Cryptocurrencies Price Prediction: Shiba Inu, Ripple & Dogecoin — Asian Wrap 16 Mar

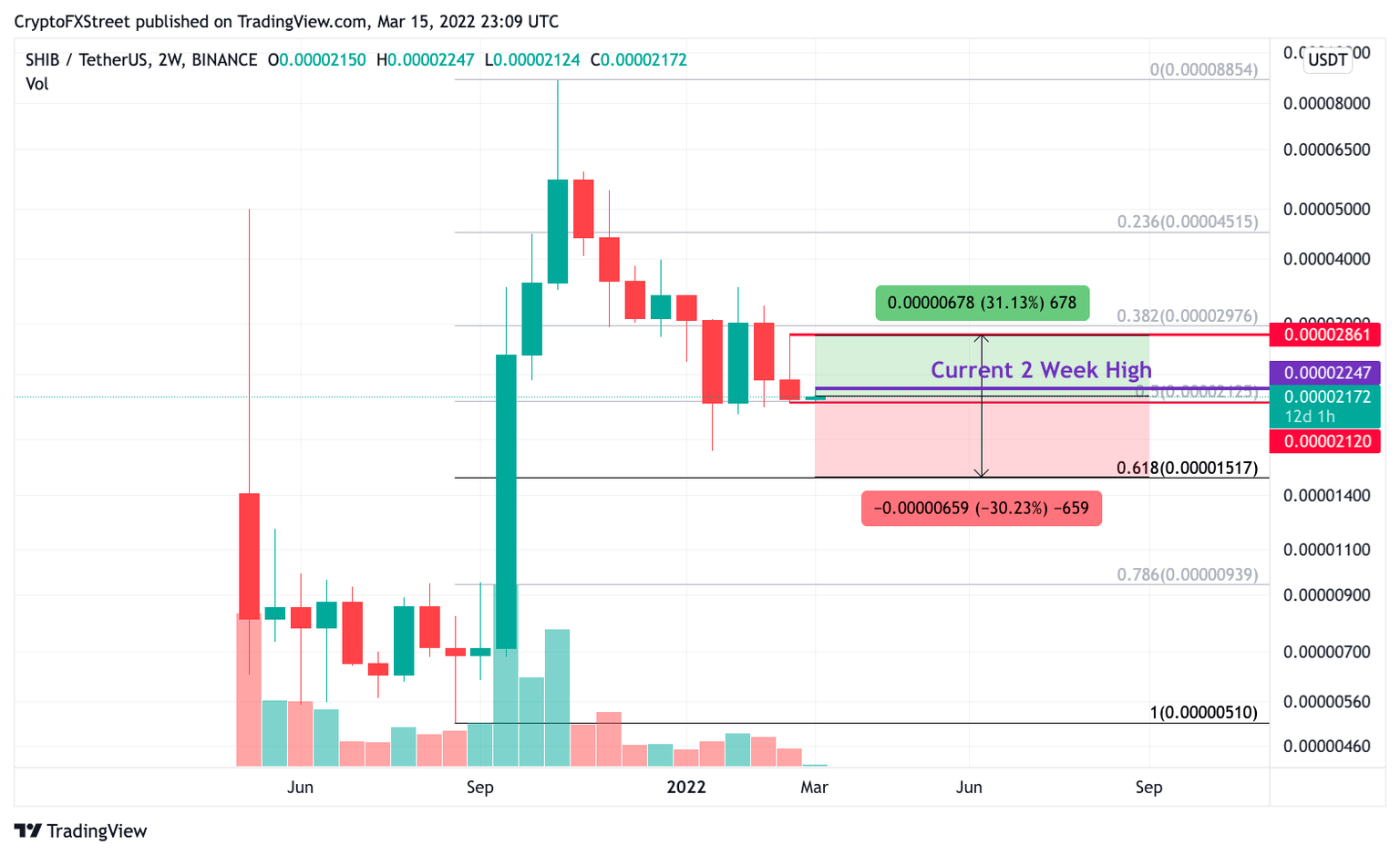

SHIBA INU price has a high chance of a 30% swing, according to the two-week chart

SHIBA INU is forecasting a 30% move in the coming weeks. Following last week’s no-trade zone, the popular meme token has printed two consecutive inside week bars, within a 30% range. SHIB price on the 2-week Chart has printed consecutive inside bars on the two-week chart.

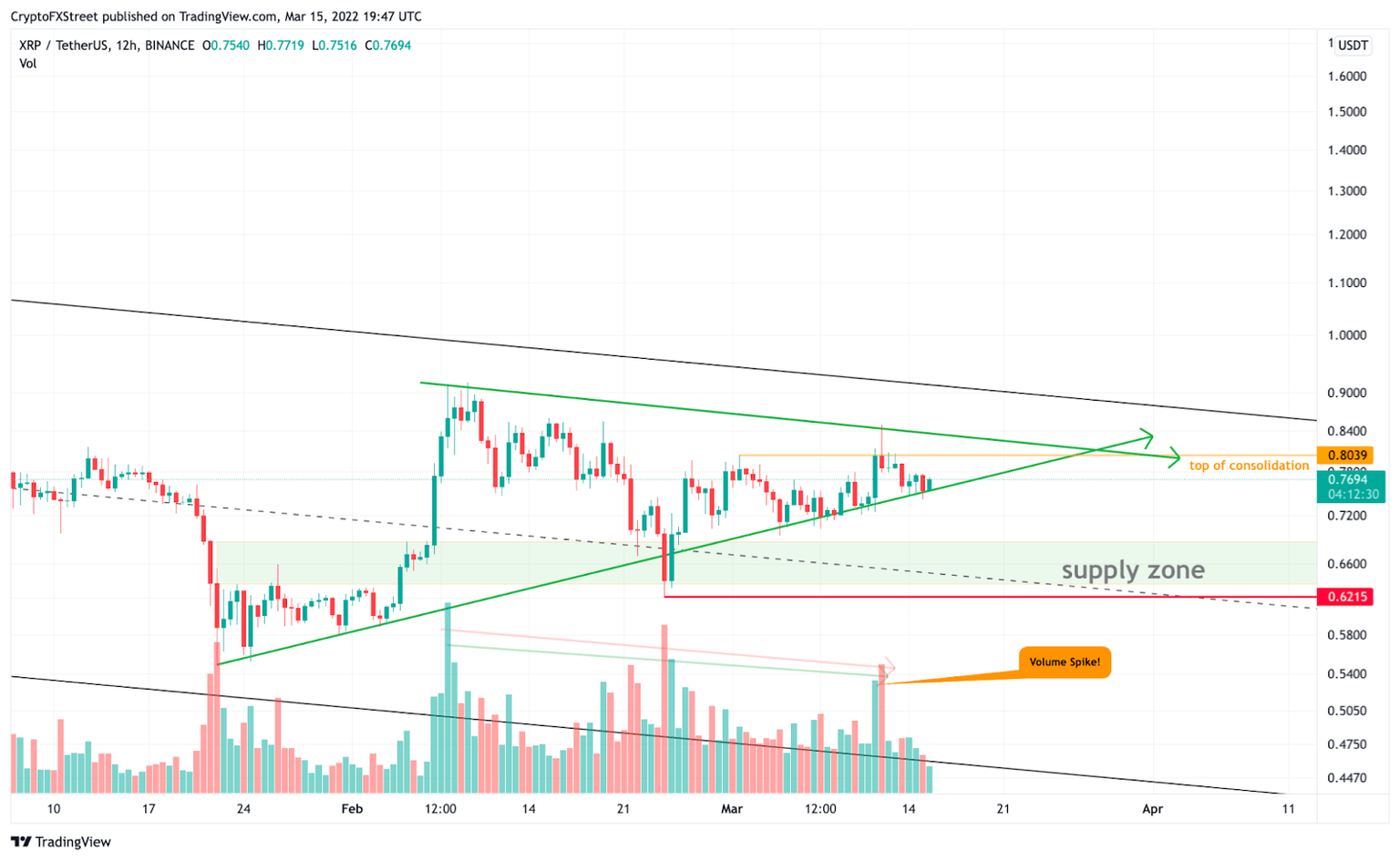

XRP price could rally towards $1.40 if bulls can break past $0.85

XRP price is still looking bullish despite last week's failure to stay above the weekly consolidation line. A 10% bounce from the current price of $0.77 could send Ripple price an additional 67% higher. XRP price has failed once again to close below the weekly trend line on the 12-hour chart.

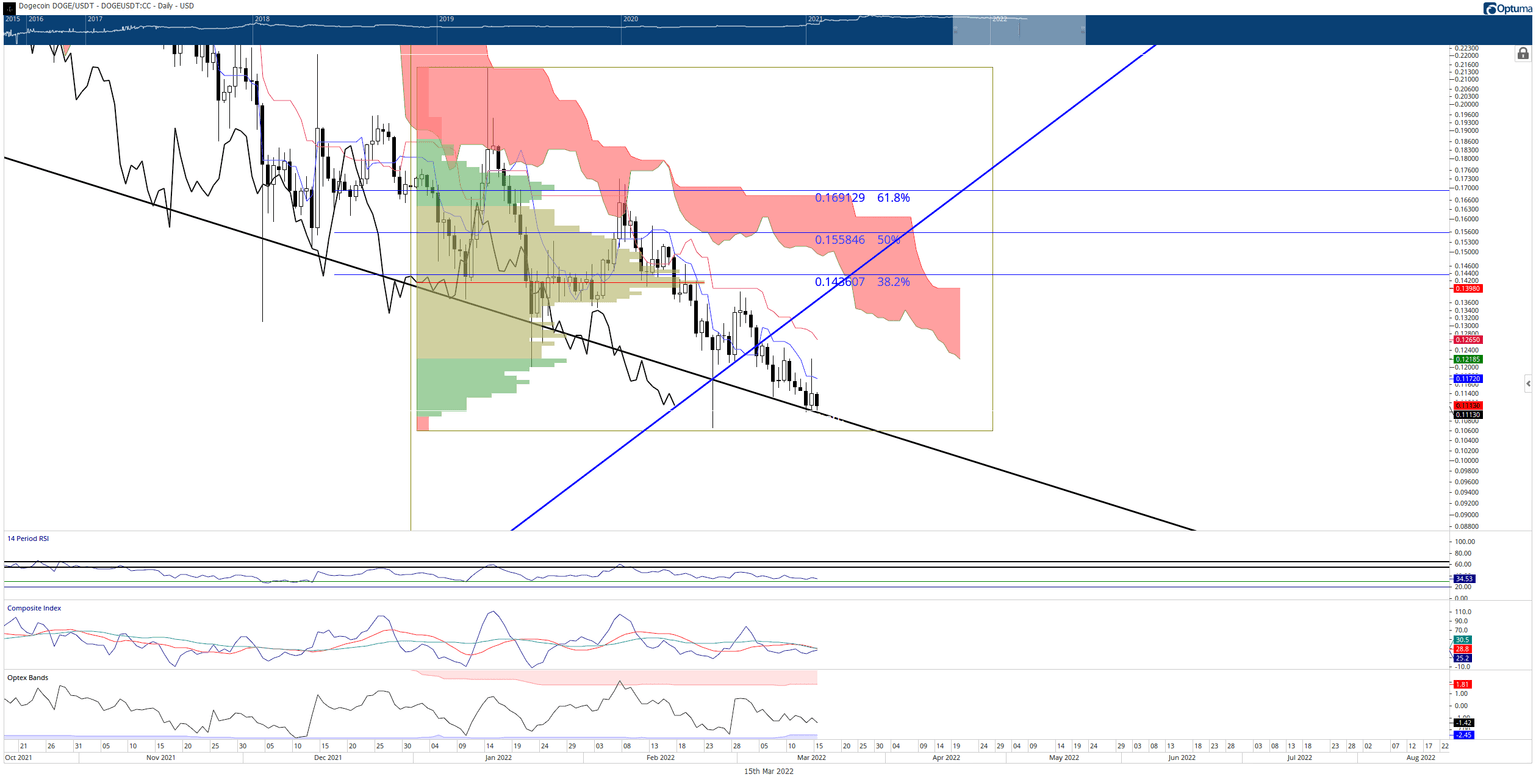

Dogecoin price shows evidence of a market bottom before DOGE spikes to $0.16

Dogecoin price is on day 311 of its downtrend, with no immediate signs of discontinuing. Bulls will likely need to wait until the crucial Gann Season Date of March 21 before a clear change in direction would occur. Dogecoin price hinted at a possible beginning to a bullish reversal on Monday.

Author

FXStreet Team

FXStreet