Cryptocurrencies Price Prediction: Ethereum, Cardano & Binance Coin – American Wrap 19 October

Ethereum Price Prediction: Network activity signals red days ahead

Ethereum price displays concerning on-chain metrics that investors should be aware of. According to Santiment’s 30-Day Active Addresses Indicator, more than 750,000 addresses have become active in October. Statistically, whenever the indicator begins ramping higher, a sharp correction in price occurs shortly after.

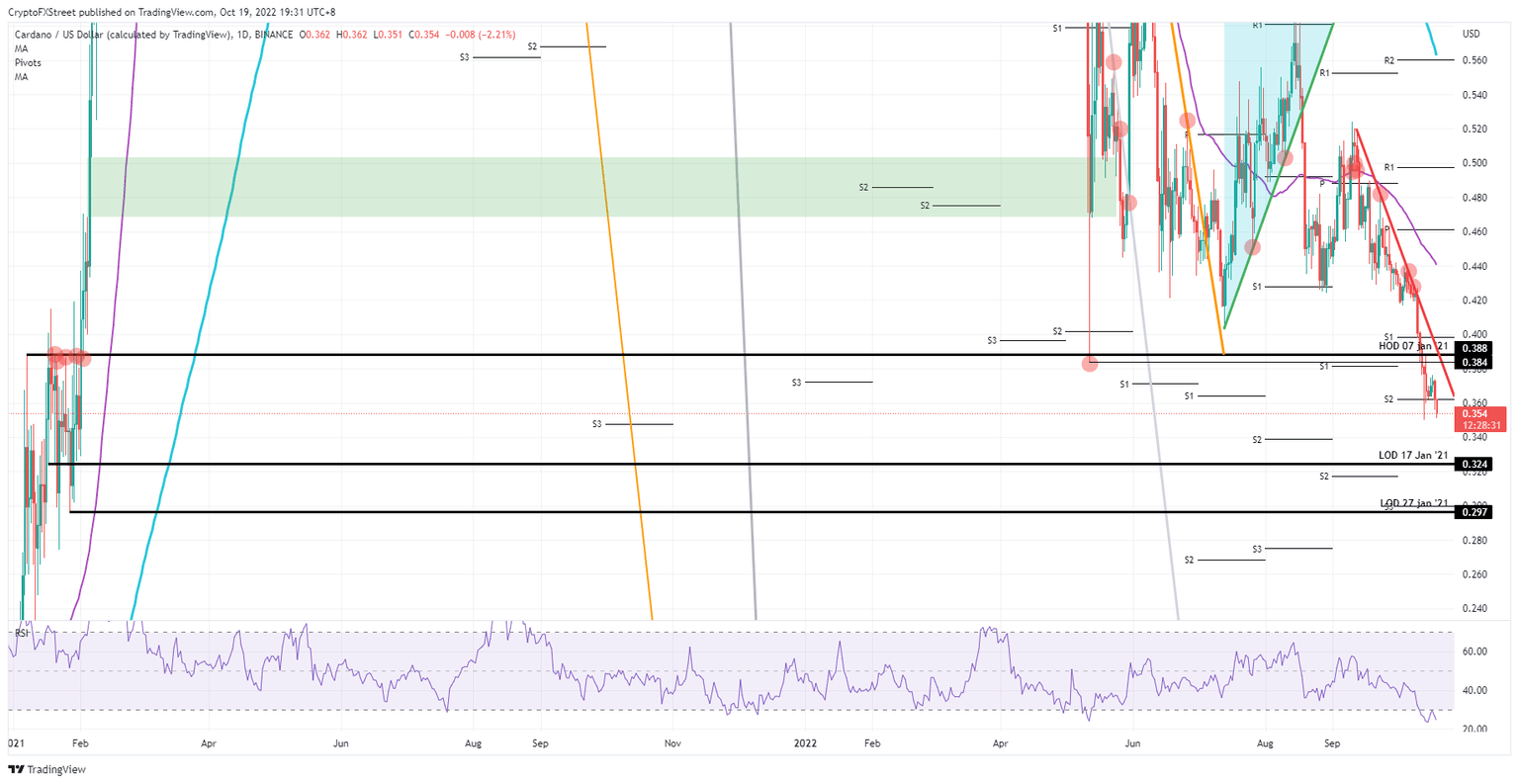

Cardano price action making a new year low is a clear and present danger

Cardano price action is the canary in the coal mine, with an overall drop of over 5% this week after hopes of a turnaround quickly faded. The early recovery was led by strong earnings out of the US from, mainly, banks but the release of UK inflation this morning, which pointed to another record high, undid early gains. With political unrest not easing in the UK, the economy looks to be on the brink of collapse as every move is only making things worse and Truss is on the ropes after just a few weeks as PM.

Why another freefall in Binance Coin price will not come as a surprise

Binance Coin price may have eased off the selling pressure after bouncing off support at $260, but investors seem skeptical that this will translate into an uptrend. Its technical outlook appears shaky, forecasting another correction to $226.

Author

FXStreet Team

FXStreet

%20%5B17.26.25%2C%2019%20Oct%2C%202022%5D-638017910868253924-638018408464612087.png&w=1536&q=95)