Gold Price Forecast: Consolidating losses near $1,950.00

- Market players are focused on the latest on the Russia-Ukraine crisis.

- The US Federal Reserve is set to raise rates next Wednesday, but for how much?

- XAUUSD is trading at the lower end of its latest range and is poised to extend its slump.

US traders hold on to a mildly optimistic stance, keeping Wall Street afloat to the detriment of safe-haven assets. Gold Price is hovering just below the 38.2% retracement of this year’s rally at $1,962, unable to attract speculative interest. It has bottomed for the day at $1,949.57, its lowest in over a week, with subsequent bounces limited by sellers aligned around the $1,970 level.

Ahead of the US opening, Ukraine’s negotiator, Mikhail Podolyak announced that a “technical pause has been taken in the negotiations until tomorrow. For additional work in the working subgroups and clarification of individual definitions. Negotiations continue.” The invasion that started nineteen days ago has resulted in hundreds of civilian casualties, but also triggered skyrocketing commodity prices, which in turn, put additional pressure on central bankers, who are struggling with record inflation levels. Later this week, the US Federal Reserve and the Bank of England will announce their decisions on monetary policies.

The international community is escalating sanctions, and even Israel has joined, publicly announcing for the first time it will comply with sanctions against Russia. At the same time, the latest round of peace talks have paused, and negotiations will resume tomorrow. The headline spurred some risk-aversion.

Meanwhile, speculative interest keeps an eye on soaring government bond yields, with the yield on the US 10-year Treasury note hovering around the daily high of 2.106%.

Also read: The great commodities supercycle of 2022 continues to break new records – What’s next?

XAUUSD Technical outlook

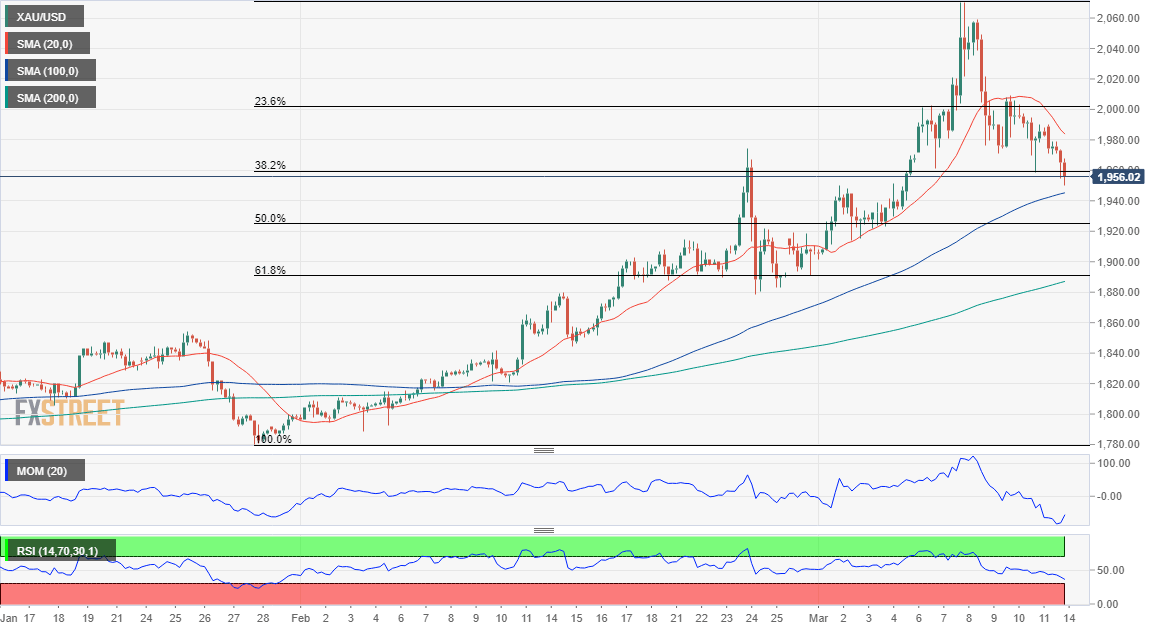

Gold Price is piercing the 38.2% retracement of its January/March rally, where it bottomed twice in the previous week. It is down for a second consecutive day, and technical readings hint at further declines, mainly on a break below the daily low at $1,949.67. The next relevant support is the 50% retracement of the same advance at $1,925.20 a troy ounce.

XAUUSD has no technical signs of an upcoming recovery, although it could happen should hope for a diplomatic solution revive. The next Fibonacci resistance level is located at around $2,000, while in the middle, the bright metal may meet sellers at around $1,981, March 8 daily low.

Author

FXStreet Team

FXStreet