Ethereum Classic Price Prediction: ETC edges closer to massive 30% upswing

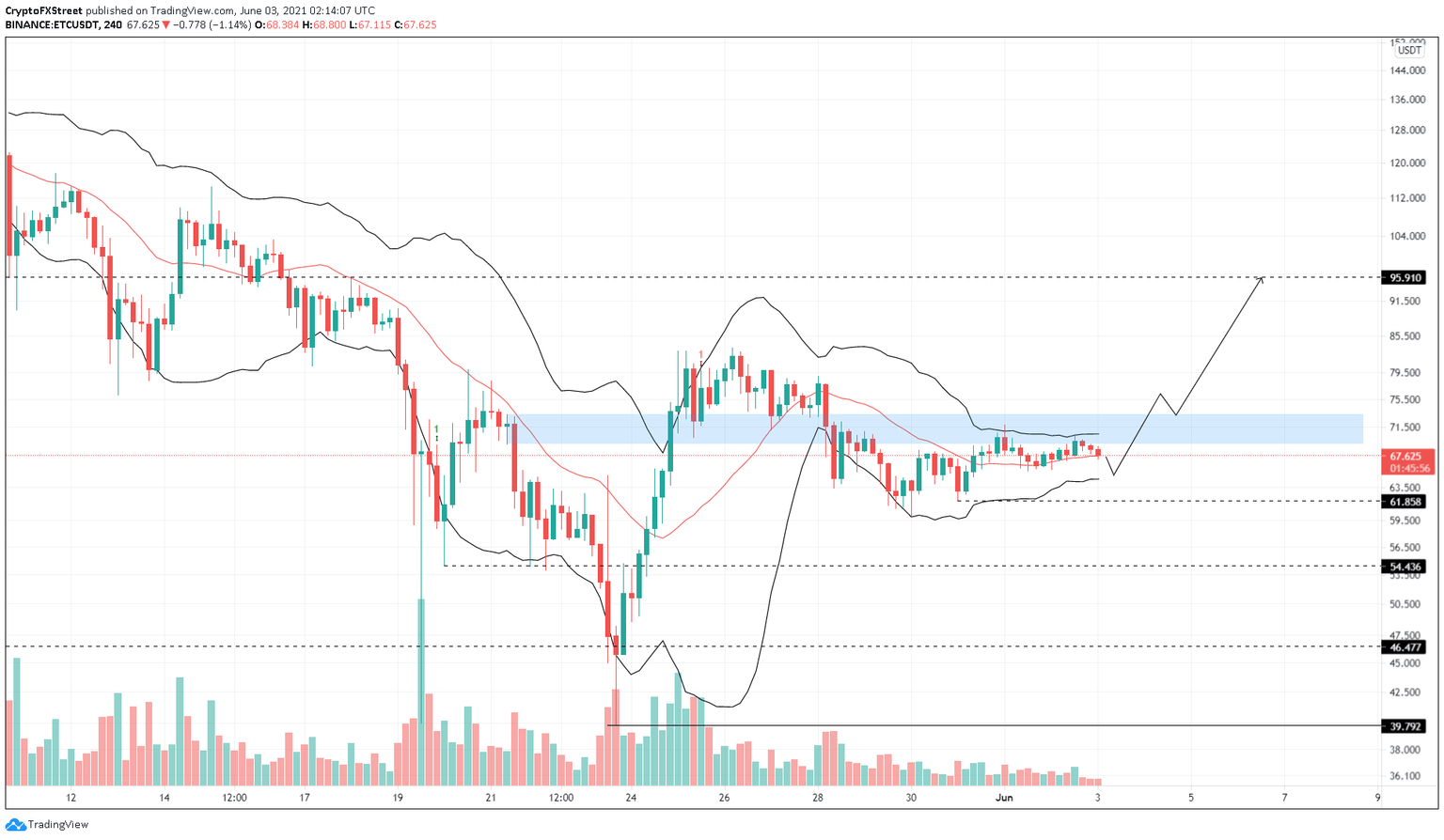

- Ethereum Classic price is trading below a supply zone ranging from $69.08 to $73.28.

- A decisive close above $73.28 will signal the start of a new upswing that could propel ETC by 30%.

- If the bears slice through the recent swing low at $61.86, the bullish thesis will face invalidation.

Ethereum Classic price is moving in a tight range after facing multiple rejections around a crucial supply zone. Now ETC could be gearing up for a volatile breakout as suggested by a particular technical indicator.

Ethereum Classic price awaits massive moves

Ethereum Classic price has been chiefly consolidating since May 25. While the first half of these rangebound moves were above the supply zone, extending from $69.08 to $73.28, the other half was below it. This shift indicated the inability of the buyers to sustain the bullish momentum.

The Bollinger Bands indicator showed a tight envelope of the ETC price action indicating a reduction in volatility. Typically, a squeeze like the one Ethereum Classic is experiencing is often followed by a highly volatile move.

For ETC price, a decisive close above the upper band at $70.77 signals the start of an uptrend. A confirmation of the upswing will arrive after the Ethereum Classic price slices through $73.28.

In that case, the buying pressure could propel the altcoin by 30% to tag a stiff resistance level at $91.13.

ETC/USDT 4-hour chart

On the other hand, if the bears push Ethereum Classic price below the lower band at $64.28, it would signal that the bullish momentum is weakening. However, a convincing 4-hour candlestick close below $61.86 would invalidate the bullish outlook.

If such a move were to happen, investors could expect ETC to kick-start an 11% downswing to $54.34

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.