District0x Price Prediction: DNT seems poised for another massive rally after rising over 700%

- District0x is on the cusp of a gigantic breakout eying $0.51 if the bull flag narrative holds.

- On-chain metrics conflict with multiple bullish technical indexes, casting doubt on the ability of DNT to rally.

District0x incredible performance in November saw it rally by over 700% from a price level roughly at $0.0084 to a monthly high of nearly $0.08. The token seems ready to break out again, this time eyeing $0.51.

District0x ready for another 700% rally to $0.51

A bull flag pattern has formed on the 4-hour chart, bringing to light the possibility of a significant breakout. A flag pattern of this nature is utilized in technical analysis to mark a possible continuation of the trend coming just before its formation.

If the preceding trend resumes, the action is usually rapid, increasing the potential for massive gains. In District0x’s case, the ongoing consolidation is characterized by decreasing volume, creating a bullish picture.

DNT/USD 4-hour chart

The same 4-hour chart shows that DNT is trading between vital support and critical resistance. The 100 Simple Moving Average caps its immediate upside. Trading above this zone could result in a massive price action on the upside, hence validating the above bullish outlook.

On the other hand, the immediate downside is protected by the 50 SMA. In case the breakout picture painted above fails to materialize, holding firmly to this support may help avert losses and keep District0x in consolidation.

DNT/USD 4-hour chart

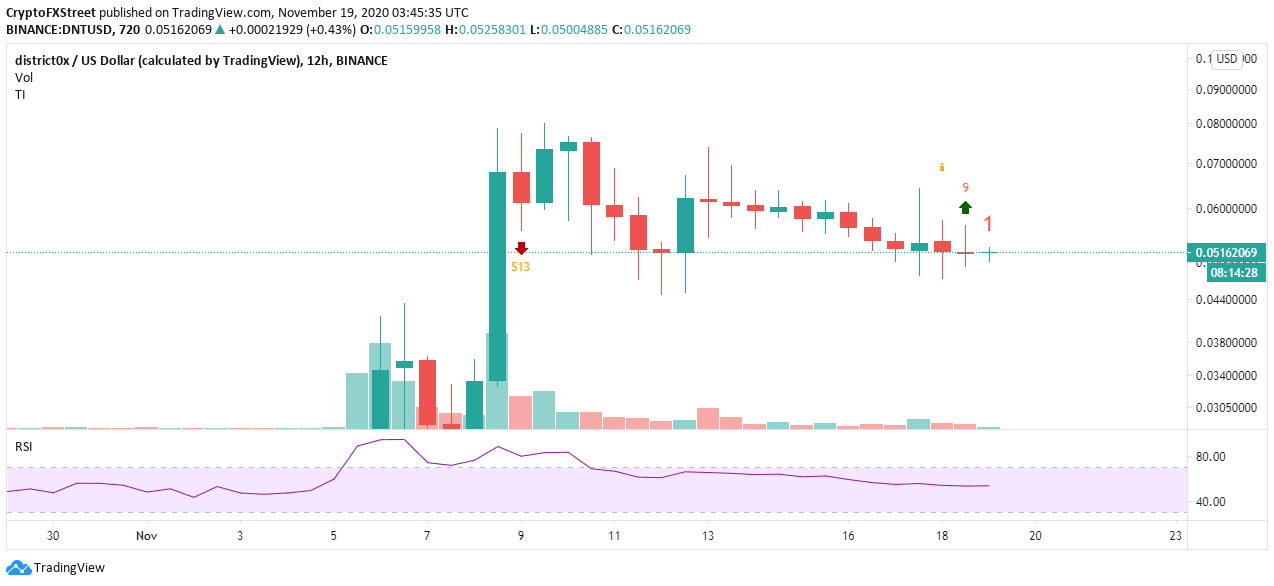

The TD Sequential indicator recently presented a buy signal on the 12-hour chart in the form of a red nine candlestick. If the call is validated, it is estimated that a spike in demand for the token might result in the prices shooting up for one to four daily candlesticks. However, in case massive buying pressure develops, DNT may even actualize the 700% tremendous upswing.

DNT/USD 12-hour chart

It is worth noting that the IOMAP model by IntoTheBlock does not support the bullish narrative. A glance at the metric reveals intensifying resistance towards $0.06. Besides, the most robust hurdle runs from $0.056 to $0.057. Here, 364 addresses had previously purchased nearly 93.6 million DNT.

District0x IOMAP chart

On the downside, the absence of substantial support shows that the path of least resistance is downwards. If losses come into the picture, District0x may spiral considerably before finding support between $0.045 and $0.047.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637413550087094824.png&w=1536&q=95)

-637413550809468529.png&w=1536&q=95)