Cryptocurrencies Price Prediction: Monero, Dogecoin & Bitcoin — Asian Wrap 18 August

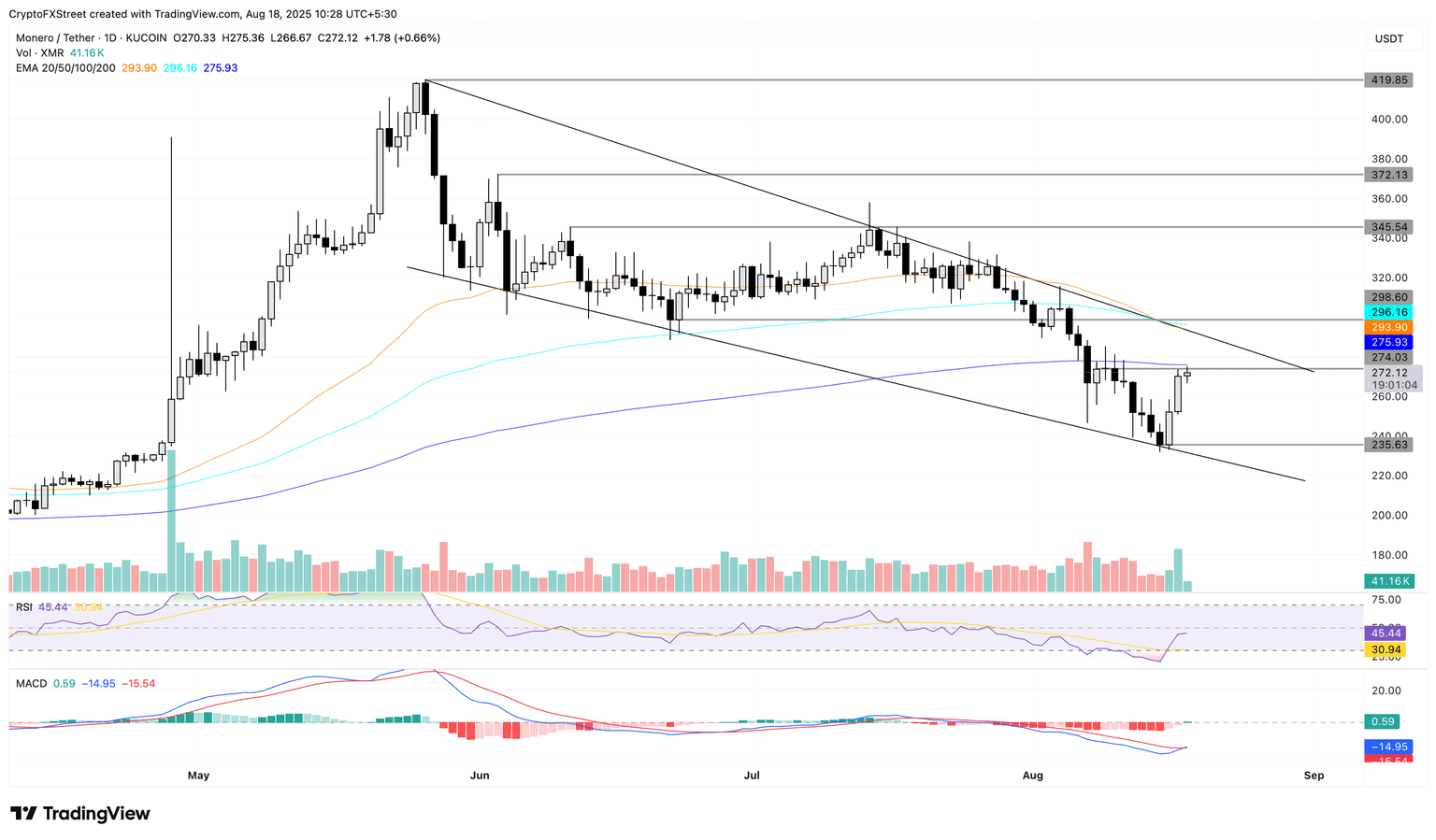

Monero Price Forecast: XMR eyes wedge breakout rally amid Qubic hashrate dominance

Monero (XMR) trades in the green at press time on Monday, marking its third consecutive day of uptrend. The privacy coin aims to reclaim its 200-day Exponential Moving Average (EMA), backed by increased demand from Qubic, which now controls over 51% of the Monero hashrate. Kraken has re-enabled XMR deposits, which now require 720 confirmations before being credited.

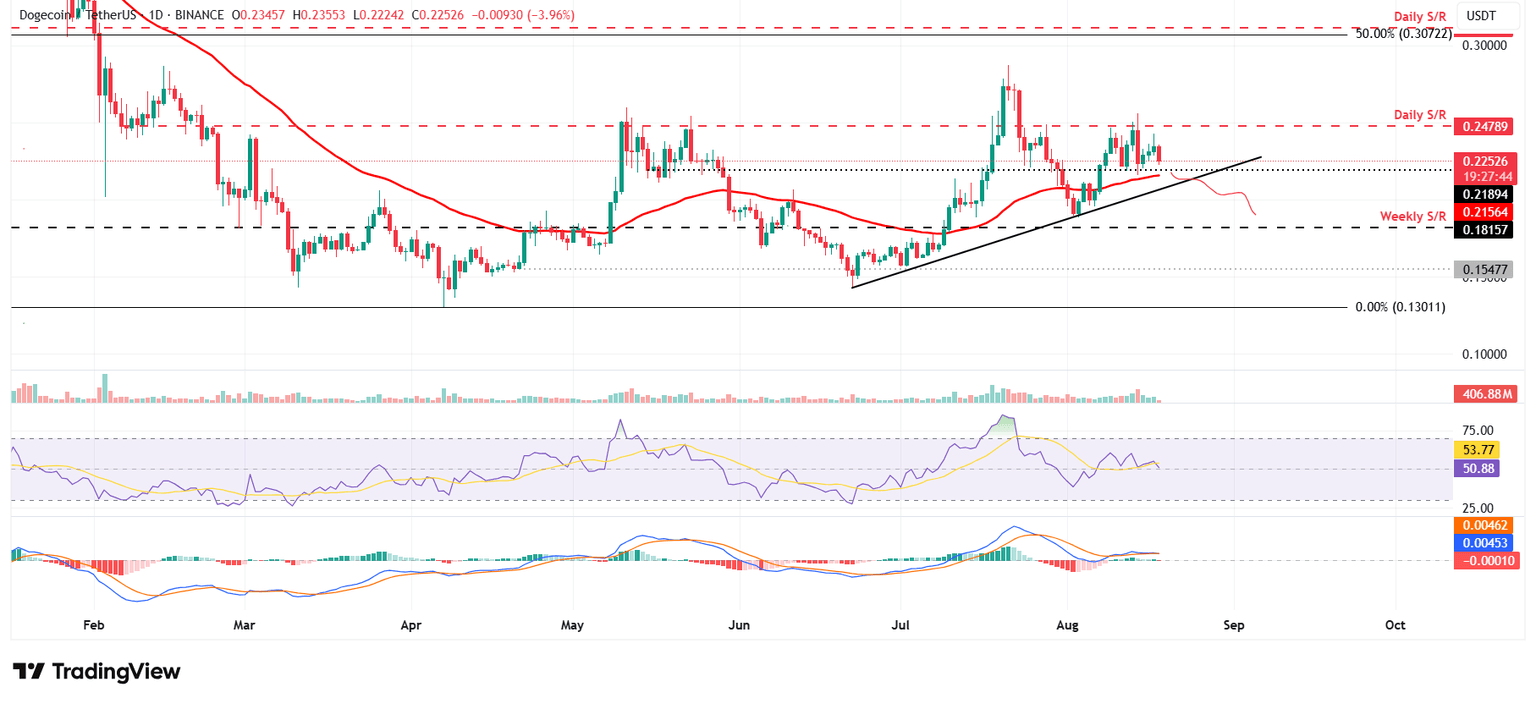

Dogecoin Price Forecast: Qubic community votes to target DOGE after Monero attack

Dogecoin (DOGE) price trades in red, slipping 4% at the time of writing on Monday, bringing it closer to the critical $0.21 support level; a firm close below could extend further downside. The decline comes as the Qubic community, which recently carried out a 51% attack on Monero (XMR), voted to target DOGE memecoin next. On-chain and derivatives data further highlight bearish sentiment, with DOGE holders realizing losses and rising short bets among traders.

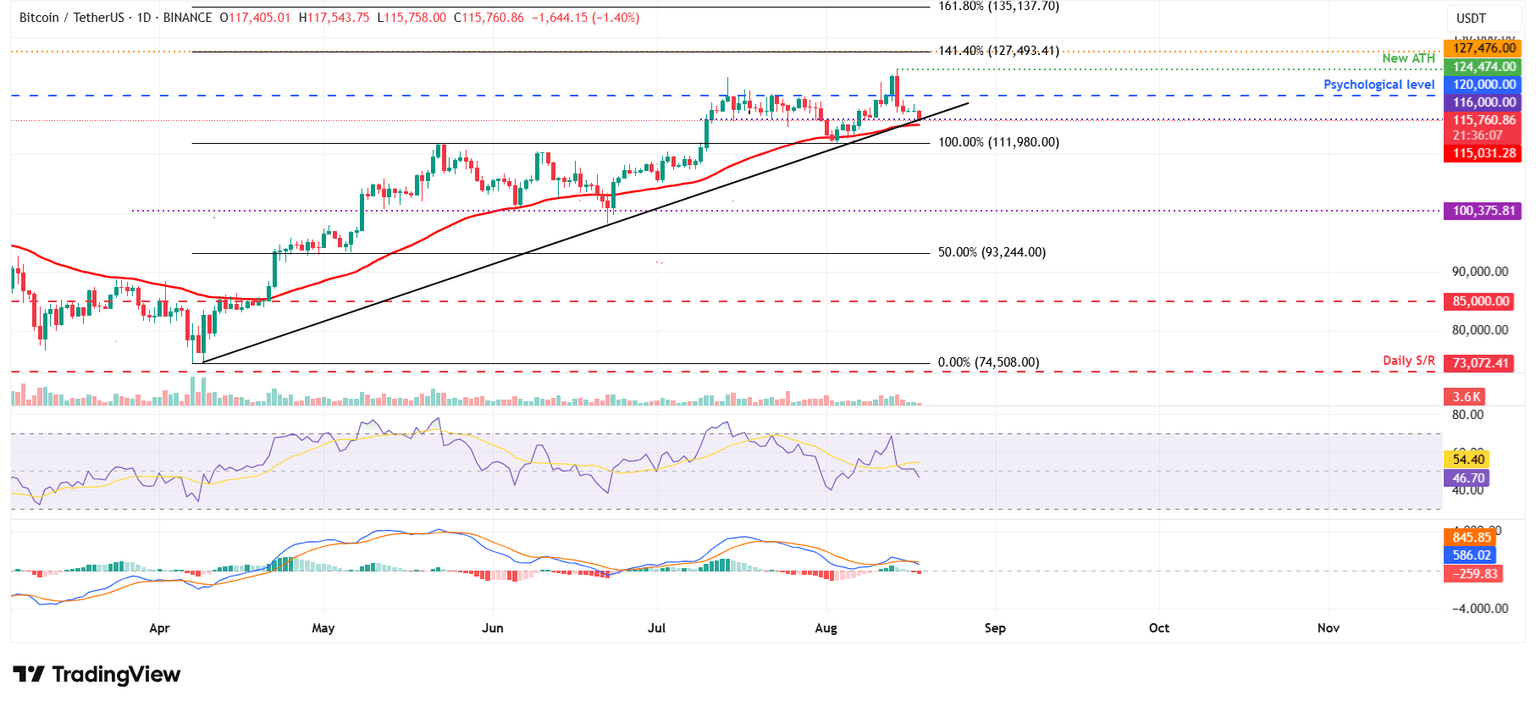

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP flash weak momentum, raising risks of deeper pullbacks

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP flash weak momentum, raising risks of deeper pullbacks

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are showing signs of weakness as momentum fades across the broader crypto market. BTC and XRP are hovering near the critical $116,000 and $2.99 supports, respectively, while ETH struggles to break above $4,488 resistance. Meanwhile, the momentum indicators of all the top 3 cryptocurrencies are hinting at the risk of a deeper pullback.

Author

FXStreet Team

FXStreet