Ethereum validator exit hits nine days waiting, with nearly $2B in ETH ready to exit the network

- Ethereum validators' exit wait time reaches nine days after the recent 160% rally.

- The validator queue shows 521,252 ETH waiting to exit the Ethereum network.

- Validators exiting the Ethereum network outpace the entry of new validators by 3 days.

The Ethereum (ETH) network is experiencing an exodus of validators waiting in line to exit with their staked ETH. A shift in validator sentiment has followed the 160% rally in Ethereum over the last four months. A spike in the entry of new validators and the ETH staking queue failing to outpace the exit queue suggests relatively lower demand.

Ethereum validators' exit queue skyrockets

Ethereum has surged over 160% in the last four months from its year-to-date low of $1,385 on April 9. However, the 26% bullish run crossed above the $3,700 mark last week, flashing an exit sign for Ethereum validators.

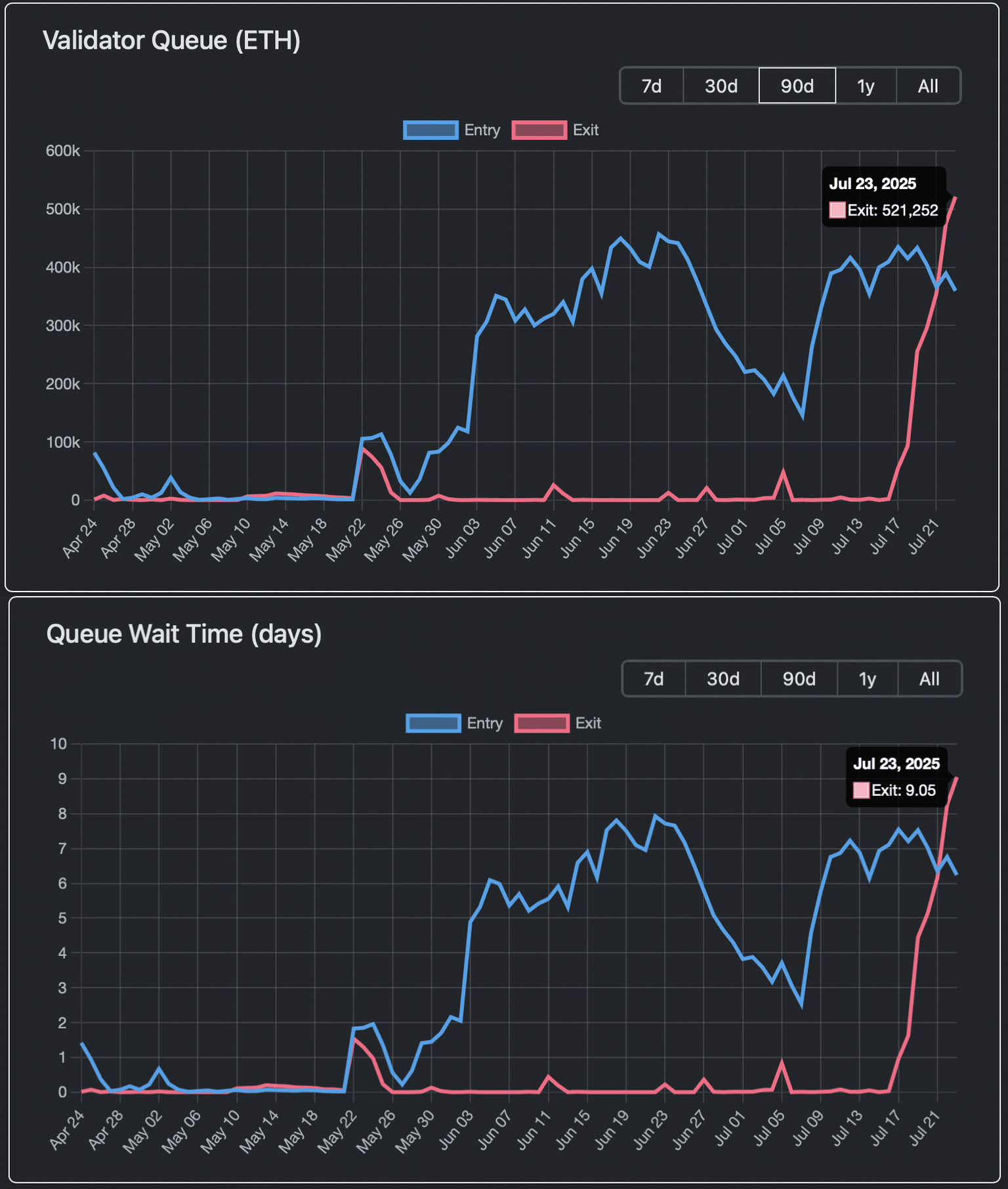

Validator Queue’s data show the ETH in queue to exit the network rising to 521,252 ETH worth $1.95 billion, up from 1,920 ETH last week. The massive amount of ETH waiting to exit the network pumps the wait time over nine days on Wednesday, up from 0.03 days last week.

Validator queue data. Source: Validator Queue

Typically, a surge in the exit queue indicates declining interest in the network, suggesting that validators are attempting to withdraw funds following the recent price surge. On the other hand, the wait time helps regulate the number of active validators on the network.

However, the rising demand for external validators waiting to enter the network gradually catches up. The Validator entry wait time is six days, with a volume of 359,557 ETH, worth approximately $1.33 billion.

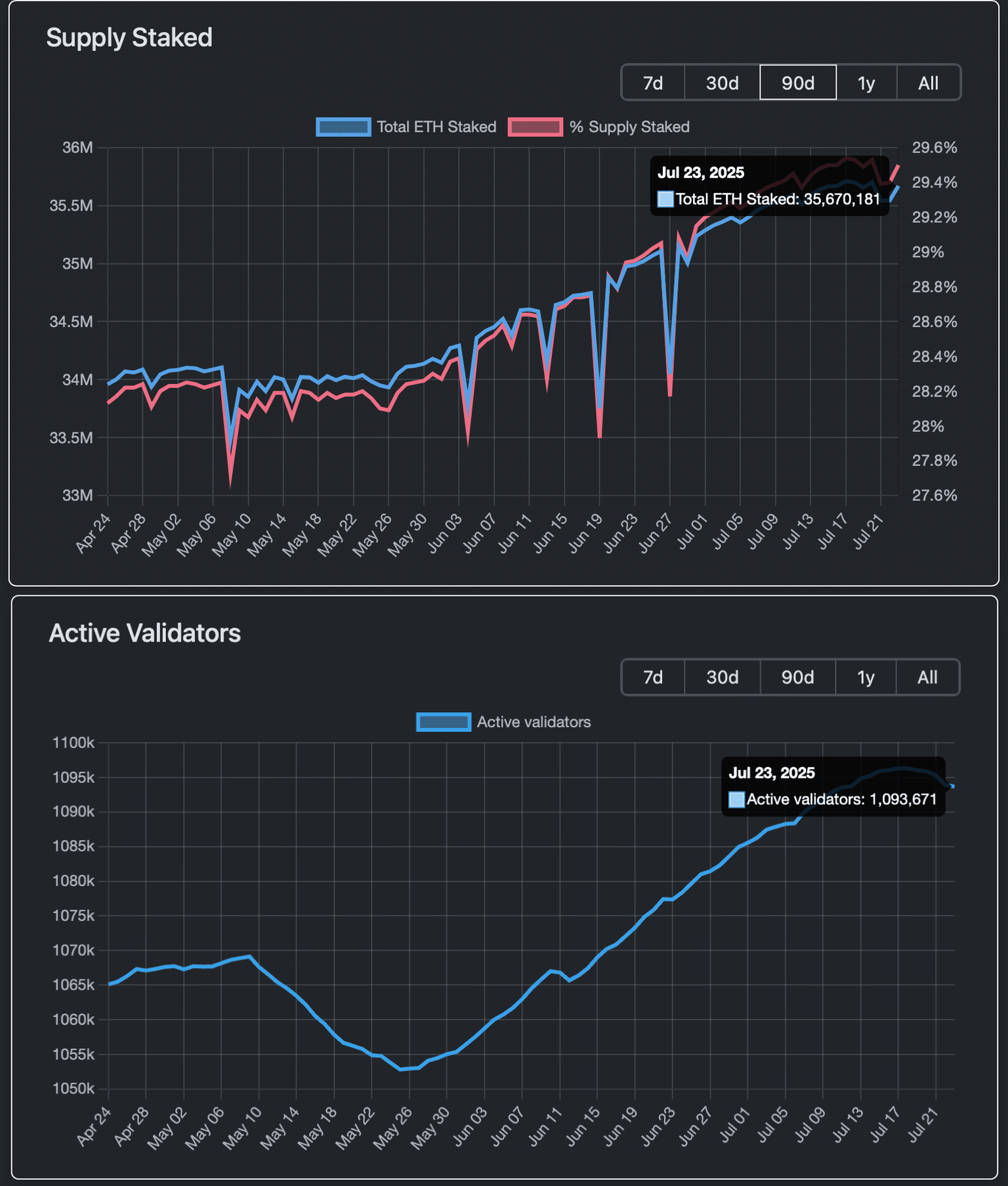

Amid the chaos, the massive surge in the number of active validators on Ethereum over the last few weeks flattened out to 1,093,671, from a peak of 1,096,339 on Thursday. It is worth noting that 35.67 million ETH is staked on the network at press time.

Active validators and staked ETH on the network. Source: Validatorqueue

Optimism in Ethereum remains heightened

Bitwise CIO Matt Hougan predicts that Ethereum is "heading higher," as previously reported by FXStreet, following ETH's recovery after months of underperformance.

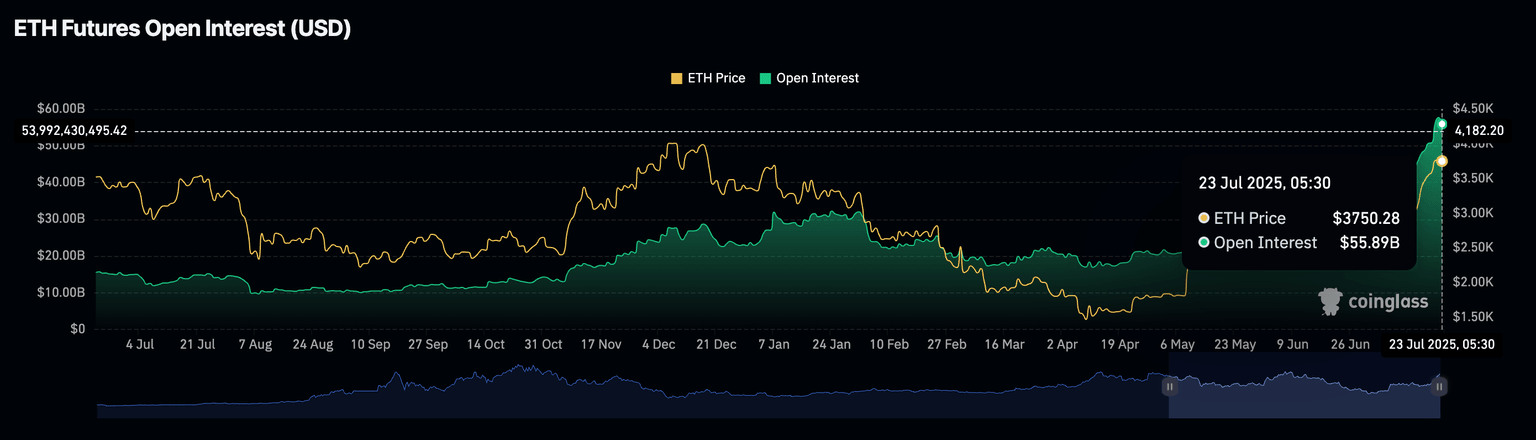

Furthermore, the Coinglass data shows the ETH Open Interest (OI) at $55.89 billion, which is close to the all-time high of $57.69 billion reached on Tuesday. The heightened OI in Ethereum refers to greater capital inflows in the ETH derivatives, a sign of increased interest among traders.

Ethereum OI. Source: Coinglass

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.