Dogecoin price to retest $0.075 as DOGE reverts to mean

- Dogecoin price shows no restraint as it has crashed by 49% in the last two months.

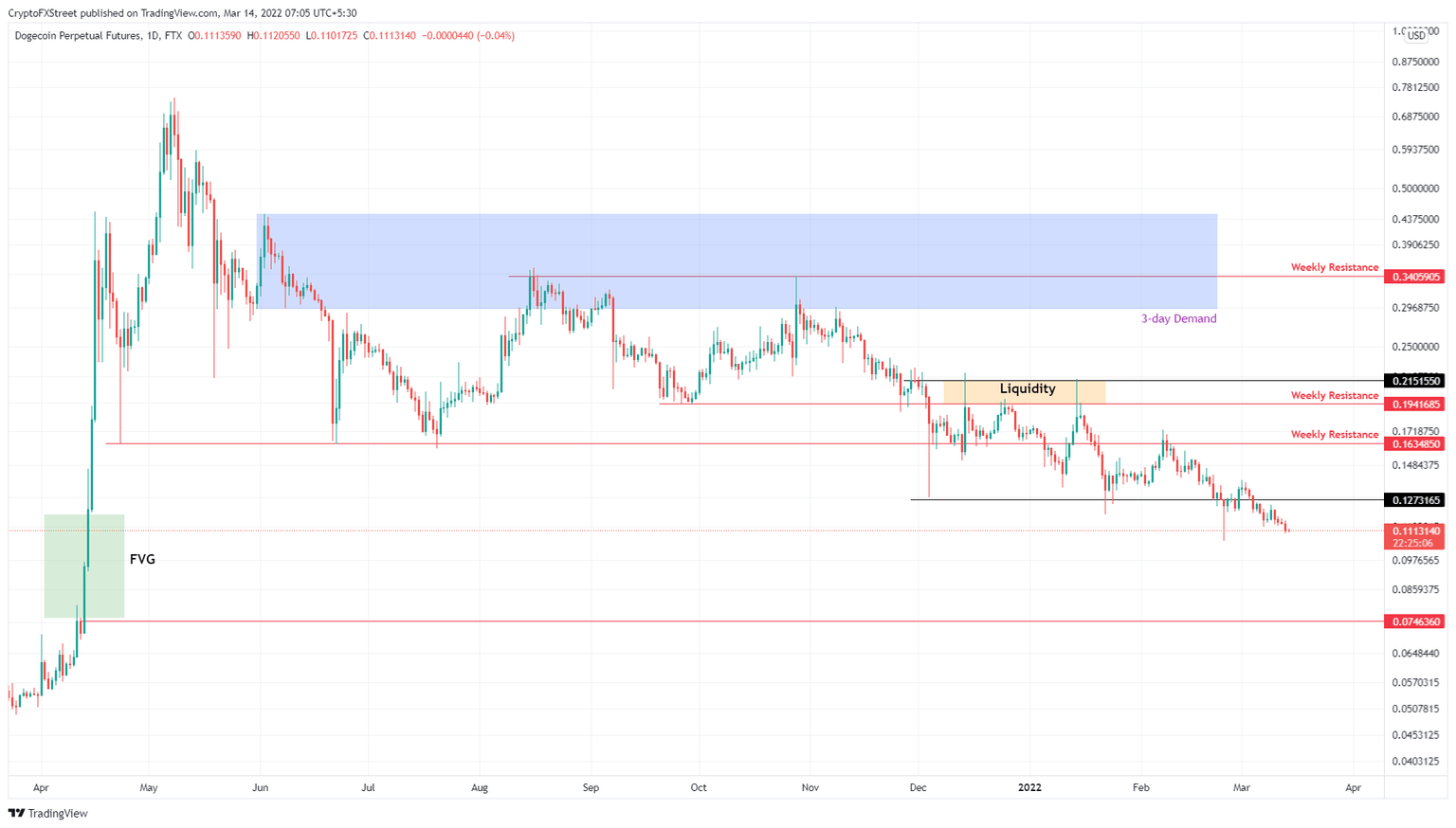

- This downswing comes as DOGE fills the FVG, extending from $0.119 to $0.075.

- A bounce around the $0.075 support level seems likely for the dog-themed cryptocurrency.

Dogecoin price has been on a slow and painful downtrend since its all-time high reached in May. This downswing has breached crucial support levels and is heading back to levels last seen in early 2021.

Also read: Gold Price Forecast: Lower lows hinting at a steeper decline

Dogecoin price continues to slide lower

Dogecoin price began its consolidation on December 4, 2021, and extended this sideways movement for roughly three months. On February 22, DOGE broke below the $0.127 support level and slid lower.

The Fair Value Gap (FVG), extending from $0.075 to $0.119, is what the Dogecoin bears are looking to target. This price inefficiency formed in April 2021, when DOGE rallied 951% in less than 25 days.

Often, markets revert to the mean to fill this gap; so, the current downswing is also a bid from market makers to close this inefficiency. While bearish, it allows sidelined buyers an opportunity to accumulate DOGE at a discount.

Therefore, the recent slow but painful downswing is the meme coin filling up this inefficiency. Hence, investors can expect Dogecoin price to drop another 32% in the near future and stabilize at around $0.075.

DOGE/USDT 1-day chart

On the other hand, the Dogecoin price is likely to begin its second leg of consolidation if BTC continues to recover. Hence, a decisive close above the $0.127 hurdle will temporarily pause the downswing.

In such a case, DOGE will attempt to rally toward the weekly resistance barrier at $0.163. If successful, this recovery run would constitute a 28% ascent and is likely where the upside will be capped.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.