Cryptocurrencies Price Prediction: Ethereum, Cardano & Ripple– American Wrap 27 January

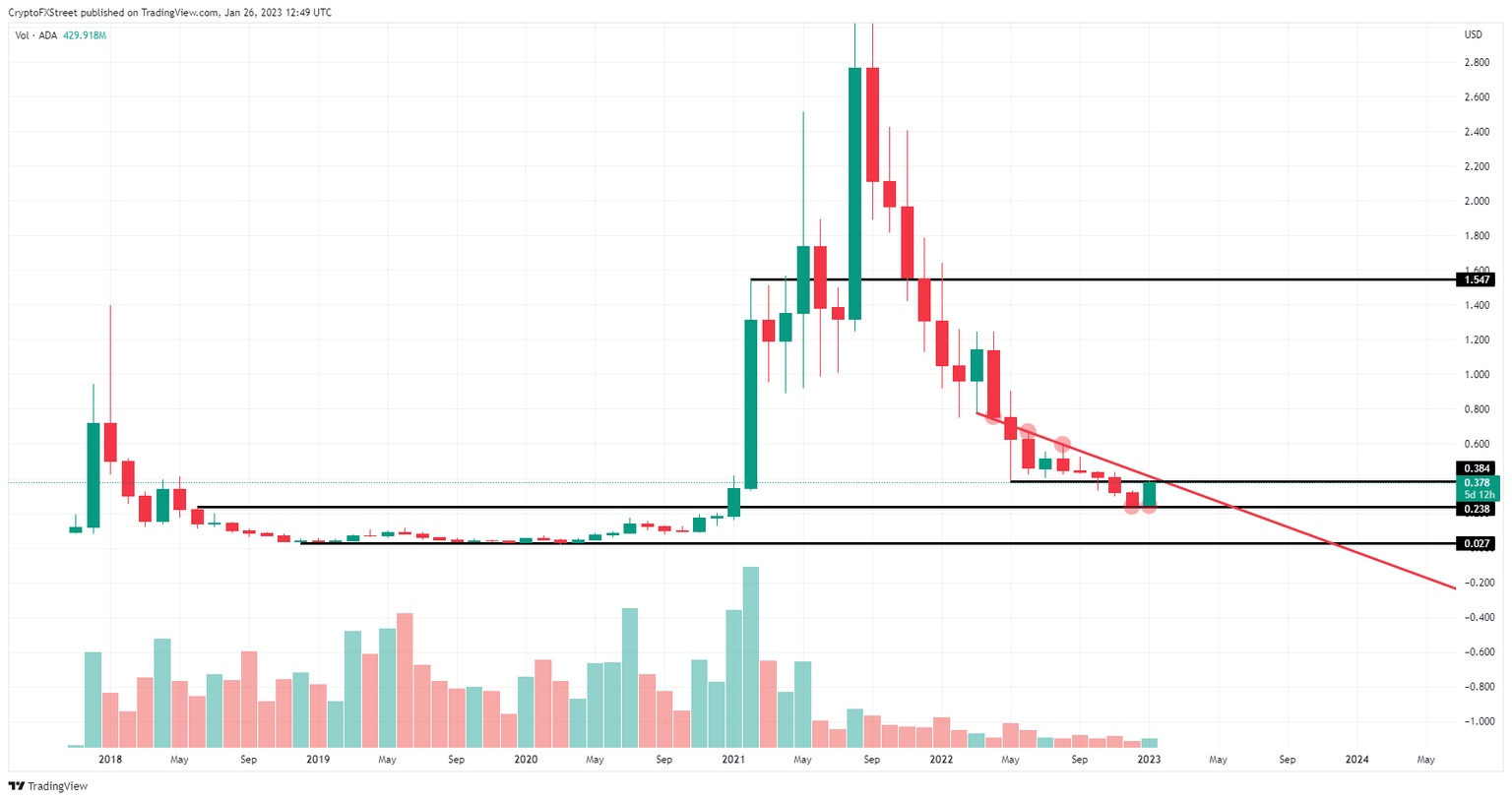

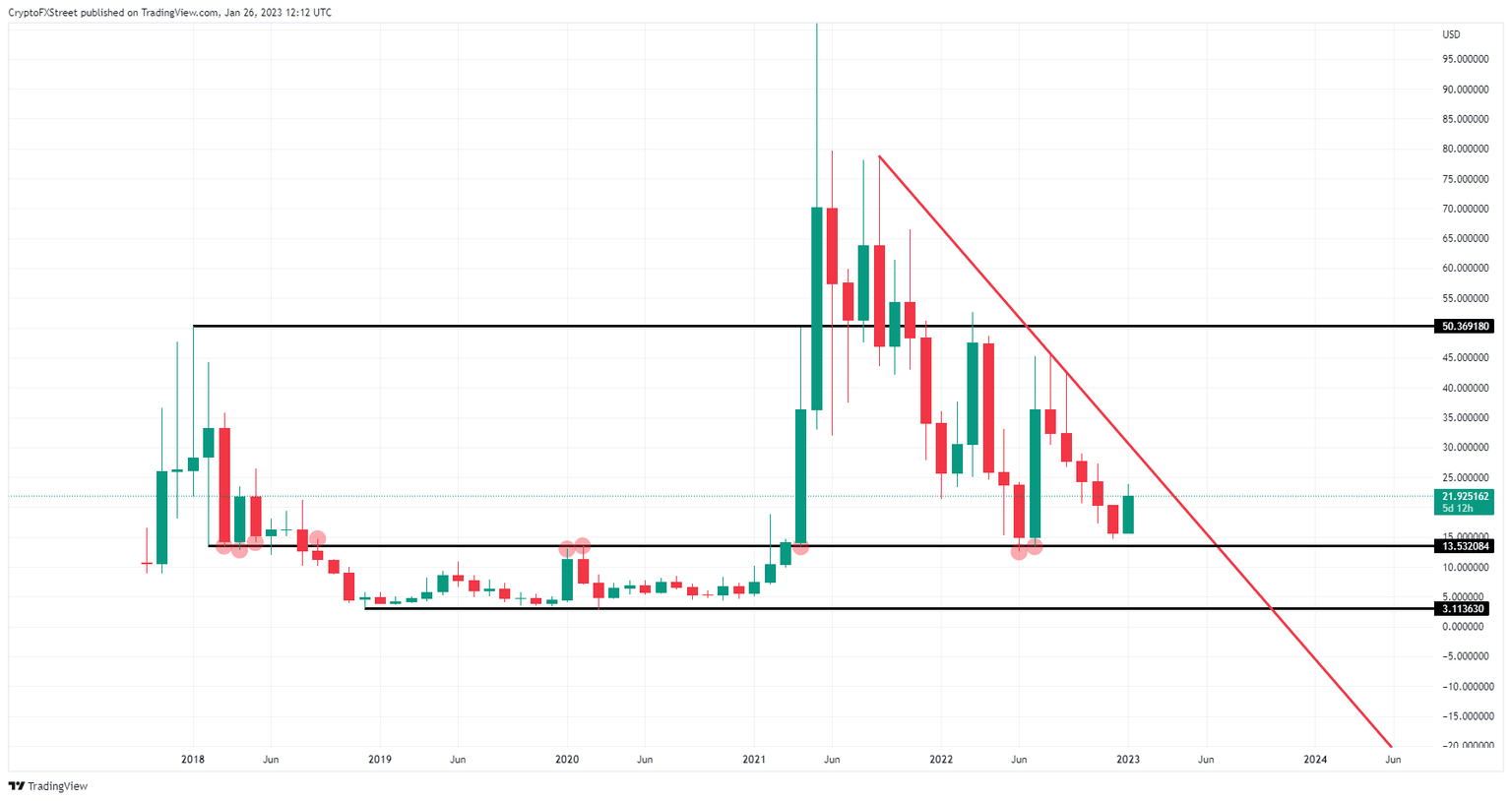

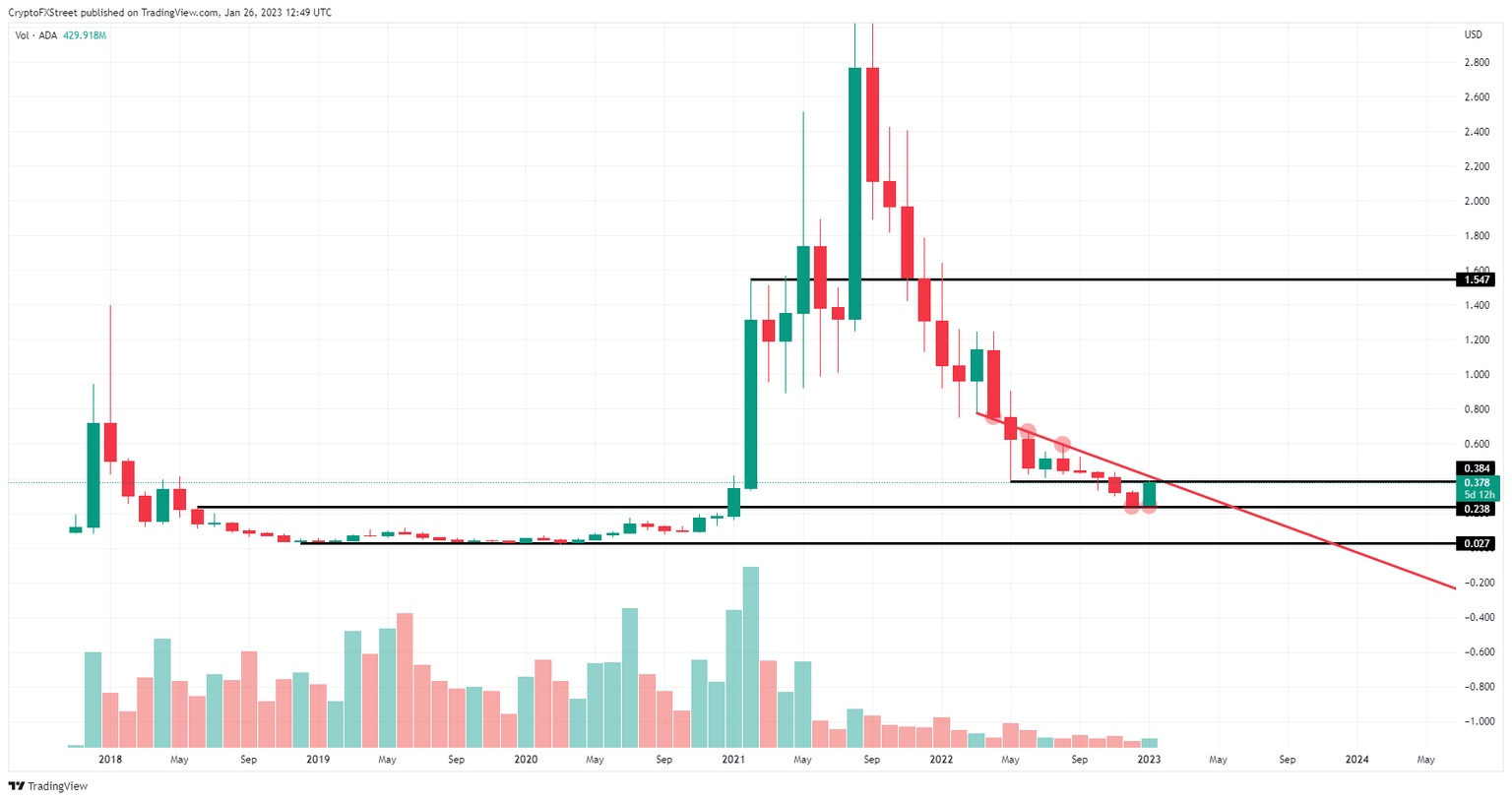

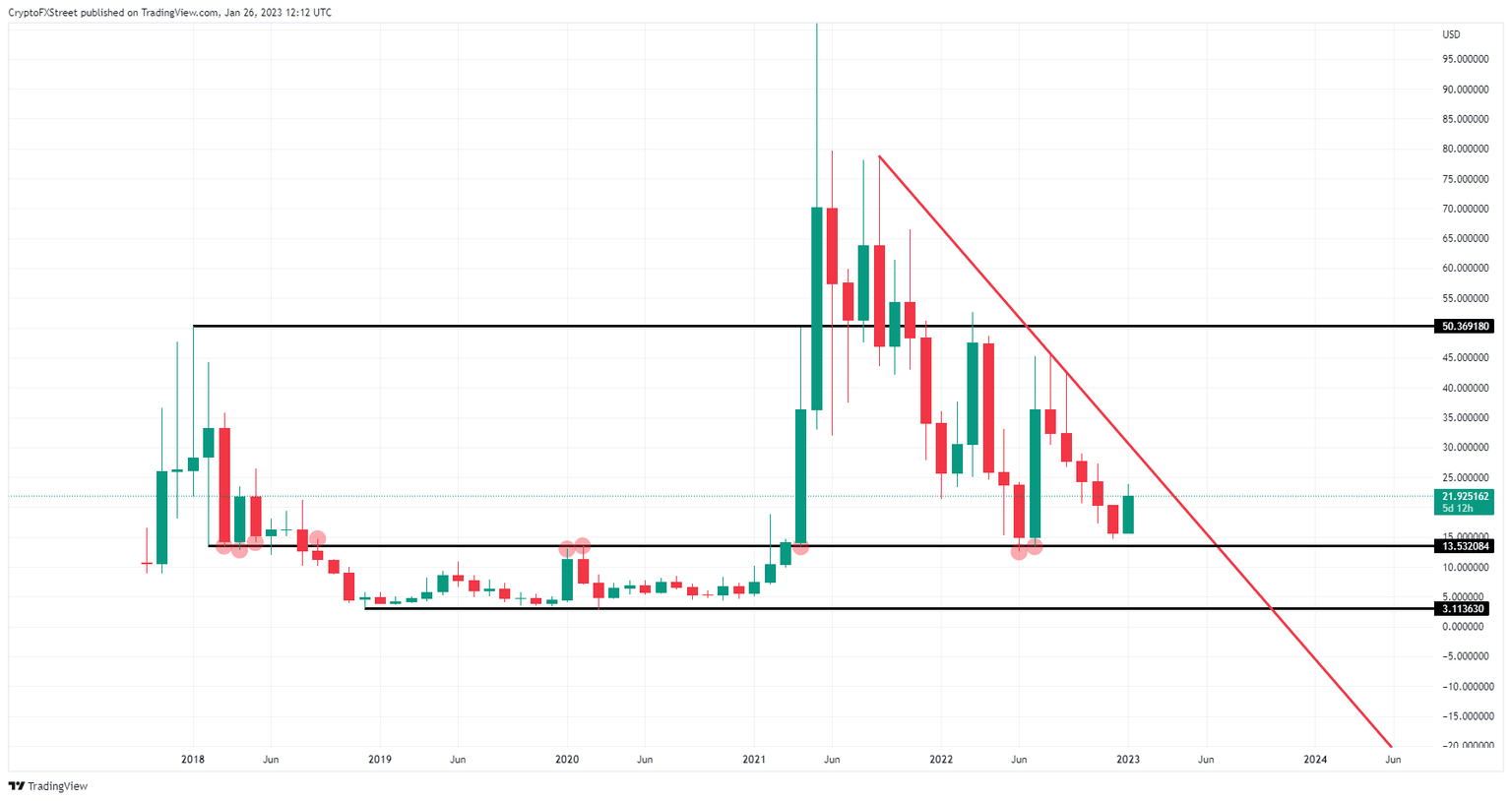

Cardano Price Forecast: If the volume does not return to normal, 2023 could be a lost year for ADA

Author

FXStreet Team

FXStreet

Author

FXStreet Team

FXStreet

Cardano (ADA) price is approaching its descending trendline around $0.28 at the time of writing, set to shape the next directional move. The derivatives metrics paint a bearish picture, with ADA’s Open Interest continuing to fall and short bets rising among traders.

Bitcoin trades above $72,500 at press time on Thursday, holding its 6% gain from the previous day, contributing to a broader market recovery. The total cryptocurrency market capitalization stands at over $2.43 trillion as the broader market sentiment improves significantly.

US President Donald Trump is urging legislators to pass the CLARITY Act after allegedly meeting with Coinbase CEO Brian Armstrong amid growing dispute over stablecoin yields.

Ethereum (ETH) has jumped above $2,100 on Wednesday, following a general recovery across the crypto market. The move was accompanied by a spike in Ethereum's open interest, which has increased to 13.43M ETH — its highest level since January 31. The top altcoin's OI has been rising since February 19, adding 1.2M ETH over the past two weeks.

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.