Cryptocurrencies Price Prediction: Ethereum, Ripple & Bitcoin – American Wrap 25 August

Analysts grow concerned as $2 billion in Ethereum flood exchanges

As Ethereum gas fees surge, it is getting expensive to transact on the Ethereum blockchain. Lower value non-fungible tokens may be hit hard with rising Ethereum gas fees that could eliminate the bottom of the NFT market. $2 billion worth of Ethereum deposited to exchange wallets may belong to whales looking to take profits. Ethereum's climb toward its May all-time high of $4,356.99 is interrupted by the ongoing consolidation. Nearly 600,000 Ether was deposited to Binance, triggering concerns of a sell-off.

Bitcoin whales trim their holdings as fear of “mass sell-off” looms

Analysts note a drop in illiquid supply ratio as dormant Bitcoins move, hold a short-term bearish outlook. Bitcoin balance on exchanges spikes, largest single-day inflow since "Black Thursday," likely to trigger a mass sell-off. Decrease in holdings of whales’ Bitcoin wallet addresses observed, likely meaning whales are waiting to begin accumulating. Historically, an increase in Bitcoin inflows to exchanges – an activity being observed now – comes before a price dip. Analysts fear further consolidation in the asset before it resumes an uptrend.

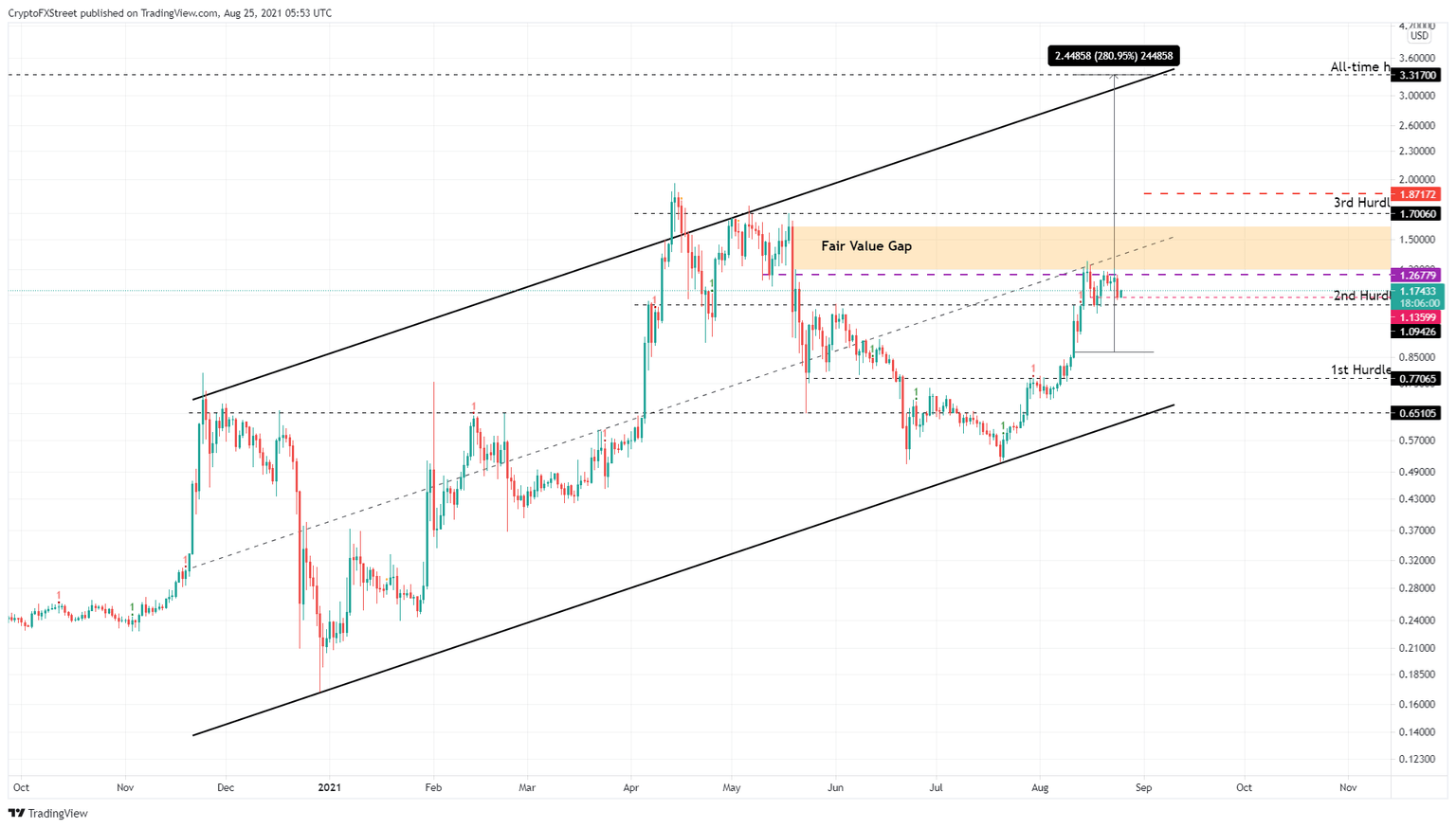

Three reasons why XRP price could double in a few days

XRP price is trading inside an ascending parallel channel, hinting at a bullish move shortly. Ripple is forming a bullish pennant on a lower time frame that could trigger a 47% advance. A steady increase in daily active addresses suggests rising interest among users, supporting an optimistic outlook. XRP price has been on an impressive upswing over the past month. While most altcoins are retracing, Ripple has managed to stay afloat without intense drawdowns.

Author

FXStreet Team

FXStreet