Dogecoin price targets $0.16 as bulls remain in control

- Dogecoin price is set to jump higher as current market sentiment did not change overnight.

- DOGE price first needs to deal with some short-term profit trading, but expect a break above $0.1242 later in the day.

- A daily close above that $0.1242 level delivers another bullish signal to the markets, with bulls preparing to attack $0.1357 by the end of this week.

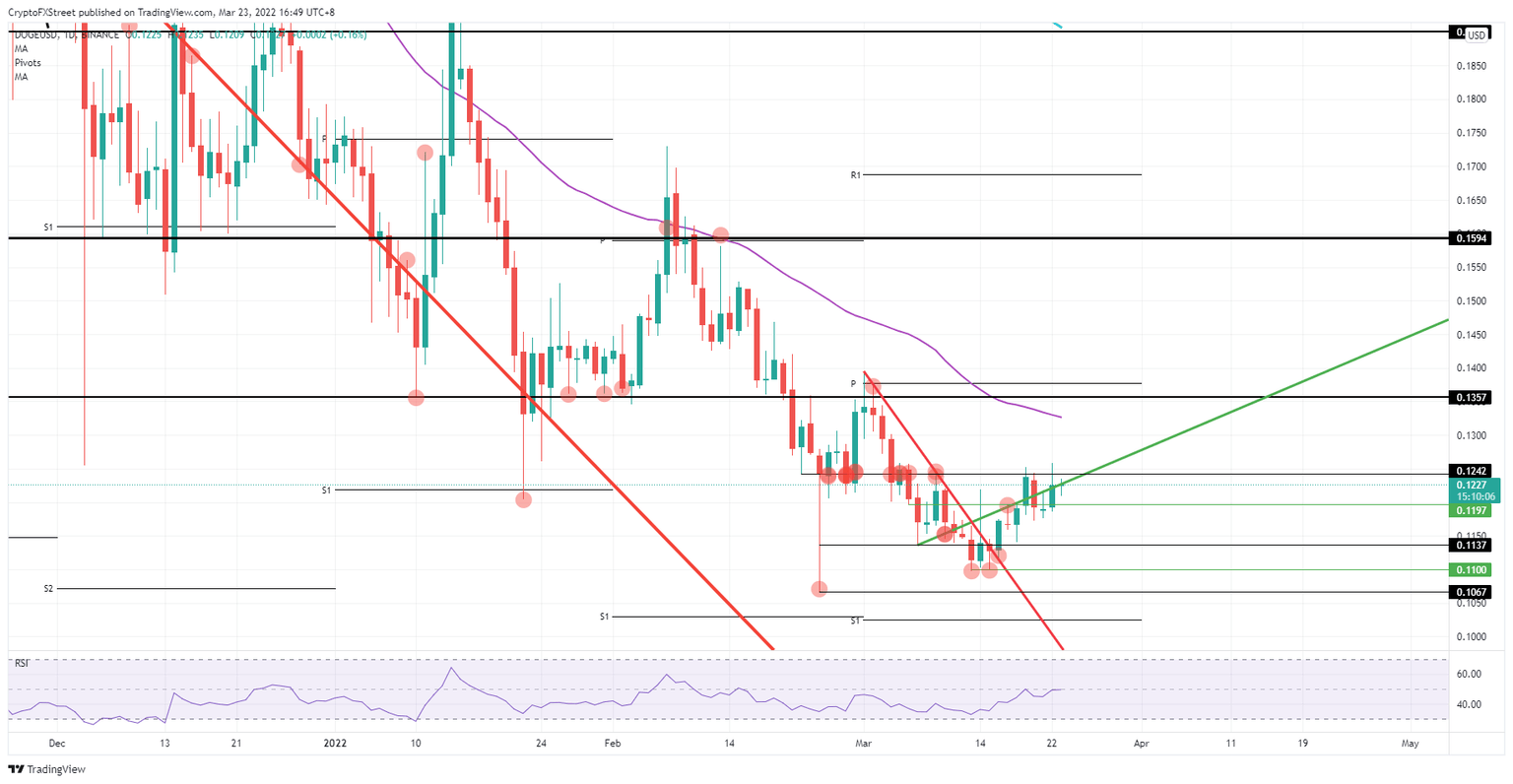

Dogecoin (DOGE) price sees bulls finally making a fist and piercing through the bearish defence wall that short-sellers have built around $0.1242. As bulls tried to push through but failed, expect another test to be unfolding on Wednesday, where a daily close above that level would set the scene for tomorrow. With the 55-day Simple Moving Average (SMA) at $0.1328 and $0.1357 as historic pivotal levels, bulls have very defined targets to jump to by this week.

Dogecoin price has another 10% gains on the table

Dogecoin price has investors returning with a vengeance after tailwinds from the equity market spilled over to cryptocurrencies. After several rumours of a peace plan being on the table between Russia and Ukraine, the strategy of ‘buy the rumour, sell the fact’ looks to be unfolding. Investors are frontrunning the rumours on the ongoing talks and bet on the fact that a deal will get brokered anytime soon.

DOGE price thus sees investors returning to cryptocurrencies after being put on hiatus for several months. Bulls already pierced through $0.1242 but failed to close above. Expect a price squeeze to enable a close above that level later today. Bulls can jump to either the 55-day SMA at $0.1328 or $0.1357, depending on the flavor and if additional tailwinds join the rally.

DOGE/USD daily chart

Although the situation looks to be stabilising, a turn for the worse in events could trigger a massive setback for global markets. This would mean that markets go into a cramp and shed any risk asset, with cryptocurrencies being first on the chopping block. That would translate into DOGE price a drop to $0.1137 or even $0.1067 to the downside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.