Elliott wave view: Litecoin ending year 2020 on a high note [Video]

![Elliott wave view: Litecoin ending year 2020 on a high note [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Digital Currencies/Litecoin/Litecoin_1_XtraLarge.jpg)

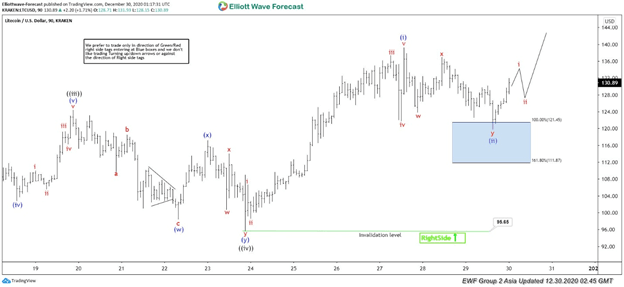

Elliott Wave view on Litecoin suggests the rally from November 26 low is unfolding as a 5 waves impulse Elliott Wave structure. In the chart below, we can see wave ((iii)) of this rally ended at 124.40. Pullback in wave ((iv)) ended at 95.65 and the Index has since resumed higher in wave ((v)). Internal subdivides of wave ((v)) is unfolding in another 5 waves of lesser degree.

Up from wave ((iv)) low, wave i ended at 106.64 and dips in wave ii ended at 98.55. Litecoin then resumes the rally higher in wave iii towards 137.34. Wave iv pullback ended at 121.70, and wave v of (i) ended at 139.21. Down from there, wave (ii) pullback ended at 119.72 in a double three Elliott Wave structure. Wave (ii) ended at the blue box inflection area which is where wave y = 100% – 161.8% Fibonacci extension of wave w. Near term, expect the crypto currency to continue higher while dips stay above wave (ii) low at 119.72. As far as December 23 pivot low at 95.65 remains intact, expect pullback to find support in 3, 7, or 11 swing for more upside.

LTC/USD 90 Minutes Elliott Wave Chart

LTC/USD Elliott Wave Video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com