Cryptocurrencies Price Prediction: Ethereum, BNB & Bitcoin — Asian Wrap 23 July

Ethereum validator exit hits nine days waiting, with nearly $2B in ETH ready to exit the network

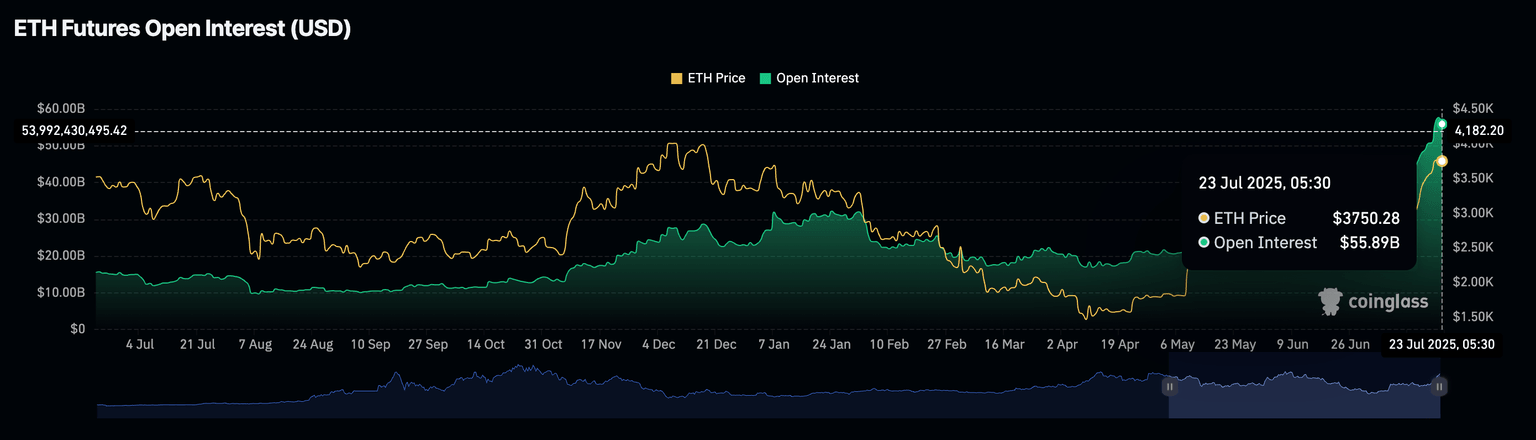

The Ethereum (ETH) network is experiencing an exodus of validators waiting in line to exit with their staked ETH. A shift in validator sentiment has followed the 160% rally in Ethereum over the last four months. A spike in the entry of new validators and the ETH staking queue failing to outpace the exit queue suggests relatively lower demand.

Ethereum has surged over 160% in the last four months from its year-to-date low of $1,385 on April 9. However, the 26% bullish run crossed above the $3,700 mark last week, flashing an exit sign for Ethereum validators.

BNB Price Forecast: BNB hits a new all-time high, surpasses Solana's market cap

BNB (BNB), formerly known as Binance Coin, hits a new all-time high of $804.70 at the time of writing on Wednesday, after closing at its highest-ever weekly close last week. This price rally pushed the BNB market capitalization above $110 billion, surpassing that of top altcoins such as Solana (SOL). Derivatives data support the bullish thesis as BNB Open Interest (OI) and funding rate show a massive spike. Additionally, the technical outlook suggests a continuation of the rally, with bulls targeting the $900 psychological level.

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC and XRP near record highs, while ETH eyes $4,000 mark

Bitcoin price has been trading broadly sideways between $116,000 and $120,000 after reaching a new all-time high of $123,218 on July 14. At the time of writing on Wednesday, it trades near its upper consolidation band at $120,000. If BTC closes above the upper boundary of the consolidation range at $120,000 on a daily basis, it could extend the recovery toward the fresh all-time high at $123,218.

Author

FXStreet Team

FXStreet