seems to be part of a bull flag pattern developing on ETC’s 12-hour chart.

- Slicing through the resistance trendline at $83 could see ETC surpass the all-time high of $178.

Ethereum Classic price had a rally over 400% during the first days of May, creating a new all-time high at nearly $178. ETC has retracted by over 70% since then due to the cryptocurrency market’s collapse on May 16 and is currently trading at $71. ETC seems ready to resume its uptrend to surpass the all-time high reached last May 6.

Ethereum Classic price accumulates strength

Ethereum Classic price has gone through a period of consolidation since the beginning of May. ETC has recorded a series of lower lows and lower highs since then, the $83 resistance level continued to prevent it from moving further.

Drawing a trend line connecting these points forms a flag, where the 400% rise that happened before the consolidation appears to have constituted the flagpole. This led to the formation of a bullish flag pattern, indicating that ETC uptrend may continue.

A break above the resistance trend line of the flag at $83 could increase the chances of an 80% rally that would place ETC at a price of $138. This target price is measured by adding the length of the flagpole to the breakout point in the upper trendline.

If ETC handles the break above the first price target of $138 and changes this level to support, Ethereum Classic price could reach a new all-time high of nearly $400, which represents a 420% rally, calculated by the height of the flagpole.

ETC/USDt 12-hour chart

Ethereum Classic price should remain above the critical support zone at $49. If ETC loses this support, it could retrace to $32, marked by the 200 12-hour moving average establishing itself as a strong support zone in the event of a rejection.

Author

FXStreet Team

FXStreet