Dogecoin Price Prediction: A smart money trap hiding in plain sight

- Dogecoin has been up 12% since the beginning of October.

- The DOGE price failed to breach the previous swing high and shows a lack of momentum despite an influx of volume.

- Invalidation of the bearish thesis is a closing candle above $0.068.

Dogecoin price could be displaying evidence of a smart money trap. A sweep the lows event is in the cards. Key levels have been identified.

Dogecoin price could re-route south

Dogecoin price is currently up 12% to start the month of October as the bulls pulled off an impressive 10% rally earlier in 24 hours. An influx of volume has poured in as sidelined investors speculate the move is just the beginning of a long overdue DOGE pump. Although the possibility for more returns does look promising, there are a few factors that investors should keep in mind to suggest otherwise.

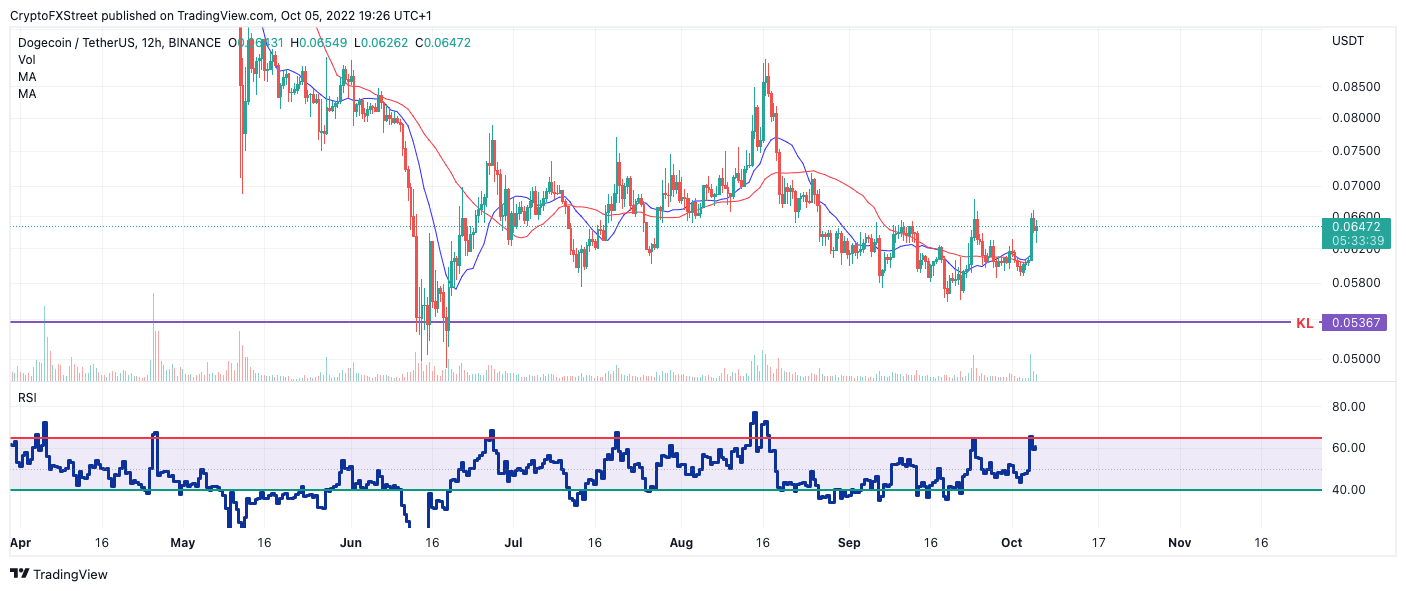

Dogecoin price currently auctions at $0.064 as consolidation takes place near the newfound monthly highs. A key ingredient to decipher the next move for the DOGE price is hiding in plain sight. At the current time, the DOGE price has failed to close above the previous swing high in October. This subtle display of resistance is also shown on the Relative Strength Index (RSI) on larger time frames as DOGE is still within bounds of previous resistance.

DOGE/USDT 12-Hour Chart

When combining these factors, early bulls should be very cautious. The influx of volume without breaking the previous swing high can be viewed as a weakening retaliation. If this is indeed the case, the liquidity level underneath the origin point of October’s rally at $0.058 is at risk of a breach. Such a move would result in an 11% decline from the current Dogecoin price.

Invalidation of the bearish thesis is a closing candle above $0.068. The bulls must show more momentum on the RSI as well. If the invalidation level is breached, the Dogecoin price could rally as high as the mid-point of the previous decline at $0.075. Said price action would result in a 20% increase from the current market value.

In the following video, our analysts deep dive into Dogecoin's price action, analysing key market interest levels. - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.