Elrond price still offers another 20% upside for patient EGLD holders

- Elrond price commanding volume support on the new breakout.

- Partnership with Shopping.io to enable US shoppers to use eGold as payments.

- Ascending triangle measured move targets $245.50.

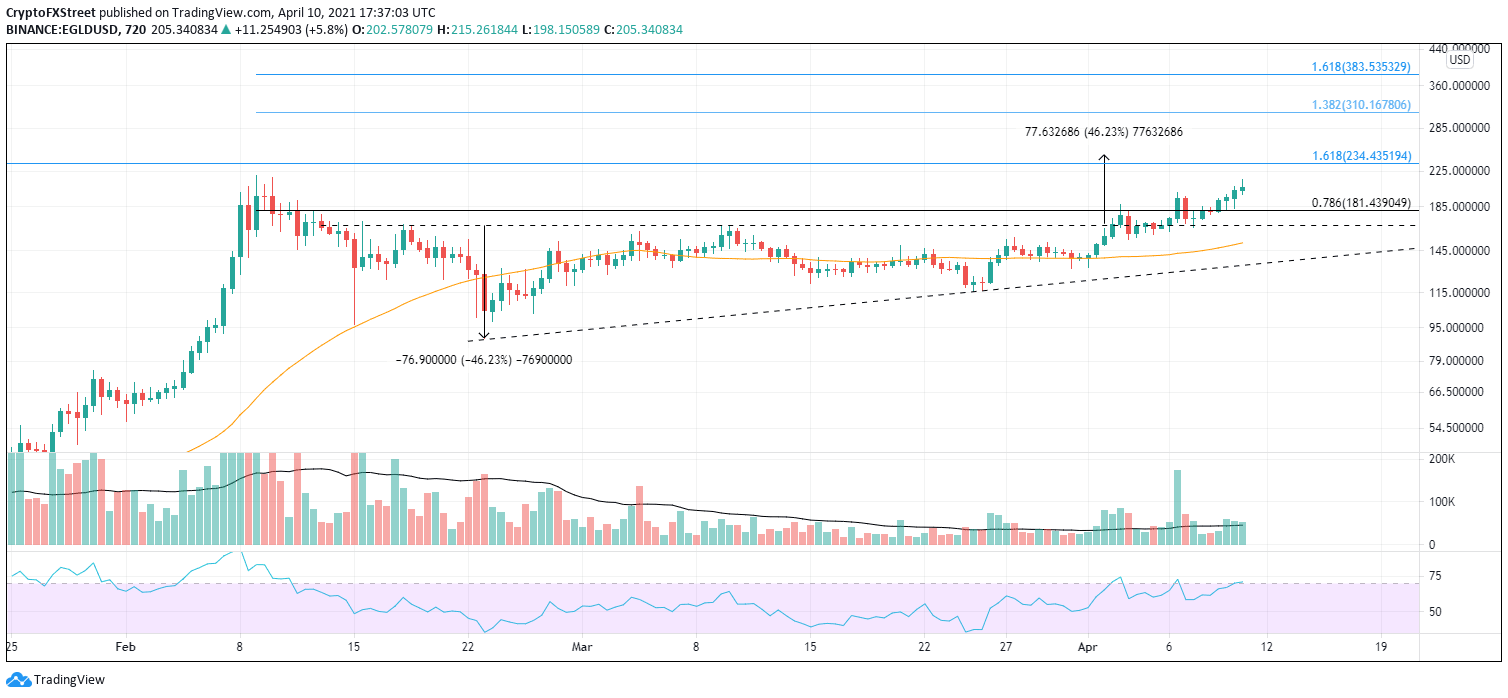

Elrond price breakout on April 2-3 stalled, but the April 6 gain on huge volume confirmed the bullish price tilt and set it on course to test the 161.8% Fibonacci extension of the 2019-2020 bear market and the measured move target of $245.50 in the coming weeks.

Elrond price responding to a better cryptocurrency shopping experience

EGLD developers announced a significant partnership with a company called Shopping.io that facilitates the use of Elrond’s eGold for shopper’s payments. The token can be used to shop on platforms such as Walmart and Amazon, and Alibaba shortly.

The successful close above the 78.6% retracement level of the February correction confirmed the breakout and set EGLD on course to test and overcome the all-time high at $219.96 in the coming days.

Speculators should prepare for greater resistance at the 161.8% extension level at $234.44 before EGLD tests the measured move target of $245.50. It would be a gain of 22% from the current trading price.

Of course, the rally does not need to end there. If volume support remains robust, EGLD could extend the rally to the 138.2% extension of the February decline at $310.17. A more ambitious target is the 161.8% extension at $383.54.

EGLD/USD 12-hour chart

Tangible support is the upper trend line of the ascending triangle pattern at $167.20, followed closely by the 50 twelve-hour simple moving average at $151.56 and the lower trend line of the triangle at $133.00.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.