Elliott Wave View: Litecoin should see further upside [Video]

![Elliott Wave View: Litecoin should see further upside [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Digital Currencies/Litecoin/Litecoin_3_XtraLarge.jpg)

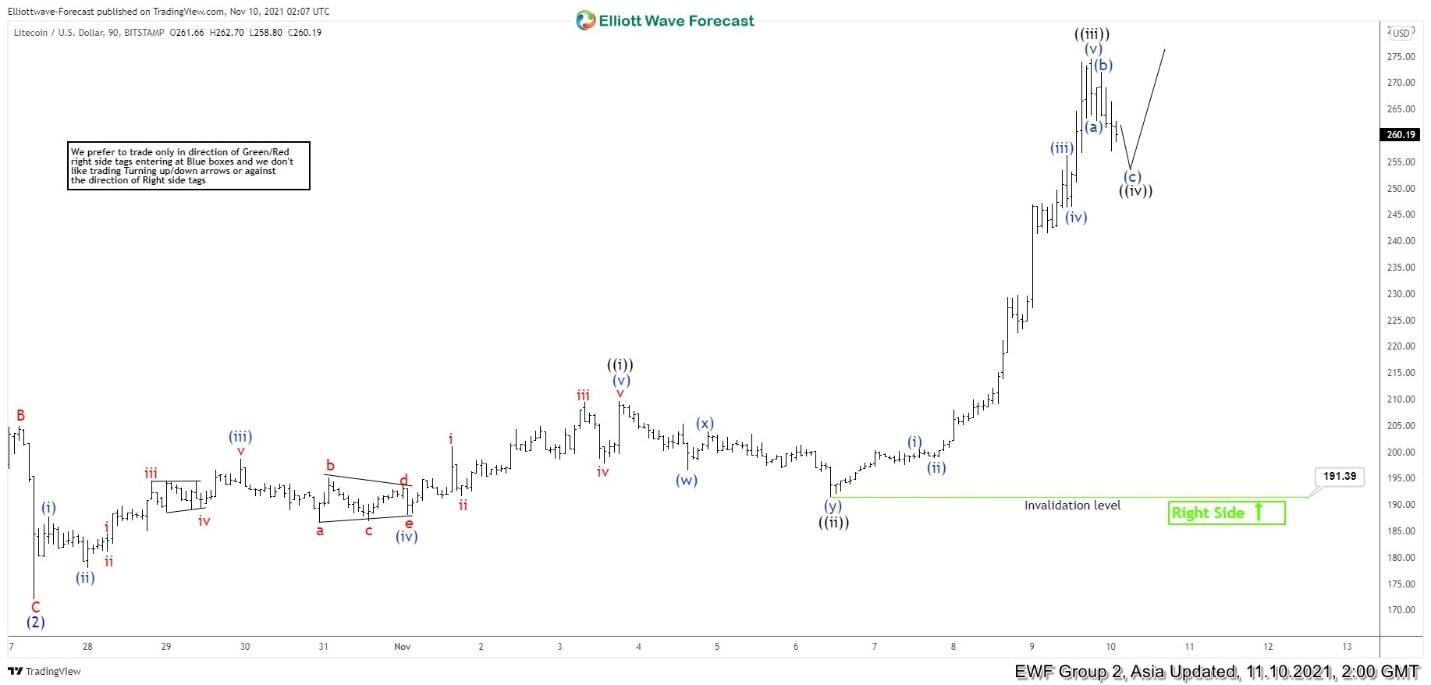

Short-term Elliott wave view in Litecoin suggests the rally from October 27, 2021 low is in progress as a 5 waves impulse Elliott Wave structure. Up from October 27 low, wave (i) ended at 187.82 and pullback in wave (ii) ended at 178. The crypto currency has extended higher in wave (iii) towards 198.62. Dips in wave (iv) ended at 188 and final leg higher wave (v) ended at 209.69. This completed wave ((i)) in higher degree.

Pullback in wave ((ii)) ended at 191.39 with internal subdivision as a double three Elliott Wave structure. Down from wave ((i)), wave (w) ended at 196.45, wave (x) ended at 203.93, and wave (y) of ((ii)) ended at 191.39. The crypto currency then extends higher again in wave ((iii)) with internal subdivision as another 5 waves in lesser degree. Up from wave ((ii)) low, wave (i) ended at 200.51 and dips in wave (ii) ended at 198.84. Wave (iii) ended at 256.20, wave (iv) ended at 246.51, and wave (v) of ((iii)) ended at 274.54. Near term, wave ((iv)) pullback is in progress to correct cycle from November 6 low before the rally resumes. As far as pivot a 191.39 low stays intact, expect dips to find support in 3, 7, or 11 swing for more upside.

Litecoin 90 Minutes Elliott Wave Chart

LTCUSD Elliott Wave Video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com