Cryptocurrencies Price Prediction: Bitcoin, Polygon & Ripple — American Wrap 08 April

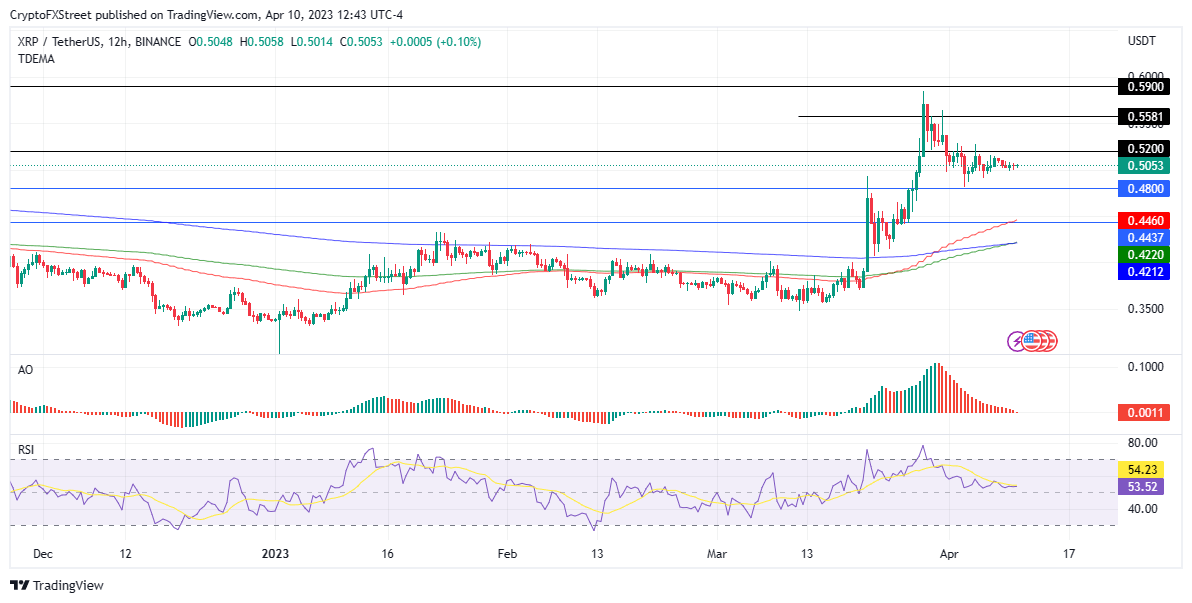

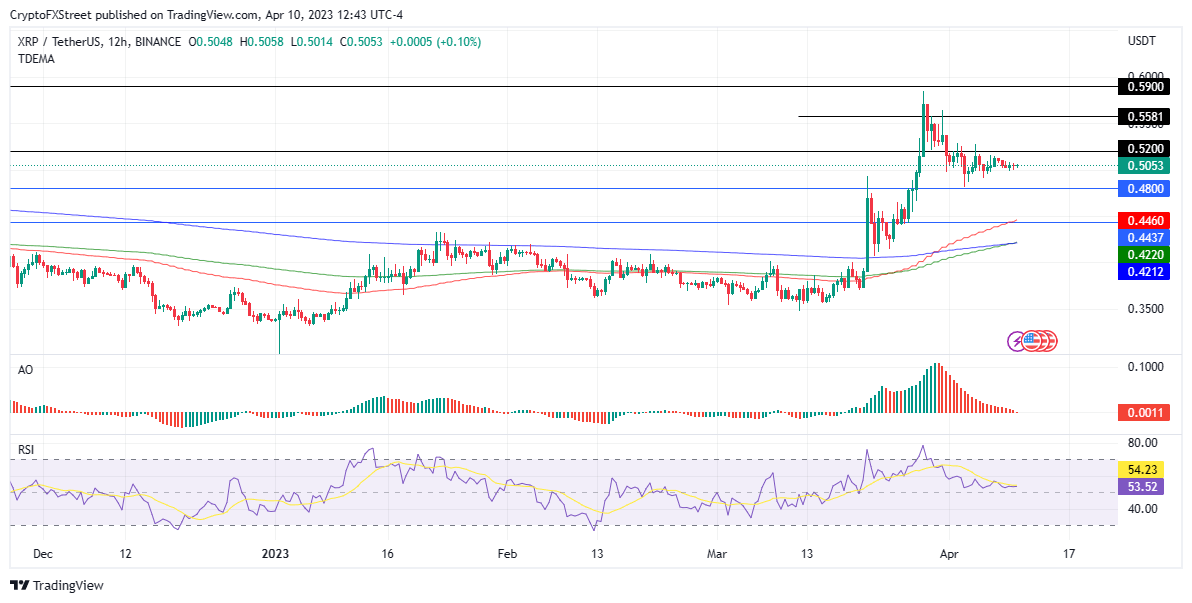

Ripple Price Forecast: XRP could drop 5% as trading volume indicates a lack of initiative among bulls

Author

FXStreet Team

FXStreet

Author

FXStreet Team

FXStreet

Ripple is rising above $1.40 at the time of writing on Monday amid fresh tariff-triggered headwinds in the broader cryptocurrency market. The sell-off to $1.33, the token’s intraday low, can be attributed to macroeconomic uncertainty, geopolitical tensions and risk-averse sentiment among other factors.

Bitcoin, Ethereum and Ripple are trading amid increasing selling pressure at the time of writing on Monday, as investors react to fresh trade uncertainty over US President Donald Trump’s push for more tariffs.

Bitcoin (BTC) is trading in red, testing the lower boundary of its recent consolidation range at $65,729 as of writing on Monday. The growing tariff uncertainty, along with rising geopolitical tensions, weighs on riskier assets such as BTC.

Pi Network extends losses by 4% on Monday, after falling more than 6% last week. Pi Network’s first anniversary on Friday occurred as the token still flirts with all-time lows at $0.1300.

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.