Dogecoin Price Prediction: DOGE primed to rebound after defending key support level

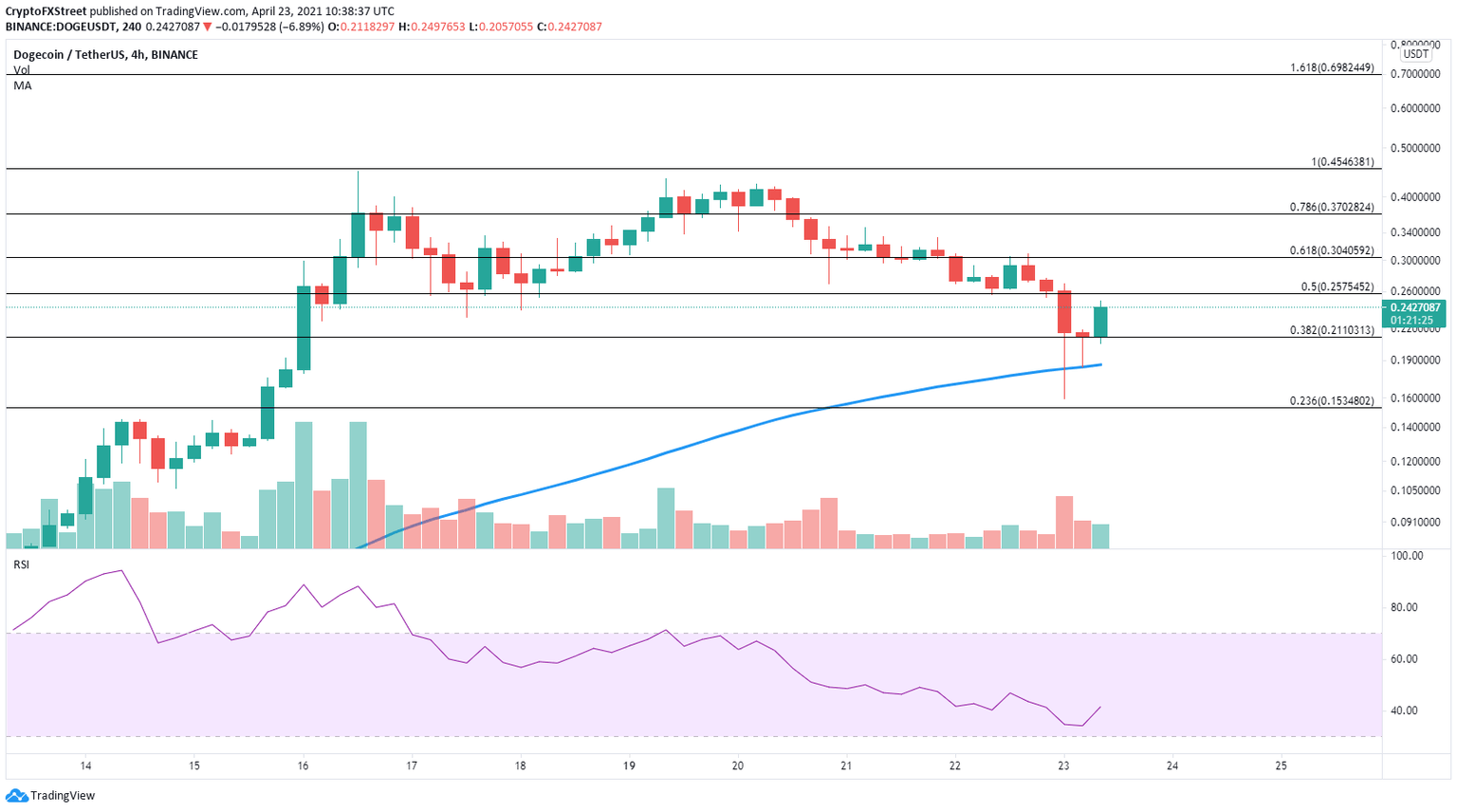

- Dogecoin price held a key support level on the 4-hour chart.

- The digital asset aims for a significant bounce as a key indicator presented a buy signal.

- DOGE is already up 50% since its last low on April 23.

Dogecoin price had a massive crash since its new all-time high at $0.45. The digital asset reached the top 5 in the market capitalization ranking after a massive rally.

Dogecoin price could see a significant bounce

On the 4-hour chart, Dogecoin price has defended the 100 SMA support level at $0.186 and has already seen a 50% bounce since hitting a low of $0.159. The digital asset faces a resistance level at $0.257, which is the 50% Fibonacci retracement level.

DOGE/USD 4-hour chart

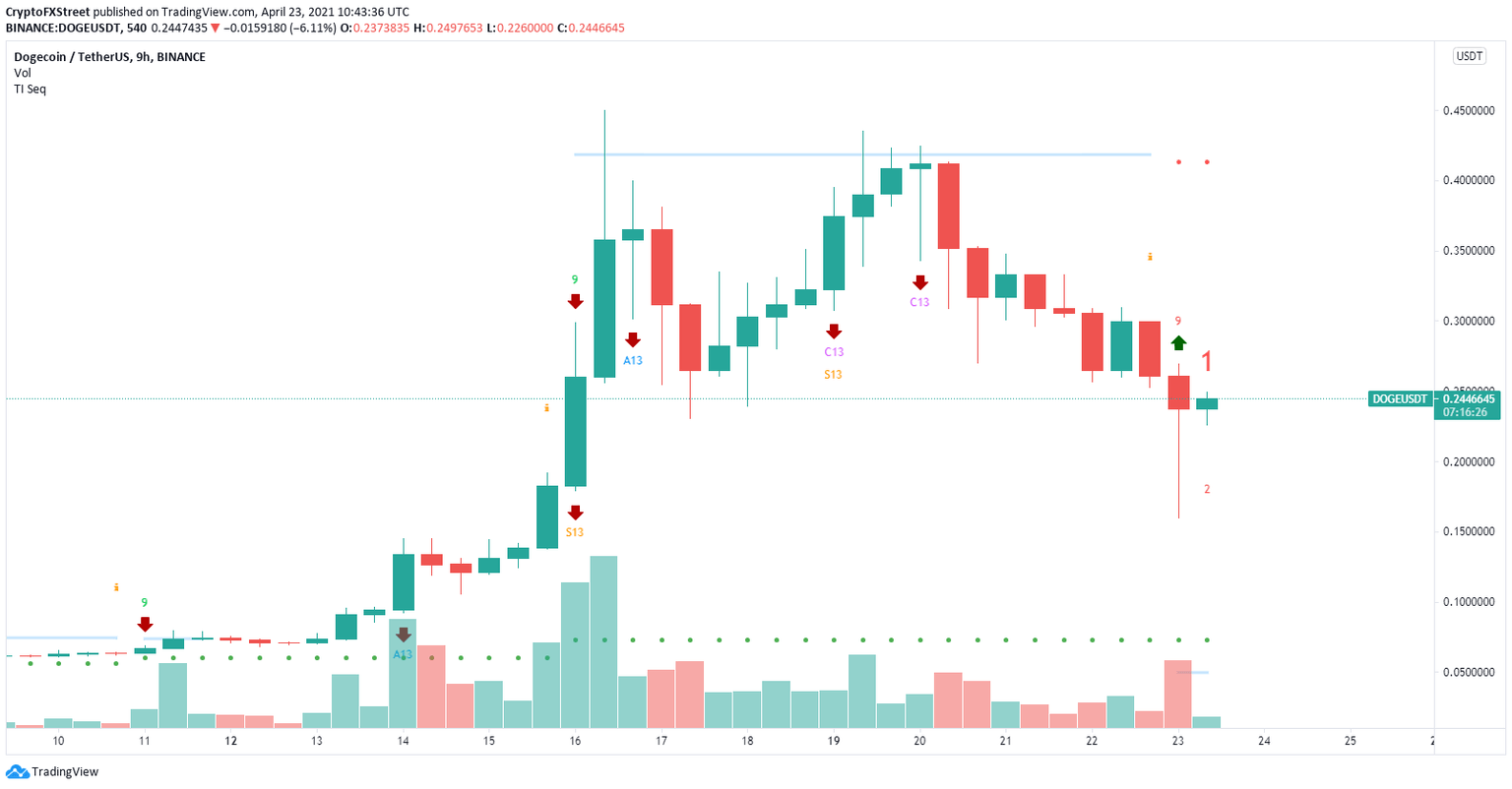

A breakout above this point could quickly drive Dogecoin price toward $0.30 at the 61.8% Fibonacci retracement level and as high as $0.37. Additionally, the TD Sequential indicator has presented a buy signal on the 9-hour chart.

DOGE/USD 9-hour chart

The previous candlestick on the 9-hour chart is considered bullish, as it formed a long lower wick, indicating that investors bought the dip.

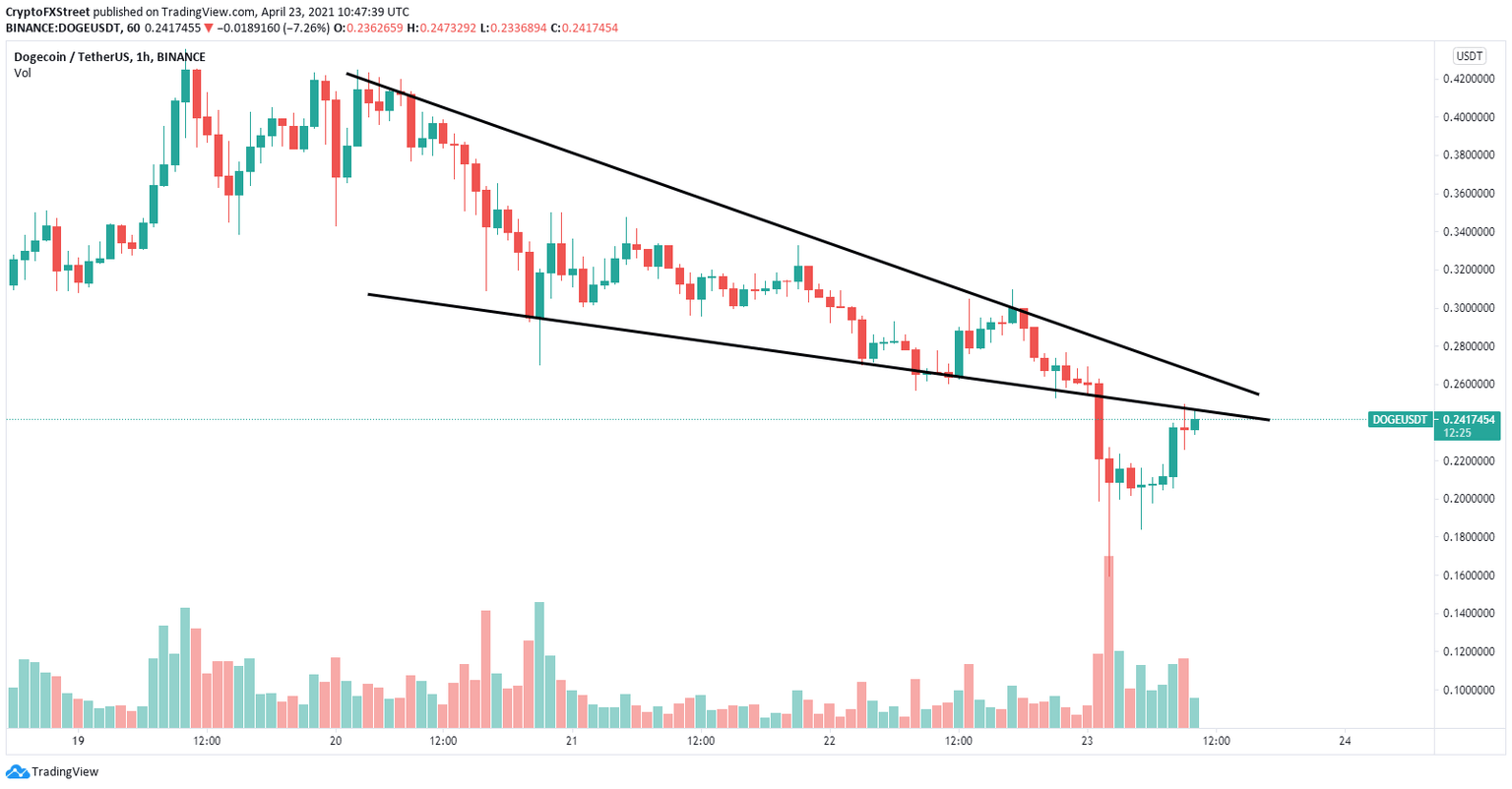

DOGE/USD 1-hour chart

On the 1-hour chart, Dogecoin price had a breakdown from a descending wedge pattern and already met its price target. However, the previous support trend line will act as a robust resistance and it’s already rejecting DOGE. This could lead the digital asset toward a new low below $0.159.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.