Cryptocurrencies Price Prediction: Ethereum, Chainlink & Solana — Asian Wrap 17 Mar

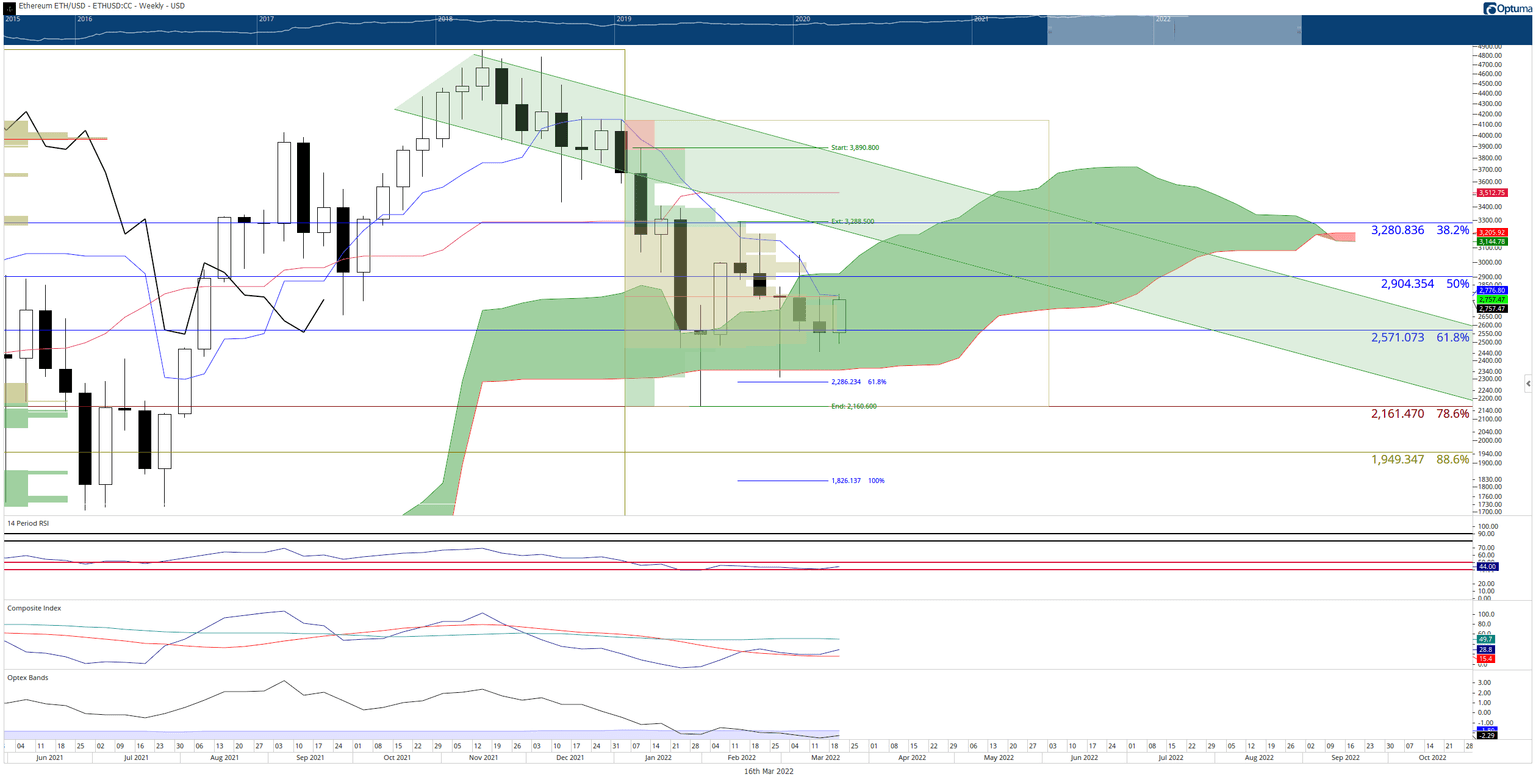

Ethereum price rallies towards $3,000 after the Fed increases interest rates

Ethereum price responded bullishly to a somewhat hawkish interest rate increase from the Federal Reserve. Likewise, risk-on markets worldwide had a positive response, indicating that market participants felt the rate hike was already priced in.

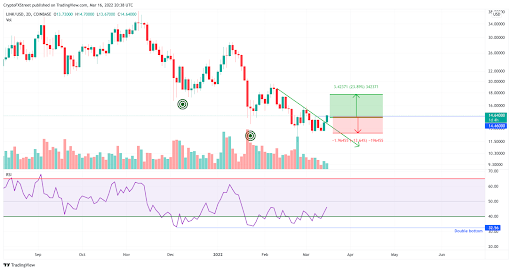

Chainlink price set for a 20% run as bulls smash through the daily trend. The next target is $17.

Chainlink price tests previous resistance as the bulls have pushed past a 2-day swing high at $14.46. There are a few indicators giving confluence that a bullish trend is underway. Chainlink price should have investors feeling enthusiastic as the bulls have successfully broken through the 2-day trend line.

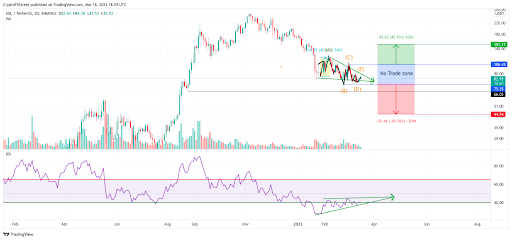

Solana Price is prepping for a 40% rally but should be considered a no-trade zone until the breakout begins.

Solana Price is still coiling inside a triangle consolidation. The 2-day chart is adding more confluence that a breakout will soon commence. Solana price should have traders on high alert, as the centralized smart contract token is ready to make its next move.

Author

FXStreet Team

FXStreet