Cryptocurrencies Price Prediction: Decentraland, Polkadot & Chainlink – Asian Wrap 22 Dec

Decentraland price likely to rally 23% if MANA can flip this hurdle

Decentraland price has been consolidating in an increasingly tight range for more than two weeks. However, buyers are seemingly crawling out of the woodwork, suggesting an appetite for an increase in the market value of MANA.

Decentraland price position itself for more gains

Decentraland price has produced three lower lows and four lower highs since December 6, indicating a steady downtrend. However, after the December 15 swing low at $2.93, the tide is turning for MANA, starting with higher lows, indicating a slow shift in favor toward bulls.

Polkadot price eyes retest of $30 after DOT breaks out of a three-week hurdle

Polkadot price is trading above crucial reversal zones on a higher time frame, indicating diminishing downward pressure. On a lower time frame, however, DOT has recently breached a crucial resistance barrier, revealing its intentions to move higher.

Polkadot price eyes a higher high

Polkadot price was stuck trading below a bear trend line since November 30. Multiple attempts to breach this trend line failed until December 20, where DOT produced a four-hour candlestick close above it.

Chainlink buyers pile in to push LINK to conservative target at $28

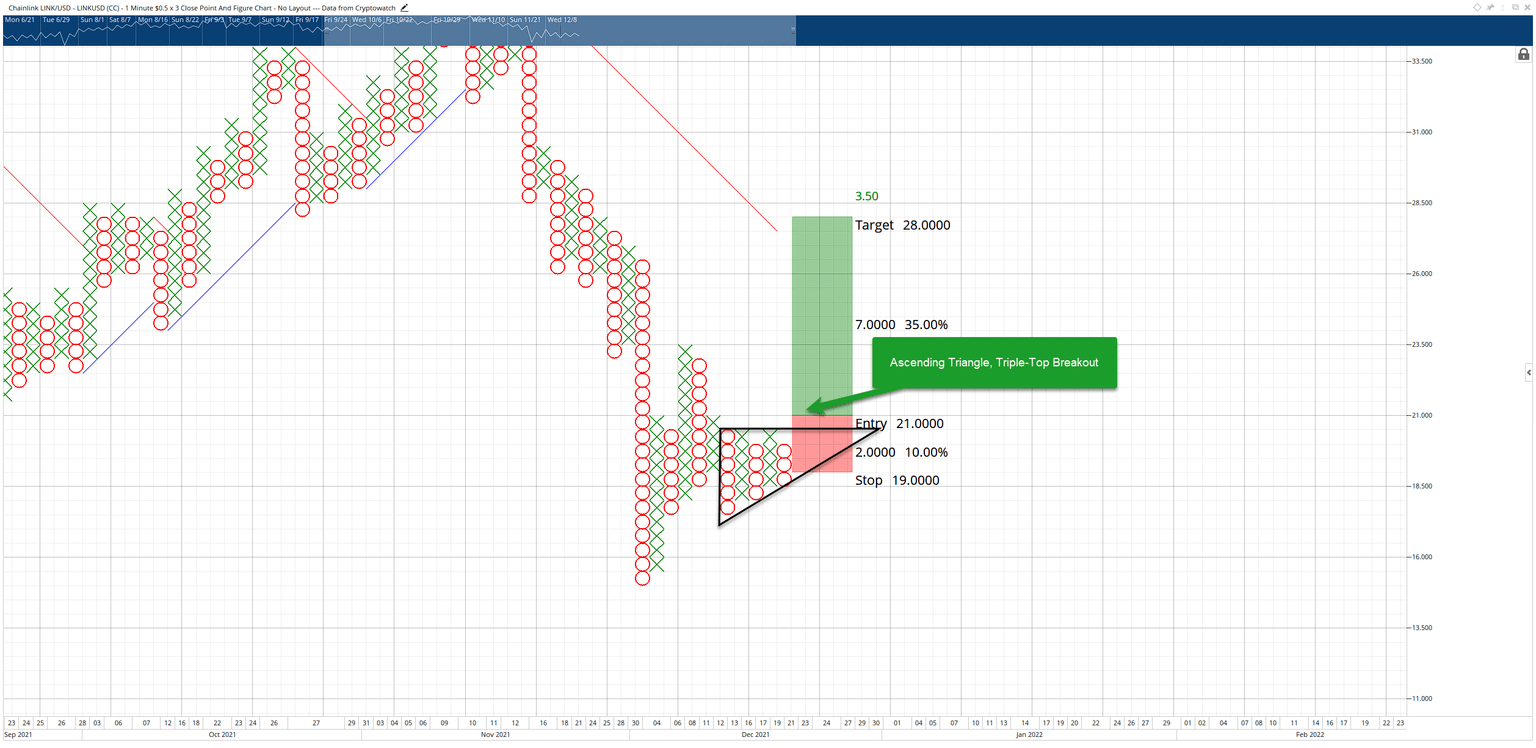

Chainlink price is developing an exceptionally bullish pattern on its $0.50/3-box reversal Point and Figure chart. As a result, reaching the entry-level of this hypothetical trade setup could see a considerable spike towards the $28 value area.

Chainlink price ready to bounce and spike higher, short sellers likely trapped and feeling the pressure

Chainlink price has a series of ascending higher lows on its Point and Figure chart while also developing a triple-top. Additionally, an ascending triangle pattern has formed, giving a greater probability of a bullish breakout in the near future.

Author

FXStreet Team

FXStreet