Dogecoin price could tank as India’s central bank closes the doors to cryptos

- The Indian Central Bank came out this morning with firm rejection against adopting cryptocurrencies in the country.

- Dogecoin price action undergoes firm rejection against a double technical barrier.

- DOGE set to tank by 8% as bears see opportunity fit to pair back gains from Wednesday yet again.

Dogecoin (DOGE) price action saw bulls being hit by ice-cold water this morning as two headlines made the sky drop on their heads. These were the Kremlin coming out saying that talks are nowhere near as positive as markets are frontrunning, and the Indian Central Bank (RBI) giving a firm rejection to the adoption of cryptocurrencies. The RBI branded cryptocurrencies as a tool that will wreck the currency system, monetary authority and government's ability to control the economy. This is a significant blow and setback for cryptocurrencies that saw bulls coming up yesterday for a catch of fresh air but are now again submerged underwater with negative prints today.

Also read: Gold Price Forecast: Why is XAUUSD under pressure?

Dogecoin price gains short-lived

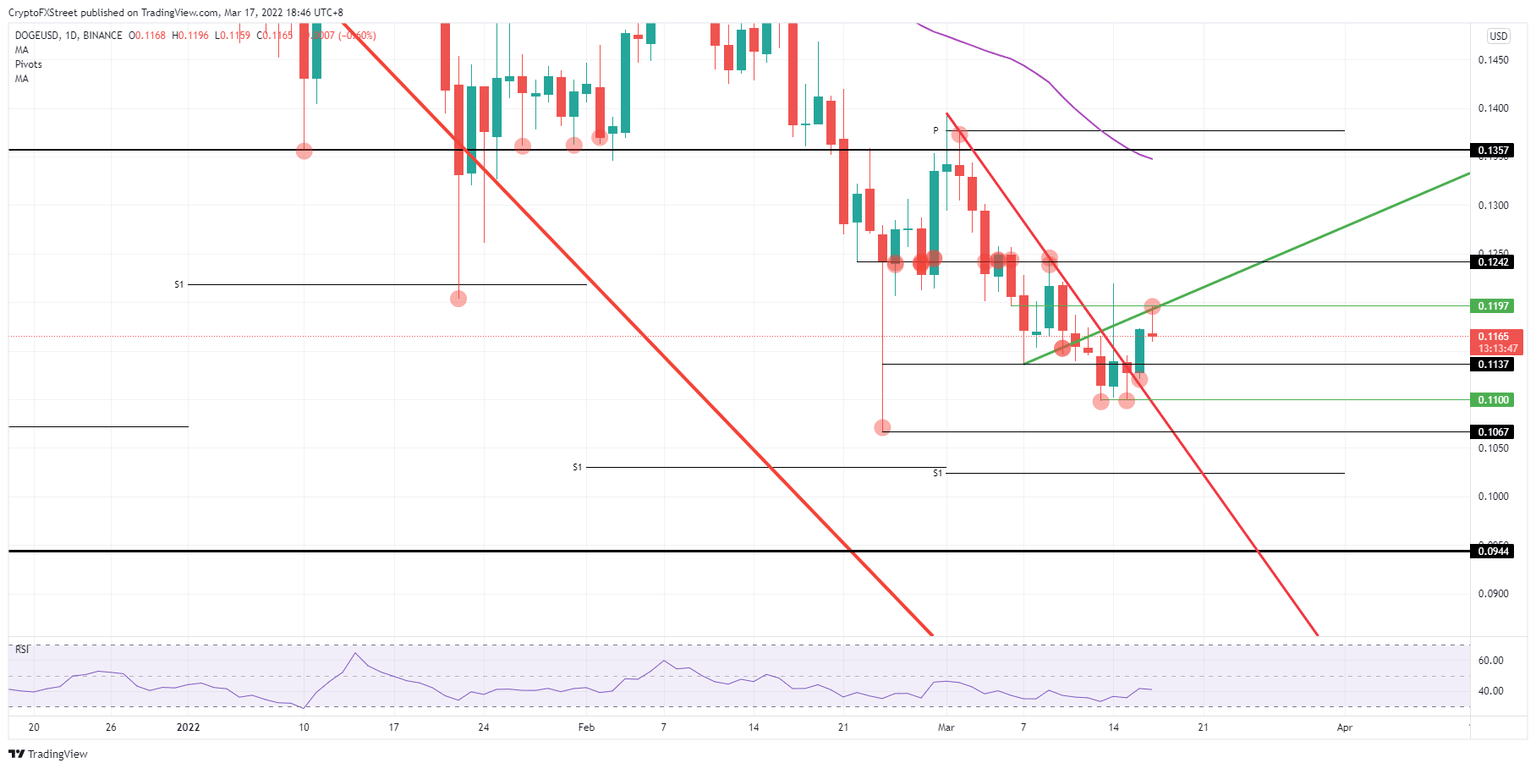

Dogecoin price action is not currently in a sweet spot as in just 5 minutes, two separate comments unrelated to each other trashed bulls’ game plan to target $0.1357 next week. Instead, DOGE price action fell back to its opening price and took a step back as bulls reassessed the situation – due to some unforeseen tail risks that caused headwinds overpowering the tailwinds that emerged the day before. Expect to possibly see DOGE price action tumble again to the downside, in a similar scenario to last week.

DOGE price action got a firm rejection from negative headlines at $0.1197 with the green ascending trend line and that intermediary top-line proving too big for bulls to take on. Instead, price action collapsed back to the entry-level and looked heavy and dangling, as if poised to drop at any moment to the downside. A possible downside target is set at $0.1137 and $0.1100 with the last one making a triple bottom – although there is also the risk of a break even further to the downside if more tail-risk materialises.

DOGE/USD daily chart

Once the US session takes over, it could well be that investors look beyond these very short-term headlines, considering them as partial hiccups before moving on. That would mean a pickup in buying interest which could lead to a punch through $0.1197 to the upside. This would open the door towards $0.1242 intraday and possibly again on track for $0.1357.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.