Cryptocurrencies Price Prediction: Crypto, Render & Altcoins – European Wrap 3 June

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin’s momentum poise to propel crypto market

Bitcoin (BTC) price consolidates in a symmetrical triangle pattern, showing directional bias. Ripple (XRP) also follows BTC’s footsteps as it continues on its 50-day consolidation streak. Ethereum (ETH) price, on the other hand, shows signs of an incoming correction.

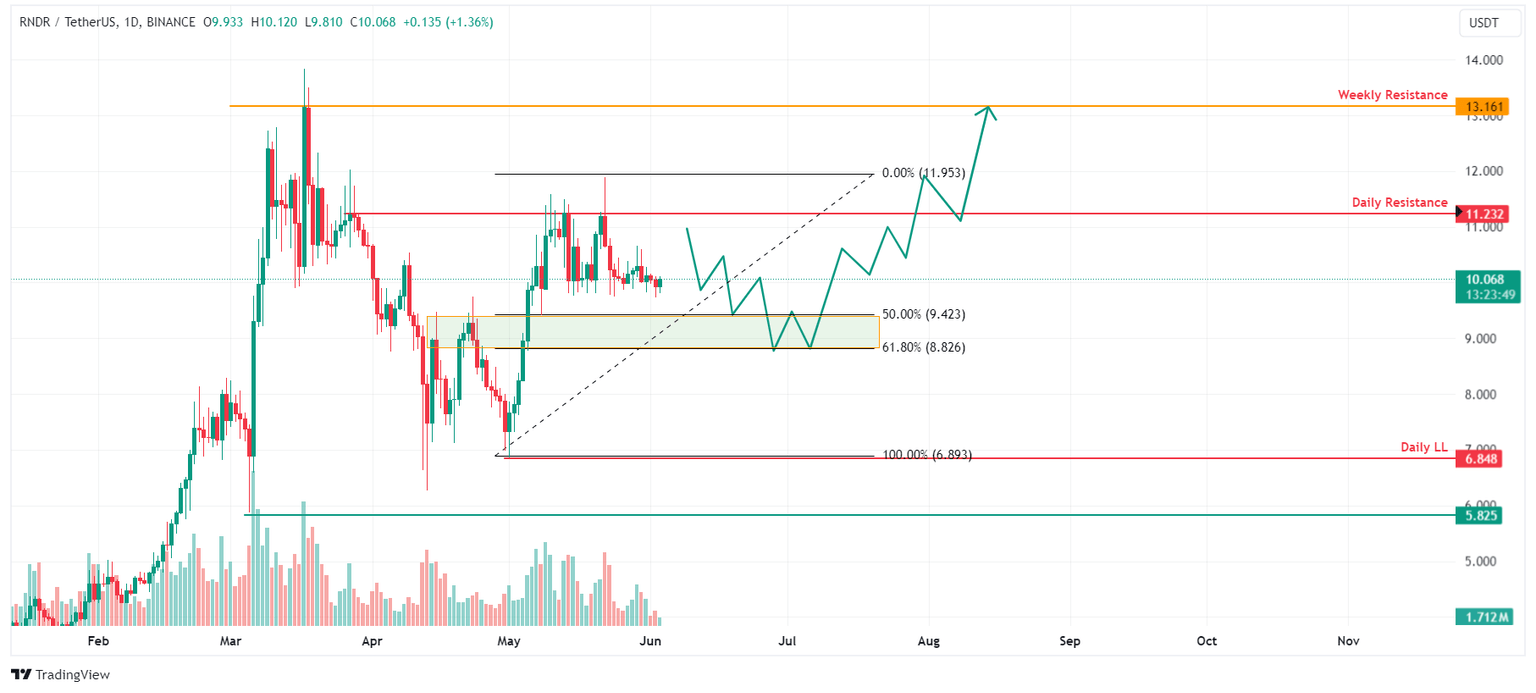

Render price could rally 20%, supported by Nvidia stock split

Render’s (RNDR) price could increase by around 20% propelled by the upcoming Nvidia (NVDA) stock split, according to technical and on-chain indicators. The AI-based altcoin is likely to face an initial pullback after struggling multiple times with daily resistance at $11.23 but falling to a key support area, the push from the AI narrative and bullish signs from large-wallet investors make it likely for RNDR to recover in the medium term.

Week Ahead: Altcoins likely to bounce due to short-term bullish wave

Last week was a bummer with Bitcoin (BTC) price consolidation, and altcoins movements showed confusion in their directional bias. Some altcoins saw bullish, impulsive moves, but most trended sideways or slid lower.

Author

FXStreet Team

FXStreet