Cryptocurrencies Price Prediction: Memecore, Litecoin & Toncoin — Asian Wrap 4 September

Crypto Gainers: MemeCore leads market rebound as Four and Ethena sustain bullish momentum

MemeCore edges higher by 4% at press time on Thursday, extending the uptrend for the sixth day. The meme coin has shed minor gains after marking a record high of $1.14 on Wednesday. Still, MemeCore holds dominance over the $1.00 psychological level and challenges the $1.07 resistance, marked by the R1 pivot resistance on the 4-hour chart. To extend the rally towards the R2 pivot resistance level at $1.47, the M token should mark a decisive close above the $1.07 level.

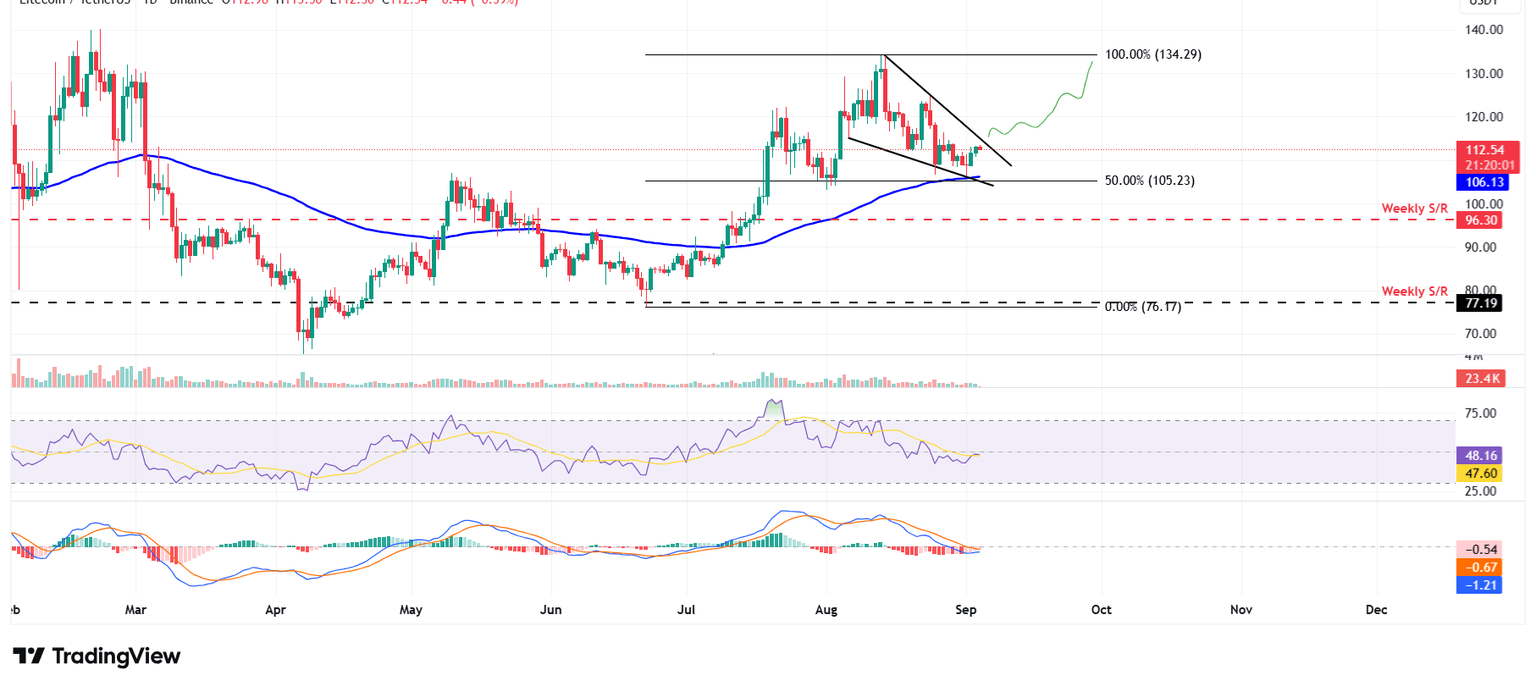

Litecoin Price Forecast: LTC fee collection hits 7-month high as bullish momentum builds

Litecoin (LTC) price trades within a falling wedge pattern around $112.5 at the time of writing on Thursday, with a breakout likely to trigger a rally ahead. On-chain activity and derivatives data support a bullish outlook as LTC’s fee collection hits a seven-month high and bullish bets reach their highest monthly level. The technical momentum suggests that bulls may soon regain control, opening the door for a potential rally.

TON holds steady as AlphaTON Capital unveils $100 million Toncoin treasury plan

Toncoin (TON) held steady on Wednesday after AlphaTON Capital announced a $100 million financing plan to establish a TON treasury. Nasdaq-listed AlphaTON Capital, formerly known as Portage Biotech (PRTG), announced plans to acquire roughly $100 million worth of TON as part of its shift to become a digital asset treasury company, according to a statement on Wednesday.

Author

FXStreet Team

FXStreet