DYDX price rally likely as community unanimously supports migration to dYdX chain

- DYDX price holds above support at $2.12 after the unlock of $14 million worth of tokens on Tuesday.

- The community unanimously supports the proposal for adoption of Version 4 of dYdX and its migration to the dYdX chain.

- The next token unlock event is scheduled for September 26, when $13.95 million worth of tokens will enter circulation.

DYDX price resisted selling pressure despite Tuesday's token unlock in light of the migration to dYdX chain and the adoption of version 4 of the project. The proposal, shared by crypto market maker Wintermute, is likely to be approved as it has received 100% support from community members on a vote that is still under way.

Adding to the success of the vote, DYDX's relative strength could also be attributed to increasing activity from Whales. On-chain data showes that large wallet addresses, or those holding between 10,000 and 10 million DYDX tokens, appear to be accumulating the DEX platform’s token.

Also read: PEPE coin early adopter acquires 1 trillion tokens despite rug pull allegations

dYdX to migrate to version 4 after community approval

Typically, token unlocks tend to push prices down as they increase the circulating supply and thus the selling pressure on the asset. In this case, around $13.95 million worth of DYDX tokens were released. Despite the unlock, the supply on exchanges remained nearly the same as the community seems to be supporting the migration to the dYdX chain.

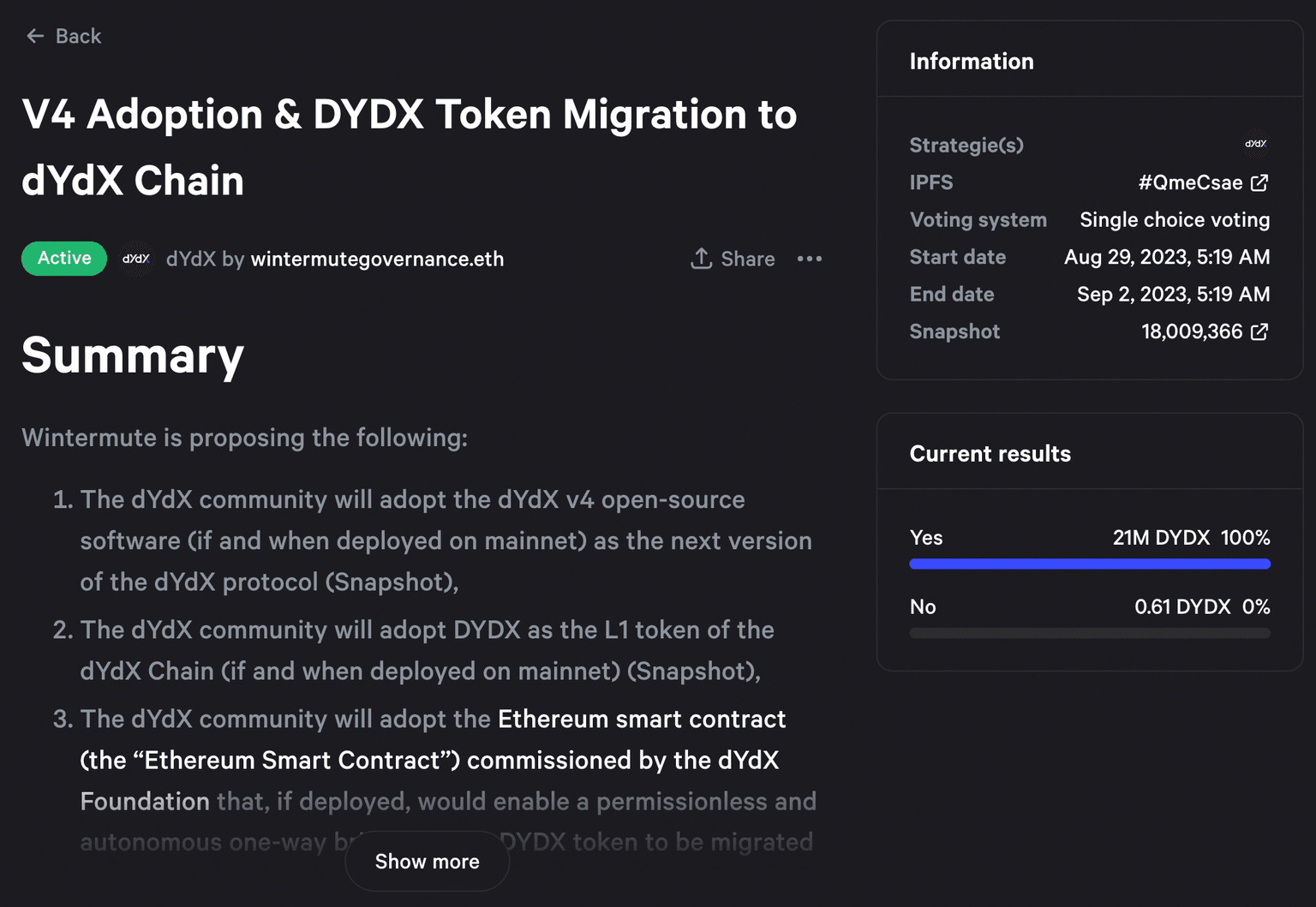

Crypto market maker Wintermute pitched the adoption of open-source software version 4 for the DEX. The proposal was put to vote on Tuesday, and community members can vote until Saturday. So far, based on the snapshot below, 100% of the community members who cast a vote, representing 21 million dYdX tokens, have voted in favor.

The unanimous approval could be acting as a bullish catalyst for the token.

V4 adoption and migration to dYdX chain

While dYdX price resisted the post-unlock sell-off, it is uncertain if the current strength will continue. DYDX price posted nearly 10% gains over the past week. In this context, short-term holders could be tempted to capitalize on the gain, although there is no sign of such behavior among dYdX holders yet.

On-chain metrics that support DYDX price gains

Based on data from crypto intelligence tracker Santiment, there is no significant gain recorded in the token’s supply on crypto exchanges despite the recent unlock event. This metric – which helps tracking the selling pressure on the asset – has declined recently, supporting a bullish thesis for DYDX price.

DYDX supply on exchanges vs price

Moreover, big wallet addresses – those holding between 10,000 and 100,000 tokens and between 1,000,000 to 10,000,000 tokens – are consistently accumulating dYdX since mid-June 2023. The accumulation trend is also bullish sign for the asset.

DYDX accumulation by large wallet investors vs price

These on-chain metrics support DYDX price gains, making a sell-off more unlikely in the short-term. DYDX trades at $2.14 at the time of writing, a 9.51% gain over the past week.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B16.21.16%2C%252030%2520Aug%2C%25202023%5D-638289902459394965.png&w=1536&q=95)

%2520%5B16.23.07%2C%252030%2520Aug%2C%25202023%5D-638289902818281714.png&w=1536&q=95)