Dogecoin price must break this resistance level before hitting $0.16

- Dogecoin price finds buyers during the Tuesday session, rallying DOGE more than 4%

- A key Ichimoku level acts as strong resistance and prevents further upside movement.

- Limited downside risks and bullish momentum returns.

Dogecoin price has performed admirably over the past four days. As a result, bulls were able to close Dogecoin price above the Kijun-Sen on Saturday (March 10, 2022) for the first time since February 16, 2022. After that, however, selling resumed, but surprisingly, DOGE found buyers at the Tenkan-Sen.

Dogecoin price must close above $0.124 to begin a new uptrend

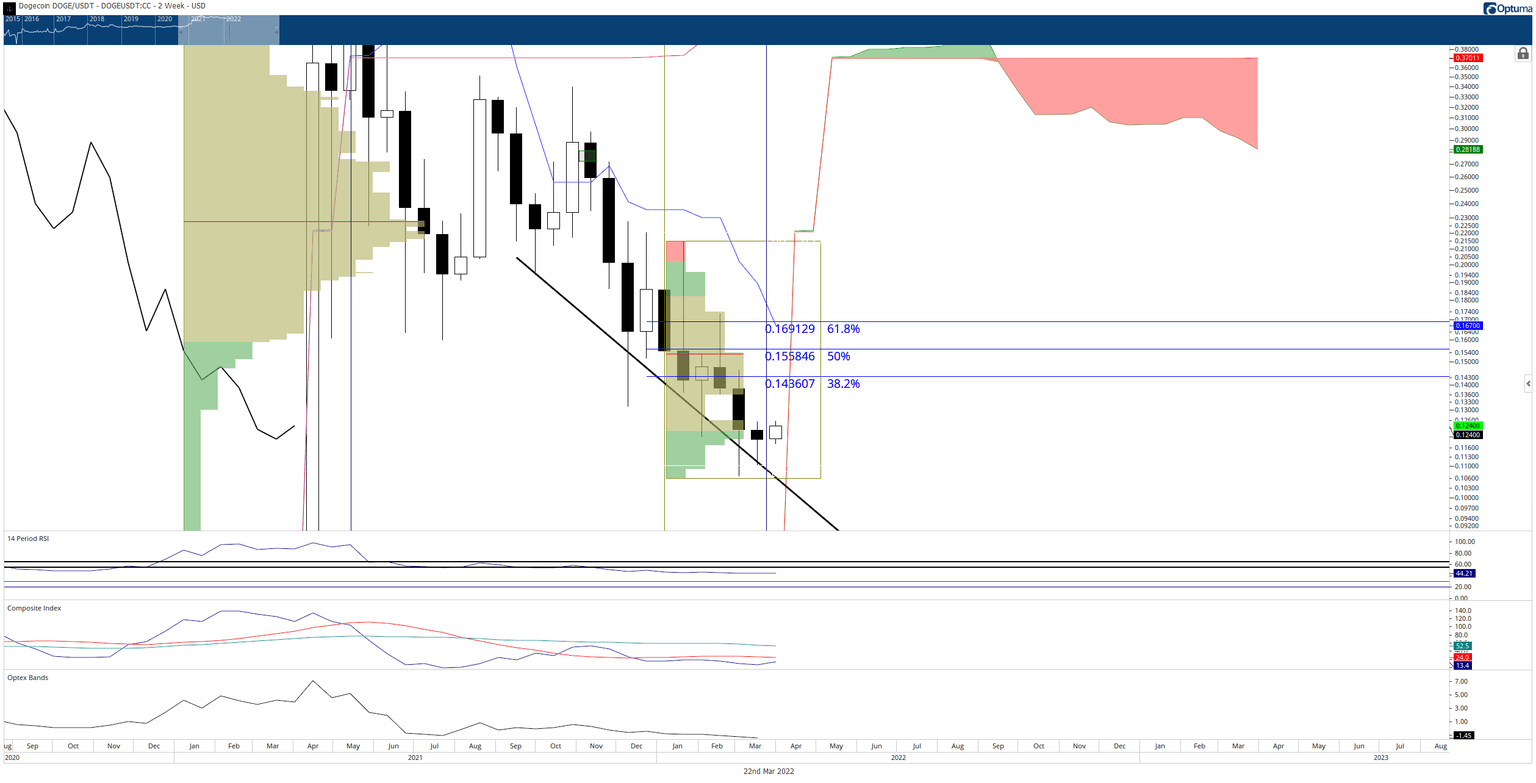

Dogecoin price faces one primary resistance level on the daily chart preventing a 20% move higher: the Kijun-Sen. The Kijun-Sen represents one of the strongest resistance and support levels within the Ichimoku Kinko Hyo system. For day traders, the Kijun-Sen is the ‘bread and butter’ of Ichimoku because many of the day trading strategies are based around the Kijun-Sen.

If Dogecoin price fulfills a close above $0.124, it should have a relatively easy push towards the next resistance cluster at $0.14. $0.14 contains the 38.2% Fibonacci retracement and the 2022 Volume Point Of Control. However, the primary target for bulls is $0.16 - which means passing the 50% Fibonacci retracement at $0.155.

The weekly chart shows how bullish Dogecoin price could be over the next couple of weeks. Kumo Twists can often identify when a market may turn and reverse, especially if that market has been trending strongly. For Dogecoin, that means a massive, bullish reversal is very likely.

DOGE/USDT Weekly Ichimoku Kinko Hyo Chart

The $0.16 limit for near-term upside potential is also confirmed on the weekly chart. The weekly Tenkan-Sen is in the $0.16 value area and will likely act as a source of temporary resistance.

Downside risks exist but are likely limited to the 2022 lows near $0.11.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.