Dogecoin killer Shiba Inu price can rally another 100% if it overcomes this barrier

- Shiba Inu price has seen a rough 200% run-up in October.

- If SHIB manages to slice through the trading range’s midpoint at $0.00002030, it can rally another 100%.

- A breakdown of the $0.00001040 support floor could seriously delay the upswing.

Shiba Inu price has been highly giving to its holders as it nearly tripled in value over the past week. While this run-up might be eye-popping, SHIB can embark on another 100% upswing if it can breach a significant barrier.

Shiba Inu price approaches crucial levels

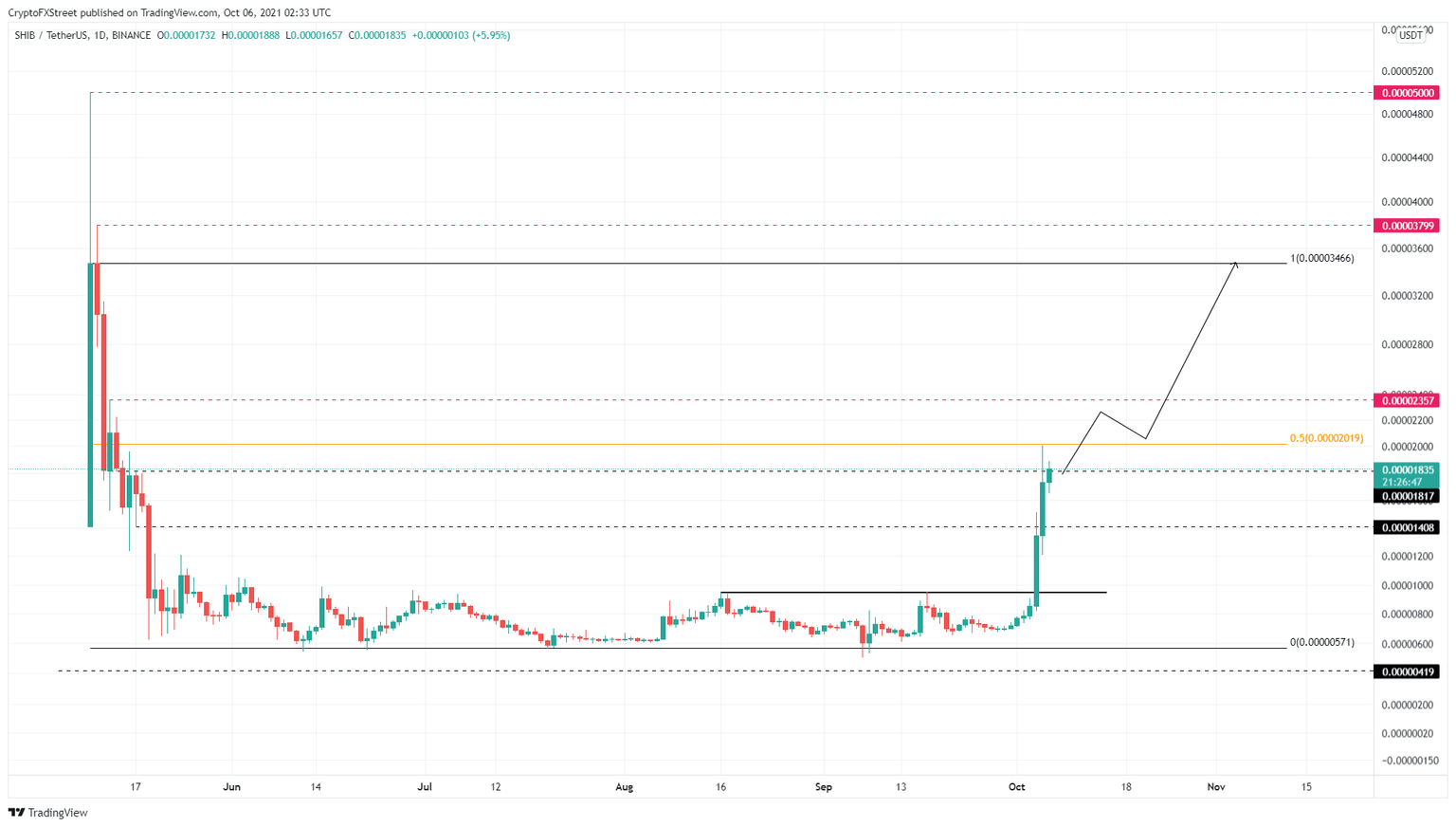

Shiba Inu price rose a whopping 187% since October 1 and is currently trading just below the 50% Fibonacci retracement level at $0.0000203. Moreover, SHIB is also grappling with another resistance level at $0.00001820, which stands between the price and the trading range’s midpoint.

If this bullish momentum continues, producing a decisive close above $0.00002030, Shiba Inu price will enter a bullish phase. In this situation, SHIB bulls only need to push through $0.00002360 to embark on an "up only" rally. The start of such an uptrend will push the Dogecoin killer to $0.0000347 or a 100% upswing from the current position.

Beyond this point, if the buying pressure continues to pour in, Shiba Inu price could attempt to retest the May 11 swing high at $0.00003800.

Although unlikely, this uptrend could overextend and make a run at the all-time high at $0.00005000.

SHIB/USDT 1-day chart

On the other hand, a failure to breach through $0.00001820 or $0.00002030 will indicate an exhaustion of the buyers. In this case, SHIB is likely to retrace to $0.0000141.

A breakdown of this barrier will significantly delay the anticipated upswing and might even cause the dog-themed cryptocurrency to consolidate.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.