Dogecoin price eyes retest of $0.12 despite macro downtrend

- Dogecoin price has crashed roughly 85% since its all-time high, indicating a macro downtrend.

- A minor 10% upswing is likely before the retracement continues to push DOGE lower.

- Transaction data shows that a move to $0.14 is plausible considering the relatively weak immediate resistance barrier.

Dogecoin price is on a massive downtrend since its all-time high in May 2021. The retracement is a result of multiple factors but the significant one is due to the flight of investors to Dogecoin-killer Shiba Inu. Regardless, the meme coin could be due to witness a minor uptrend before the downswing continues.

Dogecoin price crumbles slowly

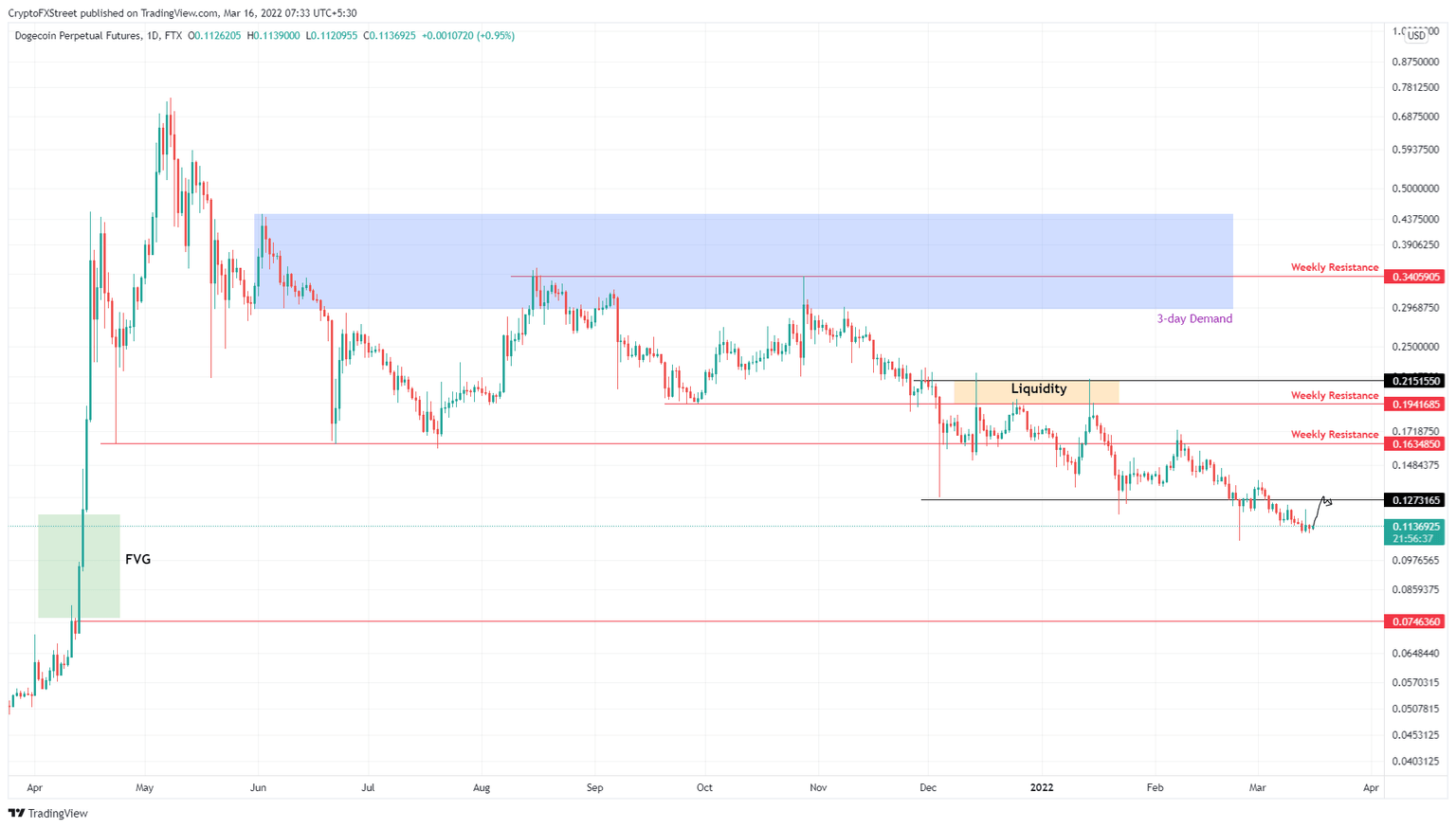

Dogecoin price has plummeted 85% in the last ten months and shows no signs of slowing down. Since December 4, DOGE has slowly but painfully lost most of its market value and continues to do so by breaching crucial support levels.

Recently, DOGE shattered through the $0.127 foothold, flipping it into a resistance barrier. Investors can expect the Dogecoin price to rally 10% and retest it to confirm a flip. While this move is short-term bullish, it is a temporary move and is likely to be followed by a continuation of the downtrend that fills the Fair Value Gap (FVG) extending from $0.12 to $0.07.

DOGE/USDT 4-hour chart

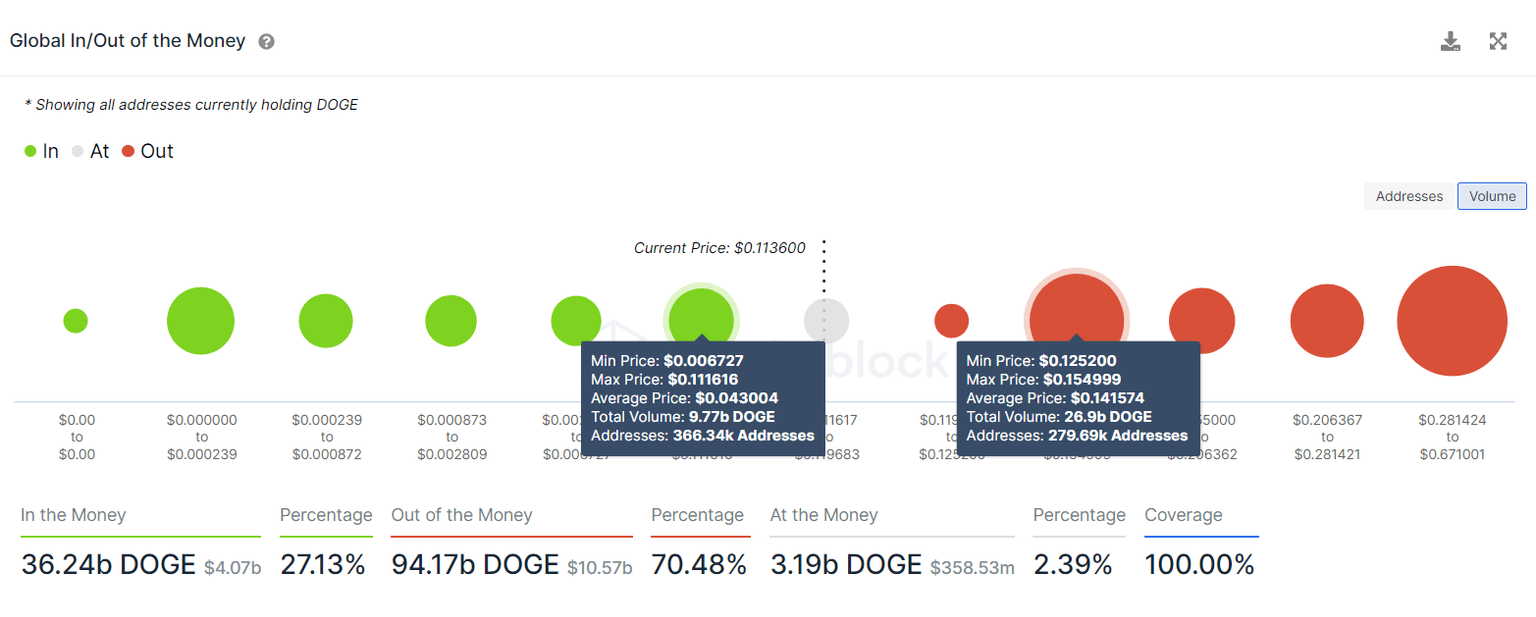

Supporting this move higher for Dogecoin price is IntoTheBlock’s Global In/Out of the Money (GIOM) model, which shows that the immediate support level is relatively stronger. Therefore, investors can expect the Dogecoin price to move to $0.14, which is the average buy price of 280,000 addresses that purchased roughly 26.9 billion DOGE tokens.

Since these market participants are holding these tokens at a loss, a move into this area will likely be met with selling pressure from investors trying to break even. Therefore, the upside for DOGE is limited to $0.14.

DOGE GIOM

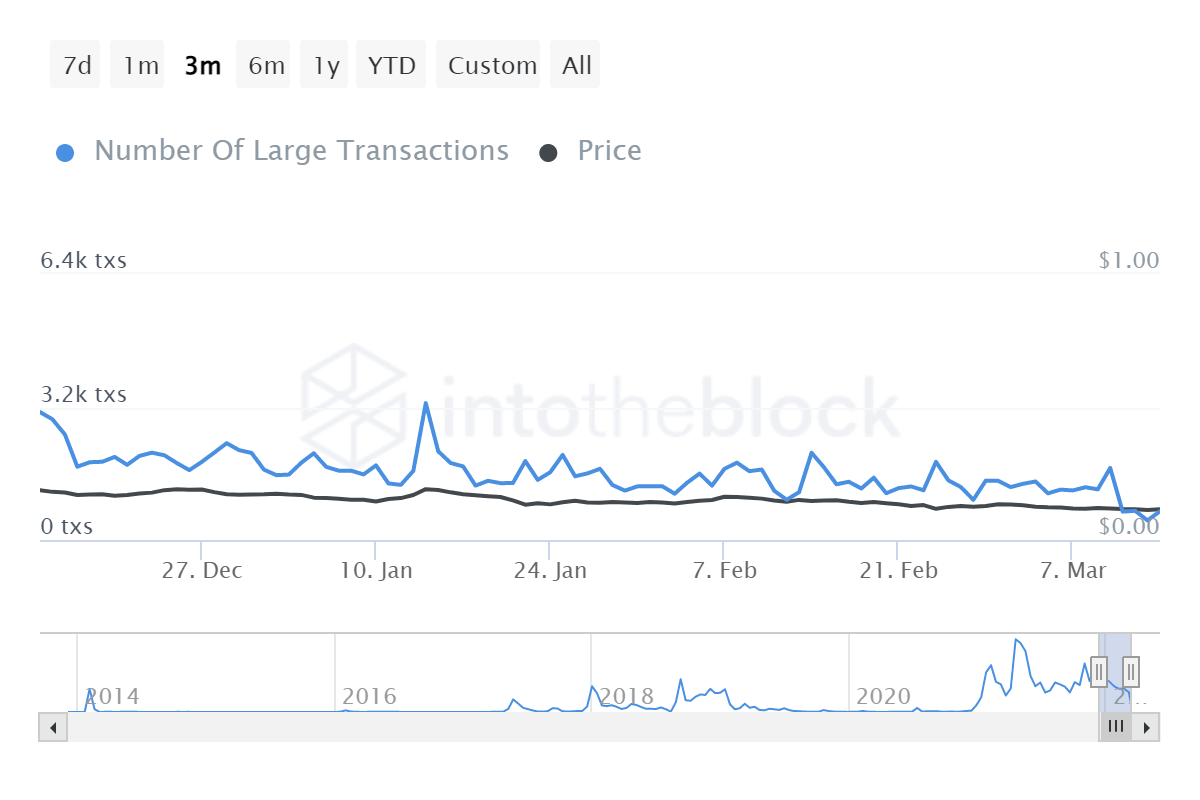

Further depicting the bearish outlook for Dogecoin price from a maco perspective is the decline in the number of transactions worth $100,000 or more over the past three months from 3,000 to 700.

This 76% drop in such transfers suggests that whales or high networth investors are not interested in DOGE at the current price levels and are pulling their investments. This downtrend further explains why the macro outlook for DOGE has been bearish.

DOGE large transactions

While things are looking bullish for DOGE from a short-term perspective, a four-hour candlestick close above $0.14 will alleviate a majority of the sell-side pressure and end the long-term bearish thesis.

Such a development will allow buyers to make a run for the next hurdle at $0.16.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.