Cryptocurrencies Price Prediction: Bitcoin, TRX & Crypto – European Wrap 4 November

Bitcoin Price Forecast: BTC edges below $104,000 as long-term holders intensify sell-off

Bitcoin (BTC) extends its correction on Tuesday, slipping below $104,000 and continuing its decline from the previous day. The bearish outlook is further strengthened as Bitcoin long-term holders continue to offload their holdings, adding to the mounting selling pressure. Meanwhile, US-listed spot Bitcoin Exchange Traded Funds (ETFs) recorded outflows of over $186 million on Monday, hinting at fading institutional demand for the largest cryptocurrency by market capitalization.

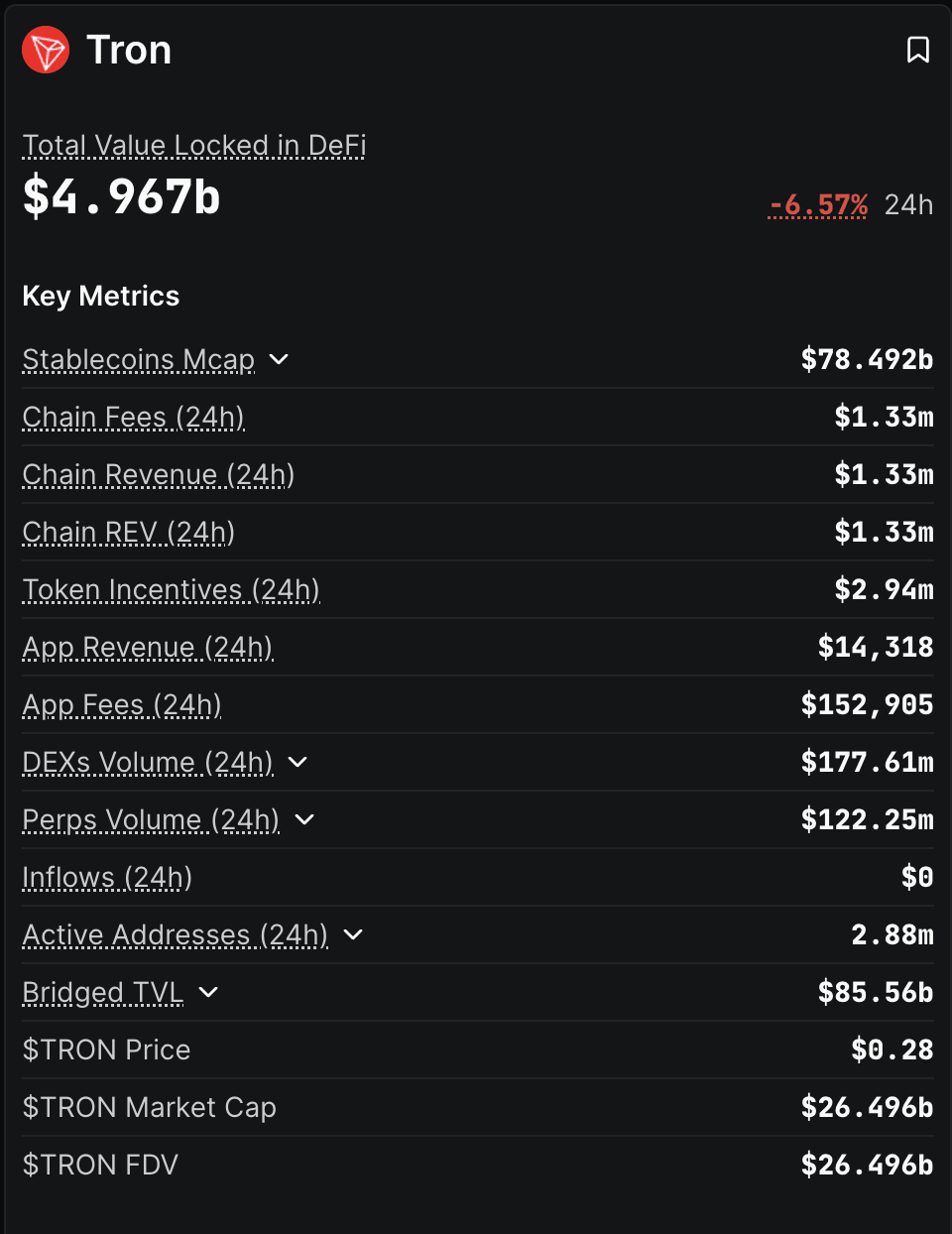

Tron Price Forecast: TRX risks breaking year-long support as user, retail demand drops

Tron (TRX) trades at $0.2800 by press time on Tuesday, under bearish pressure following a 5.64% loss on Monday. Technically, TRX risks breaking below a crucial support trendline while both derivatives and on-chain data suggest a decline in retail and user demand.

Crypto Today: Bitcoin, Ethereum, XRP descend further as retail and institutional traders exit

Bitcoin (BTC) declines for the second consecutive day, reflecting a sticky risk-off sentiment in the broader cryptocurrency market. Trading below $104,000 at the time of writing on Tuesday, the path of least resistance appears to be downward, targeting its October low of $102,000.

Author

FXStreet Team

FXStreet